As Uniswap Launches Unichain, is the game over for Ethereum pre-Surge? And what does the new DEX chain launch mean for ETH price?

Ethereum is the leader in smart contracts. It dominates DeFi and meme coins and remains the most active of them all, even better than Bitcoin.

Although there are scaling challenges, there is optimism that this “hitch” will be resolved in the coming months.

Ethereum Is Building, But There Is A Problem

Vitalik Buterin has already detailed “The Surge,” an upgrade that will average throughput to over 100,000 TPS.

The problem is that developers must first deliberate on what to do before implementation.

If anything, this may take months, if not years.

Network users and critics want action now, not tomorrow or next year.

Uniswap’s plan to launch an Ethereum layer-2, following Coinbase and Sony, is seen as a severe blow for layer-1.

Uniswap is a leader in DEX trading. The protocol is present on Ethereum and some of its layer-2s.

Altogether, the DEX generates billions in annual fees distributed directly to validators.

DISCOVER: The Best Way To Buy Ethereum in 2024: Beginner’s Guide

Will Unichain and Uniswap Destroy ETH? Comparing Fees

Now, with plans of Unichain, one analyst thinks ETH holders are in trouble since there is only one way for prices to move: Down.

The primary argument is that Ethereum layer-2s are extractive by nature. Since more users are using the platform and avoiding the ordinarily high fees on the main net, it means validators are not adequately compensated.

By design, especially after implementing Dencun, Base, Arbitrum, Scroll, and other layer-2s, they pay close to nothing when they confirm their “blobs” on the main net.

To put things into perspective, Arbitrum One pays just $136,000 in fees while Base parts away with $25,000 to mainnet validators. On the other hand, Blast has distributed nearly $5,000 to layer-1 validators who do the heavy lifting of confirming the validity of all posted transactions.

(Source)

The unfairly low compensation is despite these platforms charging network users transaction fees and stealing what could have been executed on the main net.

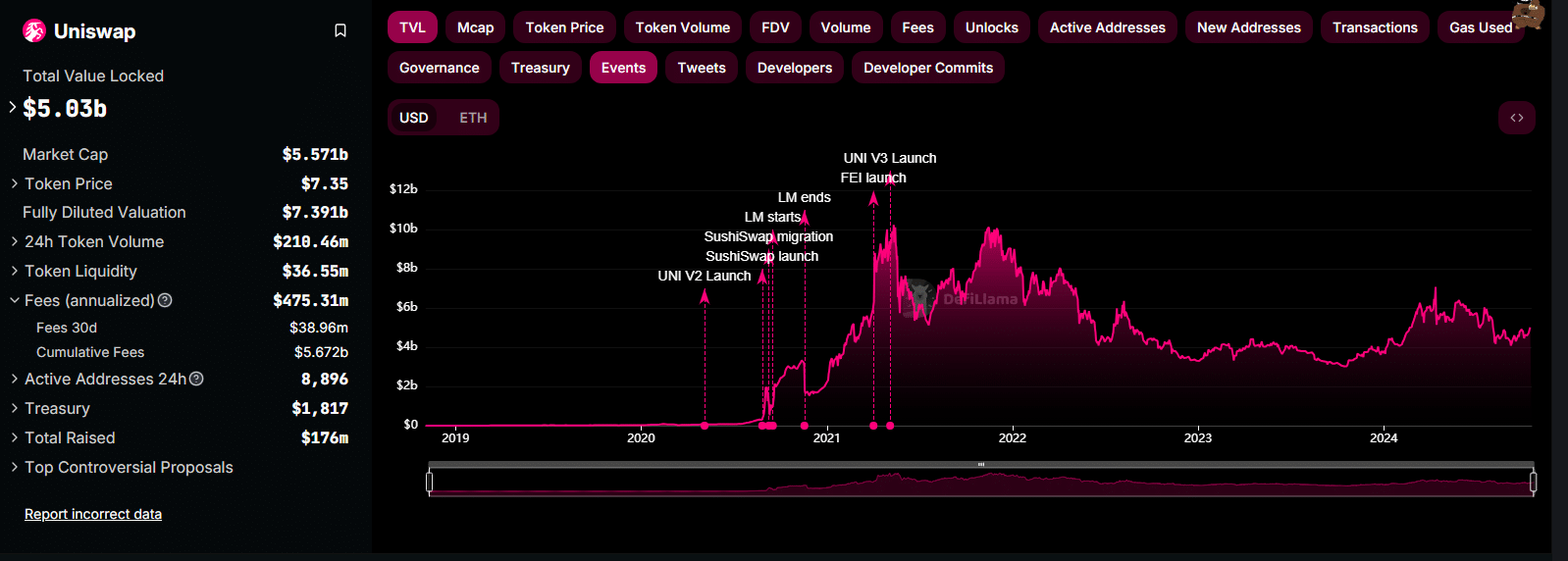

Compared to all Ethereum layer-2s, Uniswap generated nearly $40 million in fees in the last 30 days. According to DeFiLlama, over the years, the protocol has generated over $5.6 billion in fees, a big chunk, considering most swaps are on Ethereum, are moved directly to validators.

(Source)

With Uniswap planning to create a layer-2, it will effectively mean validators will be paid far less, with Unichain capturing value for Uniswap Labs instead.

DON’T MISS: These Cryptocurrencies Could 1,000x Your Portfolio in 2024

Time For UNI To Shine At The Expense Of ETH Price?

Once this platform goes live, UNI will be the bigger beneficiary. On the other hand, ETH could slump if Ethereum developers fail to adapt and move with what the market wants. It is expected that Uniswap will divert its users to their layer-2, effectively reducing mainnet demand.

The analyst specifically claims that since ETH demand from network use drives prices, the low demand exerted by layer-2s won’t, in his view, sustain prices at spot levels.

(ETHUSDT)

To survive, the analyst continued, Ethereum needs to update its infrastructure to compete with other platforms like Solana. Already, “users don’t care for technical stuff” but speed and convenience.

Still, only time will tell whether ETH has what it takes to shake off its current weakness. Bulls target all-time highs of around $4,900 in the medium to long term.

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Comments (No)