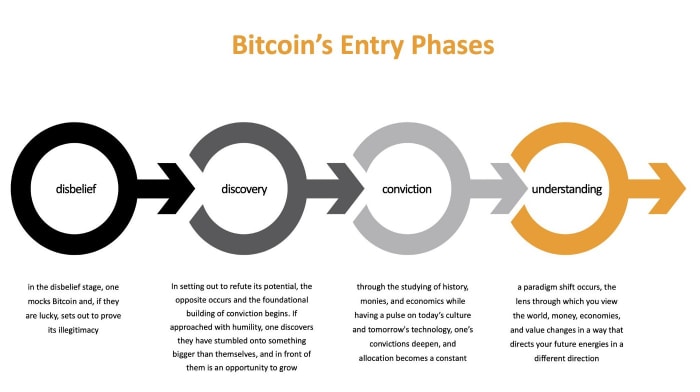

The relationship between human psychology and Bitcoin is a curious one. The more I watch how people arrive at Bitcoin, the more I notice a parallel between their experience and my own amid a much broader general trend. Conversely, these similarities act as entry barriers to individuals I failed to onboard and public antagonists alike. While everyone’s adventure varies, a consistent theme of stages unravel that look like disbelief, followed by discovery, then conviction, and lastly understanding.

At the entry phase of disbelief, individuals often challenge Bitcoin’s authenticity. Insults and mockery may accompany them, but if they are open-minded, they’re lucky enough to explore it and enter the second phase. In the discovery phase, we see individuals fall down the rabbit hole, and, more often than not, the motive is to disprove Bitcoin. Humility is required to pass through the discovery phase. This dance is more of an internal acceptance that you were mistaken, followed by exploration and outwardly seeking knowledge from others. In my experience, it is the most intelligent individuals who find it an impossible pill to swallow regardless of their towering intellect. In the conviction phase, curiosity acts as the soil for growth and grit as the irrigation, pushing the individual into a conviction-deepening state by studying Bitcoin and its multidisciplinary properties. Lastly, in the understanding phase, we see an inward mentality shift in the Bitcoiner’s actions representing an outward change in future endeavors.

Disbelief

In the disbelief stage, one mocks Bitcoin and, if they are lucky, sets out to prove its illegitimacy

The first time I heard about Bitcoin, I was in such disbelief I didn’t even give it the time of day. It was 2012, and my roommate called his dad begging for a $1,000 loan to buy bitcoin. His father told him absolutely not. I laughed, left the house, and didn’t think about it for years. Fast forward to December 2016, when I reencountered bitcoin. I saw an article about the price being around $700. Oddly enough, that same week, I randomly reconnected with my old roommate on LinkedIn when noticing he worked in the Bitcoin space full-time. We discussed Dallas, Bitcoin, and relived some funny memories before I asked him if I should buy bitcoin. He gave me the cliché answer that the best time to buy was years ago, but the second-best time is now. I thanked him, hung up, and bought bitcoin.

I got lucky. Had the advice not come from a friend I truly trusted, I would never have done that. Somewhere between humility and insecurity, I know there is a lot I don’t know. Who was I to form an overly strong opinion on day one of looking into a decentralized protocol wholly unique and created by a pseudonymous character who has since disappeared?

In hindsight, the barrier to entry hinged entirely on being open-minded. This is the moment I truly fell down the rabbit hole, but most individuals walk around the hole for a while. Some of them even toss grenades down it before entering. My initial experience of disbelief led me into the following phase, but this isn’t the case for everyone. I often laugh because the individuals I have failed to convert were always more intelligent than me, from financial advisors and scientists to engineers and CFOs. I am often met with not only disbelief but mockery. My favorite is from a chief financial officer. Since 2017, I have been trying to get him to look into bitcoin. I sent him 290,000 satoshis in 2018 ($20 then, $170 now at the time of writing), bought him Saifedean Ammous’ “The Bitcoin Standard,” and have continued to send him every major update regarding banks and treasuries changing their stance on it.

Despite “number go up,” I got the same response every time, a quote about Bitcoin being naked, a reference to the famous “The Emperor’s New Clothes” tale. A short story about pride and bias blinding one from seeing the overwhelming truth. At this point, individuals often take one of two routes, the former being a type of escalation of commitment where — despite data, large community consensus and time — the individual doubles down on previous stances. The latter being open-minded to exploring the idea that they may be wrong, and, in that wrongness, there may be something new to learn. Choosing the former acts as a barrier from ever reaching the second phase in the learning cycle: discovery.

Discovery

In setting out to refute its potential, the opposite occurs and the foundational building of conviction begins. If approached with humility, one discovers they have stumbled onto something bigger than themselves, and in front of them is an opportunity to grow.

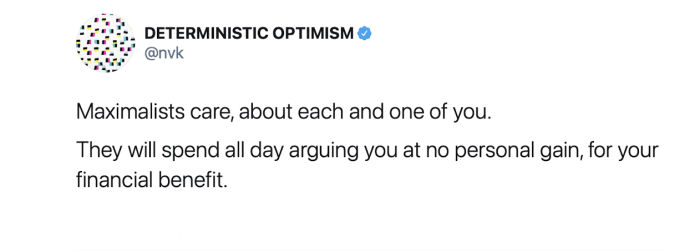

The discovery phase can be arduous due to the deafening noise enshrouding the signal. When thinking about this stage, I’ve come to appreciate Bitcoin maximalists and what some call their toxicity. While there is an argument for better understanding your audience at times and employing empathy when needed, most Bitcoiners are quick to tell you, bluntly, where you are wrong, followed by data and history. I encourage individuals to use this community feature as a tool for narrowing down on the signal sooner. I like what @NVK said about this recently.

I’ve never found a group of individuals more willing to donate their time, intellect and resources to challenge my current views. For free. Weird. When I entered this phase in 2017, the narrative was slightly different. There was less discussion on the soundness of bitcoin from money properties and economic standpoint, and everything was about “blockchain.” As I tucked my shirt in and swan dived into the rabbit hole, I grasped many of bitcoin’s value propositions intuitively. As a former banker at Wells Fargo, I understood the clunky legacy systems of transaction finality taking days, batching out transactions overnight, the number of parties actually involved in a credit transaction, and wire transfers being costly and timely inefficient. Bitcoin made sense to me, and I understood the power behind it.

Many of these initial experiences were more geared toward objective truths about how the protocol functioned, and less about deep theoretical questions, such as how bitcoin will be adopted or, bitcoin has no intrinsic value or, how will governments handle this, etc.

Additionally, at the time, one had to tunnel in a separate direction amid their rabbit hole journey to sift through the ICO boom to understand why altcoins weren’t the miracle monies they were marketing themselves to be. Today, we can draw a similar parallel between NFTs. I’m an advocate for innovation and creating new things, no matter how unique they are. However, many of these projects were overtly scammy or misleading and, four years later, many are still on this journey and do not understand the truly speculative nature behind them.

Most people think they are smarter than everyone else and can out-trade the market, or think they genuinely understand technology’s impact on solving real-world problems and the human aspect of managing those projects. I went through this cycle as well but the only wise trade I ever made was exchanging the bcash that I received from the hard fork back into bitcoin. Getting wrecked in this cycle has its role and maybe one of the most prominent mechanisms for pushing people to bitcoin.

However, on deep, theoretical questions like intrinsic value, Conner Brown wrote an excellent article discussing this back in 2019. In breaking down how skeptics use the language derived from Austrian economists themselves, Brown writes:

“While commodity and fiat monies were the only two possibilities for early Austrian economists (outside of credit instruments), times have changed. In our digital age, the distinction between commodity and fiat money has lost its value. It should be immediately apparent that Bitcoin does not fit neatly into this dichotomy — it has no use as a physical commodity but also does not exist through any legal decree. We can now hold and trade digital money wholly independent of the simple force of law. Instead, Bitcoin’s monetary properties are guaranteed with rules and logic embedded into its coded DNA. Through this purely digital existence, Bitcoin lives as a money free from the restraints of the physical world.”

Most recently, Al’s Lacrosse elegantly added to this topic on a piece in Bitcoin Magazine:

“It is this writer’s assertion that when we take a step back and discuss monetary intrinsic value in concept, what we are actually naming is a money’s property of resistance to alteration at the hands of human whim. That is what monetary intrinsic value truly is: an emergent meta-property ensuring the integrity of a money’s qualities.

“It’s not the luster of gold, electrical conductivity or ductility per se which made it so desirable as a money; it’s the fact that these qualities are set in stone (so to speak) by physical laws of nature, regardless of any king’s decree or political connections or military might. This framing of intrinsic value asserts that what it really describes is a property deeper than any particular quality of physical usefulness: it is the assurance that those transacting in the money know that, assuming they are getting the genuine article, it will be valuable, both at the time of transaction and in the future.”

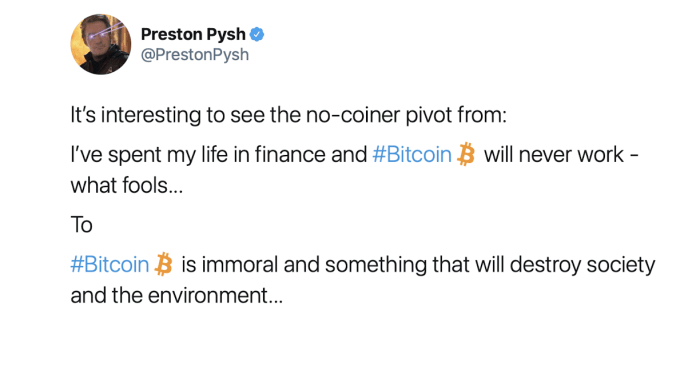

While the intrinsic value argument is now considered silly and ascribed solely to fanatical, no-coiner opponents, it was relatively common before 2016 up until 2017. Today, the argument is morphing into environmental damage, tether and ruining the economy.

In a few years, it will be something else.

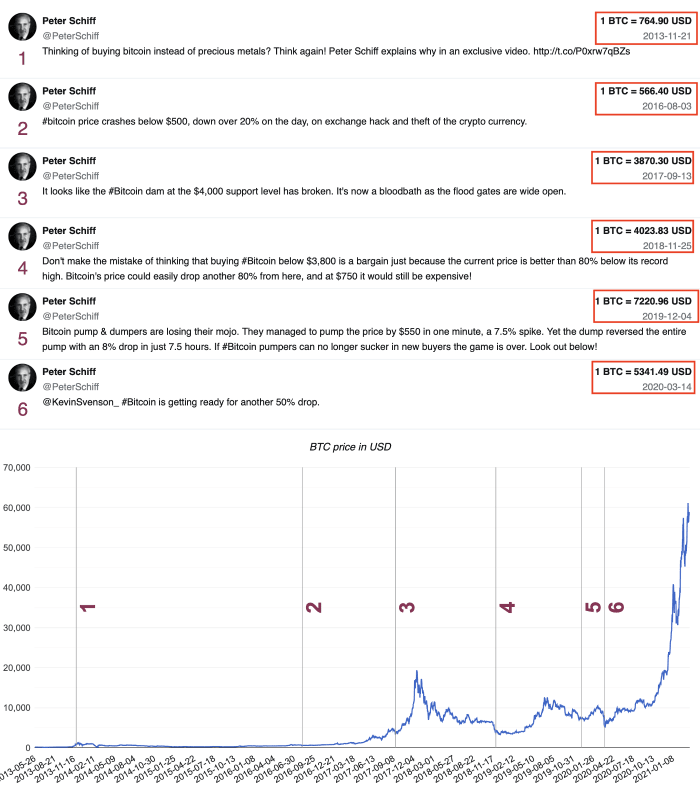

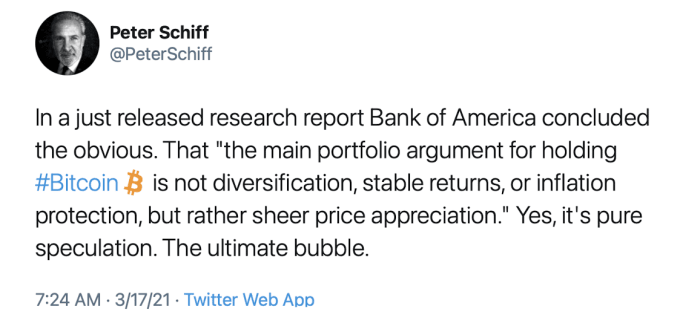

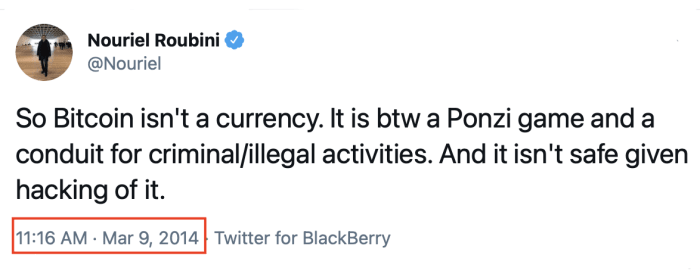

Without humility around knowing what you don’t know, the pursuit of trying to answer the philosophical, political, historical and economic questions is almost impossible. It requires, in some sense, outwardly expressing your lack of knowledge. Only through interacting with the right people, way more intelligent than myself, was I able to hone in on the signal, ask for direction and begin studying the topics that would truly change me. In Adam Grant’s latest book, “Think Again,” he states, “Research reveals that the higher you score on an IQ test, the more likely you are to fall for stereotypes because you’re faster at recognizing patterns. And recent experiments suggest that the smarter you are, the more you might struggle to update your beliefs.” I love this page by BlockchainCenter.net which showcases Peter Schiff’s continued escalation of commitment and an inability to rethink his opinions on the topic. Individuals who lack humility will struggle to enter the conviction phase.

Conviction

Through the studying of history, money and economics, while having a pulse on today’s culture and tomorrow’s technology, one’s convictions deepen, and allocation becomes a constant.

Everyone’s conviction varies in scope and arrival, but they all contain individual growth through challenging previously learned models and deep identity-rooted ideologies. Learning is a lifelong process, and similarly, it doesn’t stop in phase two. The hope is always that self-development and learning act as fertilizing the soil for a future self which is better than the current self. Suppose being open-minded helps push one from disbelief to discovery, and humility allows one to enter the conviction stage. In that case, curiosity and grit will enable individuals to explore new sectors for a well-rounded understanding. Gigi simplified this in a recent tweet.

In this phase, Bitcoiners experience the moment where it truly clicks, the lighthouse appears and illuminates the fog. An unquenchable thirst arises for learning about new topics one never knew they were interested in. If you weren’t previously concerned with banking, history, the Federal Reserve, inflation, computer science, energy consumption and economics now you are. Those who make it to this point experience the beauty of Bitcoin’s onion-like, multidisciplinary characteristics and the sheer depth of everything that went into creating it, intended or not. I’d argue that curiosity is a prerequisite here, but there’s more to be said about grit as the counterpart. While some people intuitively pick up on Bitcoin, there’s no shortcut of getting through this phase without sacrificing time and energy. If your busyness badge of honor is on display for everyone to see, you’ll slowly wade through this process like a snail. Getting to know Bitcoin intimately is an intentional decision to sacrifice your time and offer it up to these topics. High-time-preference goggles do not help you see here.

The first truly AHA! moment I had came about when reading “A History of Money and Banking in the United States: The Colonial Era to World War II” by Murray N. Rothbard. It’s entirely possible to read this incredible work and not take from it what I did, but it impacted me greatly. In addition to Nick Szabo’s “Shelling Out,” I felt as if Rothbard’s work on banking was a longer volume on how value has been transferred historically from one individual to another and the collective needs that arise out of cultures. How monies are created, and the pitfalls they face as society’s demands change and grow with new technologies. Rothbard provides an example from history:

“In the sparsely settled American colonies, money, as it always does, arose in the market as a useful and scarce commodity and began to serve as a general medium of exchange. Thus, beaver fur and wampum were used as money in the north for exchanges with the Indians, and fish and corn also served as money. Rice was used as money in South Carolina, and the most widespread use of commodity money was tobacco, which served as money in Virginia. The pound-of-tobacco was the currency unit in Virginia, with warehouse receipts in tobacco circulating as money backed 100 percent by the tobacco in the warehouse.”

How could I have worked at a bank selling financial products and known so little about both the history of money and banking? After reading about how money has developed over time, one realizes that value is, and always has been, subjective and consists solely of what two parties, or a society, agrees has value and will thus exchange it. Not necessarily because they were physical, but because they served a purpose and had value because of the problems they solved. Those who cannot wrap their heads around an intangible asset haven’t studied history. Be wary of people who are more intelligent than you but who haven’t studied history.

Rothbard also touches on inflation, and today what we call quantitative easing (QE).

“The issue of this fiat “Continental” paper rapidly escalated over the next few years. Congress issued $6 million in 1775, $19 million in 1776, $13 million in 1777, $64 million in 1778, and $125 million in 1779. This was a total issue of over $225 million in five years superimposed upon a pre-existing money supply of $12 million. The result was, as could be expected, a rapid price inflation in terms of the paper notes, and a corollary accelerating depreciation of the paper in terms of specie. Thus, at the end of 1776, the Continentals were worth $1 to $1.25 in specie; by the fall of the following year, its value had fallen to 3-to-1; by December 1778 the value was 6.8-to-1; and by December 1779, to the negligible 42-to-1.”

While the context is vital during this time in history, as is our current context in 2021, fears around inflation and money printing are valid. We have a rich history full of the devastating effects laid barren to societies who print money accompanied by zero data to support any long-term benefit. Below, I have added a few additional resources that I studied in my conviction phase that might help.

In being curious, equipped with grit, one explores uncharted seas and enjoys proving themself wrong and learning about new topics. While lacking open-mindedness, humility and curiosity overlap and are interchangeable at any phase in this process, it can be hard to overcome any of them if you see them below you. In spending time in each phase listed above, I found myself arriving at a place I didn’t foresee, what I call the understanding phase.

Understanding

A paradigm shift occurs, the lens through which you view the world, money, economies and value changes in a way that guides your actions and future energies in a different direction.

At the understanding phase, you experience a shift in your mindset. This isn’t a chapter where you reach enlightenment or true understanding of any one thing because none of us ever will, and circumstances change quickly. It’s more about having a better understanding of the bigger picture, which you previously didn’t have. I found a reoccurrence here among Bitcoiners that the lens through which they viewed the world changed. Our future thoughts and energies are directed down a new path, and as the saying goes, sell your chairs to buy more bitcoin.

Do I really need a Tesla, or can I settle for a used vehicle under $20,000? If I am American HODLer, do I really need to spend a few more dollars on guacamole at Chipotle? Is it possible for me to sell some of the things I don’t use and never really needed in the first place? What’s the difference between being rich and wealthy, and how does one build generational wealth and actually preserve it? What does success even look like? What’s the value of being able to do whatever I want, whenever I want, wherever I want, with whoever I want, for as long as I want? Does it matter how much bitcoin I have if I am not healthy? Am I loving and taking care of my family?

Bitcoin’s most potent effect is changing the lens through which we look at consumption, savings, habits and our discipline or lack thereof.

Bitcoin is an example of proper incentives and fundamentals first. Your time preference lowers because you aren’t looking at tomorrow; you’re focusing on the next decade. In setting out to see if bitcoin was a good investment, it ended up changing my life entirely. I rearranged my habits and how I plan on taking care of my family for the future. I took a deeper dive into inequality and how decentralized finance can impact developing countries. It’s even played a role in my health and diet. This is not unique to me though, and this is part of the passion that spurs the community to share the impact bitcoin will have on your life and the change that might ensue. Aleks Svetski has referred to some of these experiences relative to the Hero’s Journey and I think that’s a powerful analogy.

Will Kenton wrote in an article on “Paradigm Shift”, “Although the idea of paradigms has been around for quite some time, the concept of paradigm shifts was explored by American physicist and philosopher Thomas Kahn Kuhn in his book ‘The Structure of Scientific Revolutions.’ Kuhn contested that paradigm shifts characterize a revolution to a prevailing scientific framework. They arise when the dominant paradigm, under which normally accepted science operates, is rendered incompatible or insufficient, facilitating the adoption of a revised or completely new theory or paradigm.” It’s important to note that Kuhn’s point is not about science itself, but more sociology around how people think about science. Through this lens, I don’t think bitcoin could be described more accurately in comparison to fiat currencies. Both in their fundamental properties and in the context of how we will transact in the future.

Conclusion

On the surface, bitcoin’s true barrier to entry is education, but, on a deeper level, it is truly ourselves. If you aren’t open-minded, humble in accepting you might be wrong, and curious to learn something new, you’ll never even get into the discovery phase. If this pattern is present among many, how do we expedite this process? For starters, if you aren’t willing to sacrifice tens or hundreds of hours of learning, you won’t expedite anything. Similarly, if you aren’t curious about this sound money’s multidisciplinary properties, bitcoin might not be for you. That latter is true for every subject in life and people get bitcoin at the price they deserve.

Adam Grant on great thinkers:

“Great thinkers don’t harbor doubts because they’re impostors. They maintain doubts because they know we’re all partially blind and they’re committed to improving their sight. They don’t boast about how much they know; they marvel at how little they understand. They’re aware that each answer raises new questions, and the quest for knowledge is never finished. Humility is a reflective lens: it helps us see them clearly.”

Speeding through this cycle is easier than ever in 2021 if you’re willing. Education is abundant, and Bitcoiners are more than happy to sacrifice their time and resources to help someone get it, which is one of my favorite things about the community. If you’re new to bitcoin and are eager to learn, start here.

- Clubhouse — If you have an iPhone, download Clubhouse and hop into Cafe Bitcoin. I cannot believe how much I learned in one month on Clubhouse compared to three years of articles and podcasts. Do. This. Now.

- Follow Bitcoin People — Joining Clubhouse and following Bitcoin people are actions you can take today, and position yourself in the best spot to learn within hours. Learning has to be intentional, and you can start with looking toward helpful people.

- Create a Learning List — Through major outlets like Bitcoin Magazine, Kraken and Swan, you can find a ton of content. Save it to a list or document, click into it whenever you have time. I use Notion to do this which allows me to write questions down as well and highlight notes. It’s free and may even help you organize other parts of your life.

- Listen to Twitter Spaces — Bitcoin Magazine’s Twitter hosts some of the most compelling conversations in the industry currently happening.

Thank you for reading. Let me know if you’ve seen a similar theme or experienced these phases yourself. A big thank you to the Bitcoiners who donated their time adding to and editing this article. #Bitcoin.

This is a guest post by Nick Beaird. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Comments (No)