Ireland is ready to introduce new cryptocurrency regulations in response to a forthcoming European Union (EU) crackdown on money laundering. In anticipation of the EU’s directive, Ireland is drafting urgent legislation aimed at regulating cryptocurrencies more effectively.

The Irish Examiner published a report on 16 October 2024. “The Finance Minister, Jack Chambers, will draft urgent legislation to update regulations, as it must be in place by the time the EU regulations come into place on December 30,” it said.

🚨🇮🇪 Ireland is drafting “urgent” #cryptocurrency regulations ahead of the EU’s Anti-Money Laundering laws set for December 30.

Finance Minister Jack Chambers emphasized the need for updates to ensure compliance, though specifics are still unclear.

How will these changes… pic.twitter.com/ffqz8UKV3J

— TheNewsCrypto (@The_NewsCrypto) October 17, 2024

Explore: Bank Of Italy Set To Release MiCA-Based Crypto Guidelines In “Coming Days”

Ireland’s Race Against Time To Align Regulatory Framework With MiCA

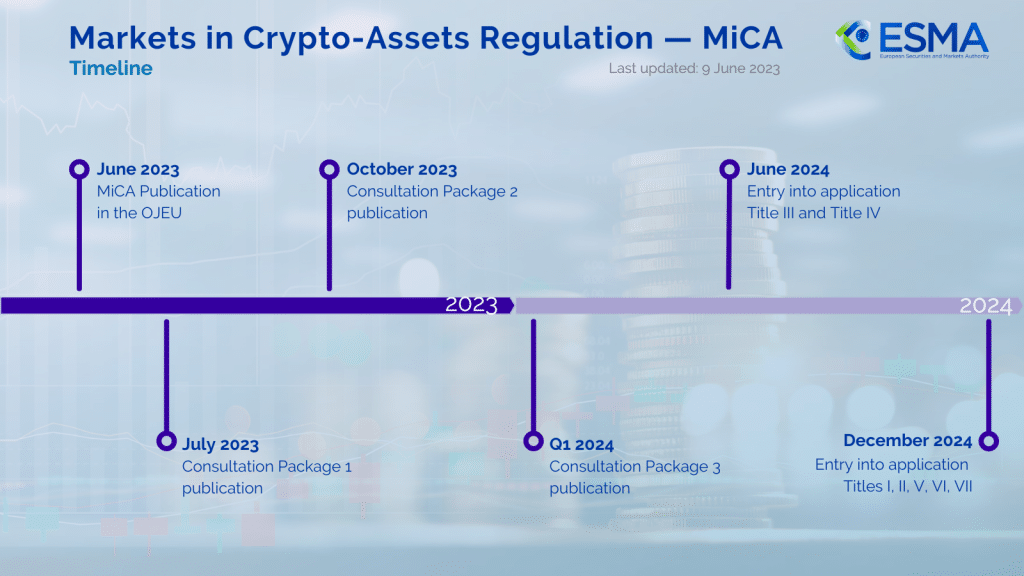

The Markets in Crypto-Assets Regulation (MiCA) institutes uniform EU market rules for crypto-assets. Importantly, the regulation will cover crypto-assets that are not currently regulated by existing financial services legislation.

The EU’s directive is seeking to mitigate money laundering risks. It will mandate member states to implement robust AML measures tailored to the crypto sector.

Furthermore, the urgency with which nations are addressing the challenges posed by potential misuse of digital currencies is a major push for Ireland to act.

Ireland is the THIRD RICHEST country in the world with a GDP per capita of $94,392, and its crypto-friendly policies has resulted in major crypto companies including Gemini, Kraken, and the massive Bank of New York Mellon, US, establishing their European Base in Ireland. pic.twitter.com/tQKItntIah

— FLOKI (@RealFlokiInu) October 15, 2021

As the EU tightens its regulatory framework, Ireland’s proactive stance reiterates its commitment to aligning with broader European efforts to combat financial crimes.

Italy is also taking steps to enhance its surveillance of the cryptocurrency markets to comply with the MiCA regulatory framework.

Read more: EU Watchdog Warns Crypto Firms of Offshore Risks Under MiCA

What The Proposed Legislation May Or May Not Include?

Recently, the European Securities and Markets Authority (ESMA), the regulatory body overseeing the EU’s financial markets, warned crypto firms seeking partial authorization under MiCA regulation while maintaining substantial operations offshore. ESMA is actively overlooking other such crypto related regulations.

The latest directive will aim to impose stricter controls and transparency requirements on crypto transactions. These have been identified as potential channels for money laundering and terrorist financing.

Also, the proposed legislation will likely focus on several key areas: Cryptocurrency exchanges and service providers may be required to register with Irish authorities and obtain licenses to operate legally.

Enhanced due diligence procedures will be mandated for crypto transactions. Furthermore, it will require service providers to verify the identities of their customers and monitor transactions for suspicious activities.

Importantly, Ireland will work closely with EU agencies and other member states to share information and coordinate efforts in tackling cross-border financial crimes involving cryptocurrencies.

Explore: EU’s MiCA Regulations Become Top Priority for Stablecoin Issuers As June Deadline Approaches

Comments (No)