The bull market is back, and crypto is rallying. Most analysts think Bitcoin price is on its way to $100,000, pumped by spot Bitcoin ETFs, Donald Trump’s win, and FOMO.

Crypto, Bitcoin, Ethereum, and even upcoming projects like Pepe Unchained—a meme coin-centric layer-2 on Ethereum—are on fire.

Bitcoin is above $81,500 and defies gravity, while Ethereum is trading above $3,000. Although much more is needed, sentiment is improving, and more buyers are than sellers.

Whether FOMO kicks in now or is already underway, traders and investors are clearly over the moon.

Bitcoin Pumping $100,000 Up Next?

Optimism is so strong that some traders expect Bitcoin

to ease past $100,000.

(BTCUSDT)

A break above $90,000 this week, looking at the Bitcoin candlestick arrangement in the daily chart, could easily see the world’s most valuable coin expand to six figures for the first time since launching.

If that happens, Bitcoin will have soared 5X from the 2017 ICO-induced rally and another 30% from the DeFi-NFT bull run of 2021.

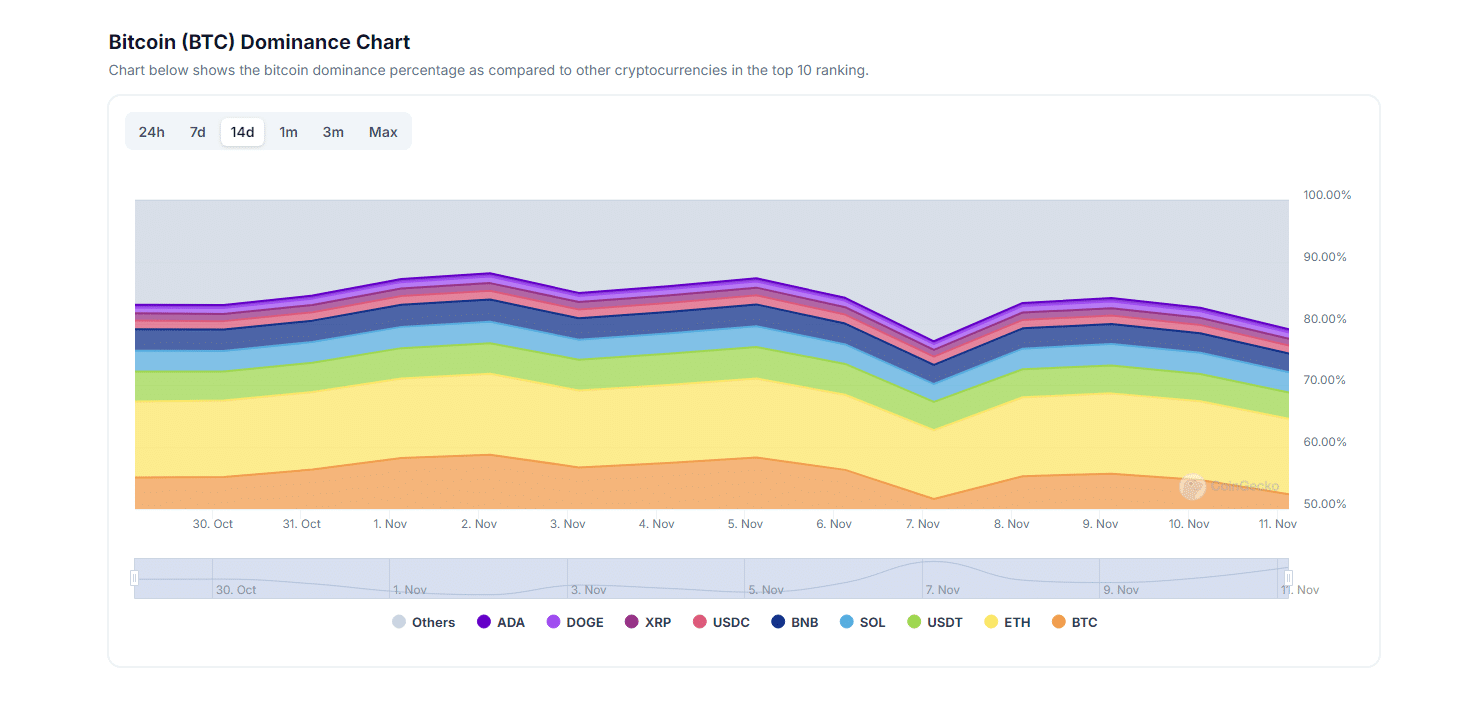

From Coingecko, Bitcoin commands a 56% market share and maintains a positive correlation with altcoins.

(Source)

For this reason, an uptick in BTC to six figures directly benefits altcoins. In this cycle, some tokens, especially meme coins, would likely post 100X or more.

EXPLORE: 17 Best Crypto to Buy Now in 2024

What’s Driving Bitcoin Price Push to New All-Time High?

The question now remains: What is driving Bitcoin prices?

Top of the list is FOMO–fear of missing out.

Retailers are back, piggy-riding on the back of the big boys, mostly institutions. After the approval of spot Bitcoin ETFs, their demand has shaped the pace at which prices tick higher or lower.

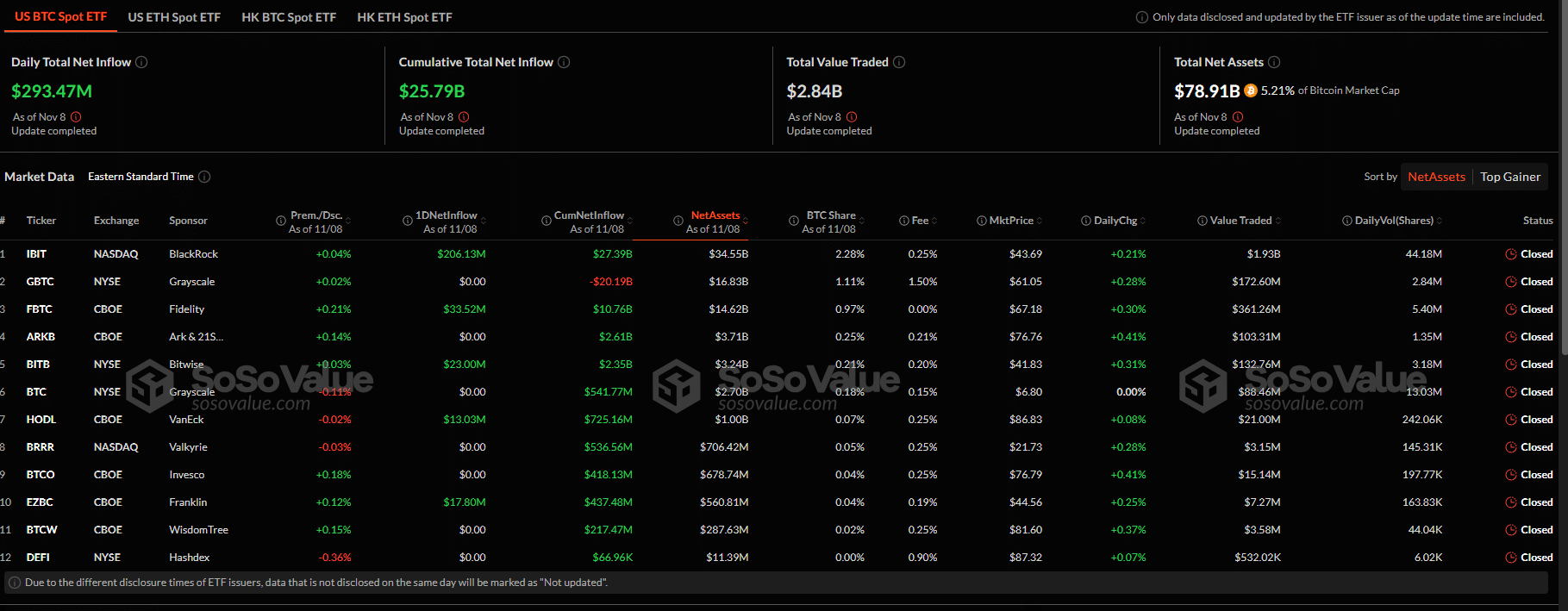

Looking at Soso Value on November 11, spot Bitcoin ETF issuers in the United States currently manage $78 billion worth of assets, buying over $293 million on November 8.

(Source)

The infusion of capital to Bitcoin via spot Bitcoin ETFs saw prices soar above $72,000, then $74,000.

This breakout attracted retailers who have been buying on every dip since the spike above March highs last week.

While Skew analysts see resistance at around $82,500, the pace of this growth depends on demand, mostly from traders in Europe and the United States bidding higher.

(Source)

If this happens and volume increases, Bitcoin could extend its parabolic growth, springing higher after the consolidation and potential accumulation after the swing down from March to August 2024.

Already, Peter Brandt thinks Bitcoin will not only reach $100,000 but spike to $125,000 by the end of the year.

(Source)

Beyond price action, politics will shape how prices evolve.

EXPLORE: 15 Best No KYC Crypto Exchanges for 2024

Donald Trump Is Back: Will Bitcoin Reserve Fuel $100K?

With Trump in power, the Federal Reserve will continue slashing rates even lower this December and 2025.

Lower rates translate to an economy flush with money, forcing inflation higher. Bitcoin is digital gold; buyers will find tailwinds to sustain the leg up from this status.

Bitcoin and crypto would also likely trend higher because of pro-crypto legislators who were elected in the last election and Trump in the Oval office.

When campaigning, Trump promised to fire Gary Gensler, the United States SEC chair, and replace him with a pro-crypto and innovation appointee.

Additionally, the vocal president-elect plans to establish a crypto framework and possibly add BTC as a strategic reserve.

EXPLORE: ETH Price Shifts Bullish Amid Monumental ETH ETF Inflows

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Comments (No)