In a thread on X (formerly Twitter), Raoul Pal, a renowned trading guru and the founder/CEO of Global Macro Investor and Real Vision, has illuminated the crypto community about the advent of what he terms as the “Macro/Crypto Summer.” This period, according to Pal, is not just a fleeting season but a significant phase in the financial and cryptocurrency markets, deeply rooted in the cyclical nature of the global economy.

Why The Macro/Crypto Summer Matters

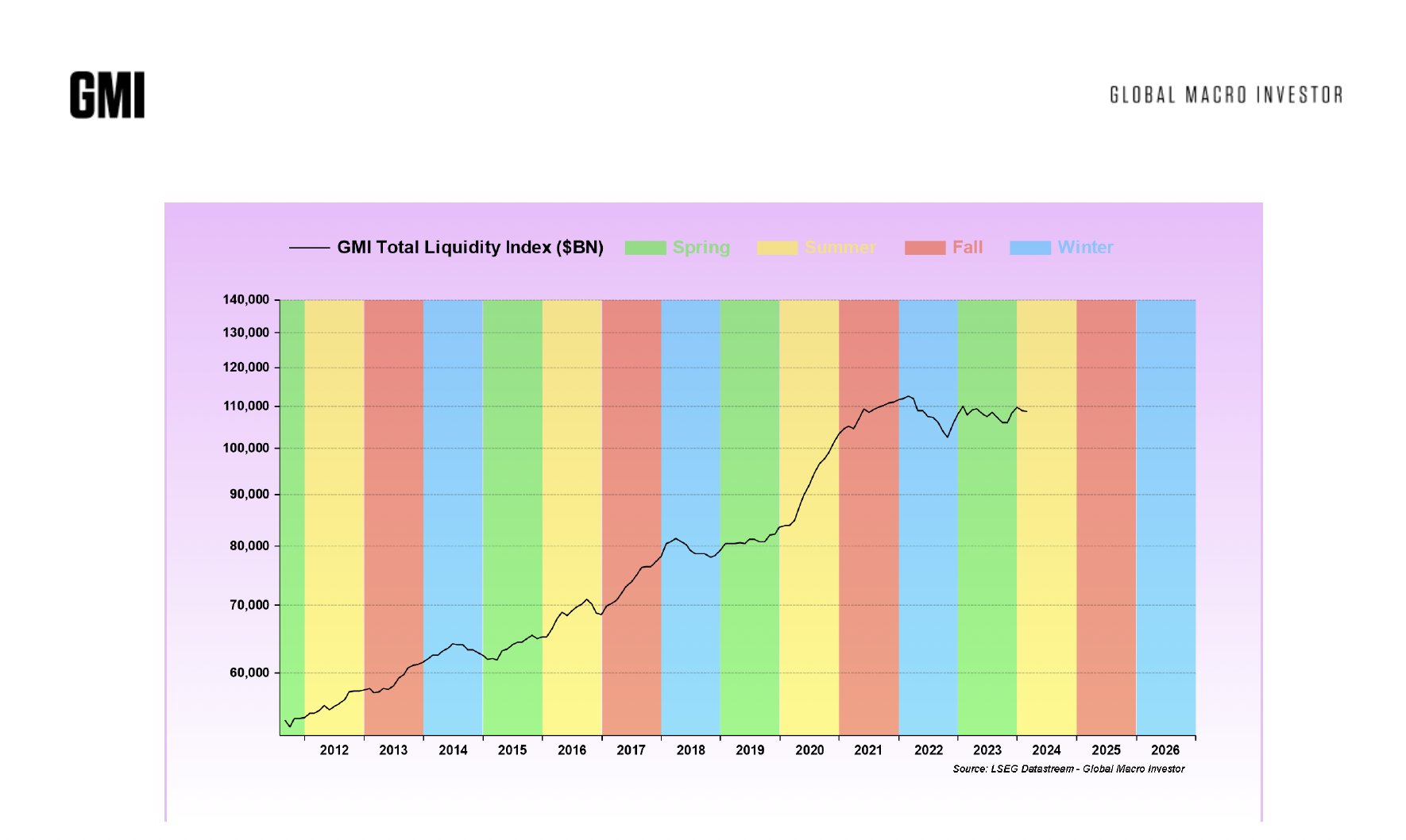

Pal elaborates on the concept of the “Macro Summer,” explaining it as a pivotal phase in “The Everything Code” cycle, closely following the Financial Conditions Index, which historically precedes the cycle by approximately ten months. The ISM (Institute for Supply Management) index, a key indicator of economic health, often bottoms out during this period, marking the start of GDP growth.

Pal’s thesis draws attention to the “near-perfect 3 1/2 year cyclicality” in the ISM business cycle, propelled by liquidity dynamics and the debt refinancing cycle at its core. He underscores the significance of liquidity: “And that is driven by liquidity, which bottomed at the end of 2022… macro summer and fall are all about liquidity rising and is a core part of The Everything Code thesis.”

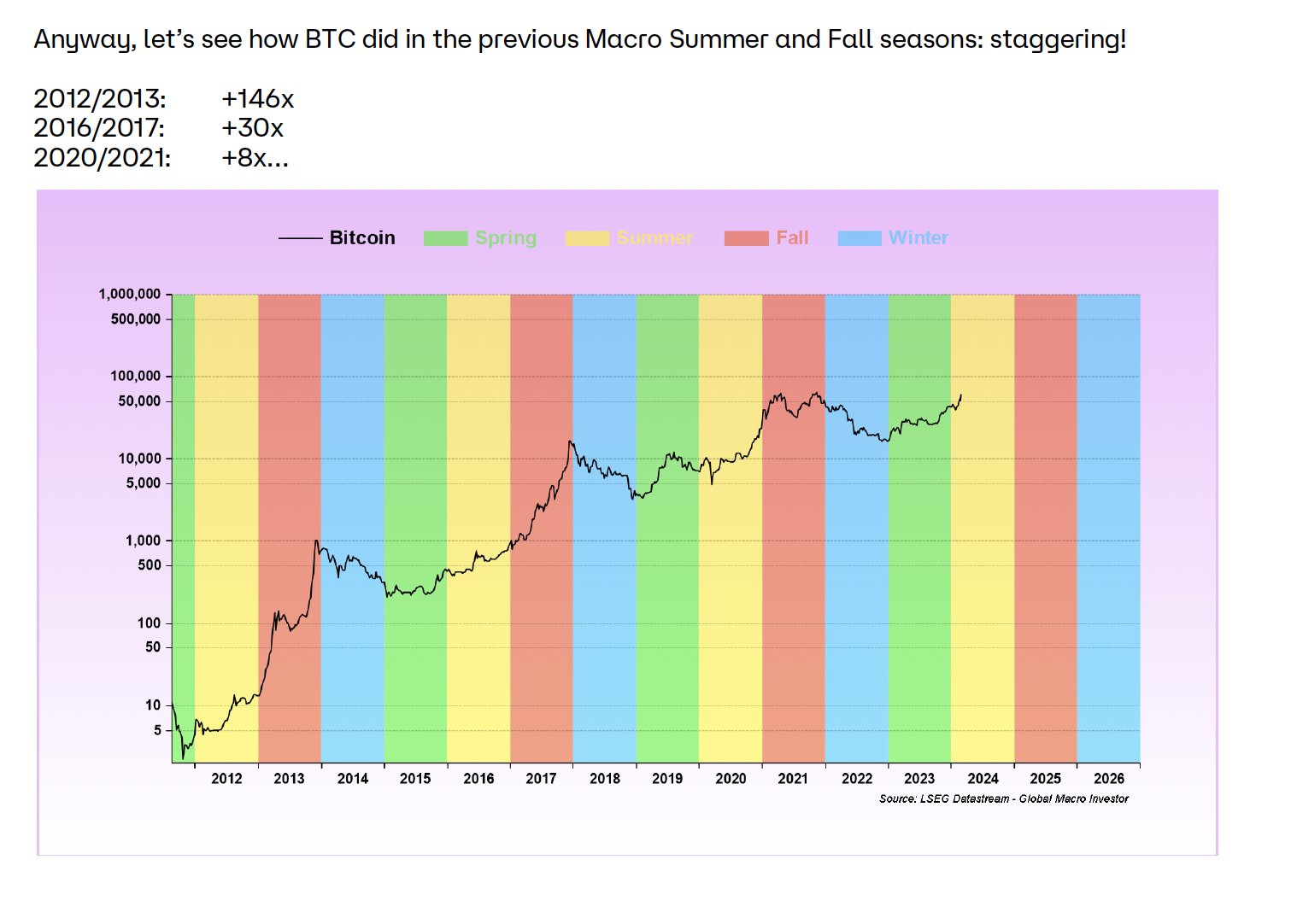

This influx of liquidity is crucial for tech stocks, which historically thrive during these phases. Yet, it’s Bitcoin and, more broadly, the cryptocurrency market that exhibit the most dramatic responses. Pal presents staggering growth figures from past Macro Summer and Fall seasons to underscore his point:

- Bitcoin: Saw increases of “2012/2013: +146x, 2016/2017: +30x, 2020/2021: +8x…”

- Ethereum: As an altcoin during the 2016/2017 and 2020/2021 cycles, it achieved “2016/2017: +1,770x, 2020/2021: +41x.”

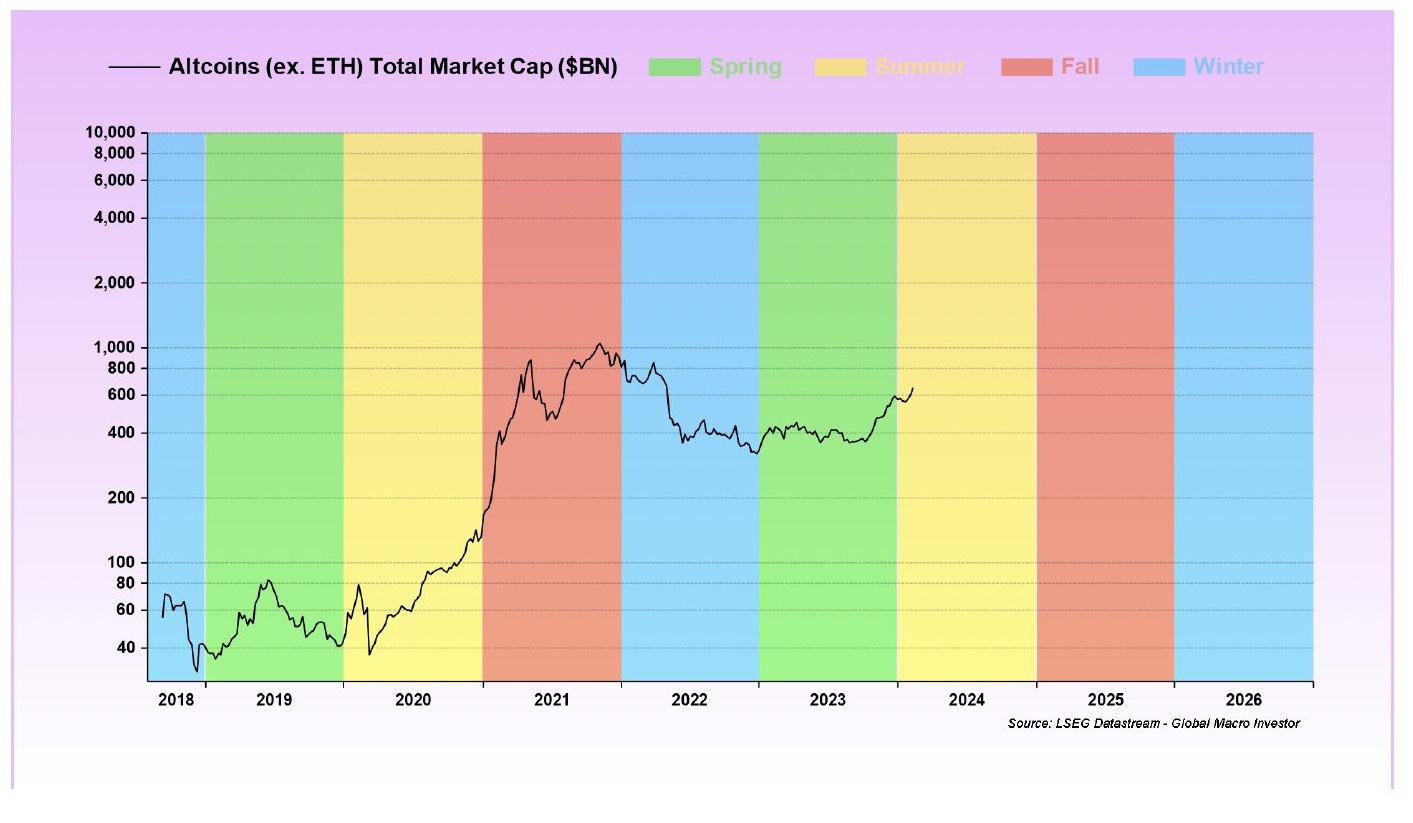

- Altcoins (excluding ETH): Witnessed an aggregate market cap rise of “+24x” in the last cycle.

“Wild! When we just look at Altcoins ex-ETH (we only have shorter data for the last cycle), the entire market cap rose +24x! And that includes thousands of worthless tokens that didn’t rise, so I’m not just cherry-picking winners here,” Pal remarked.

DOGE, a popular meme coin, is mentioned by the expert as another prime example of the “power of Crypto Summer and Fall,” with its value experiencing significant multipliers – “2016/2017: +136x, 2020/2021: +370x” – in the aforementioned cycles.

These figures underline the significant influence of macroeconomic cycles on crypto valuations, with Pal pointing out the alignment of these cycles with Bitcoin’s halving events. “Crypto summer has started and fully develops post-halving,” he states, highlighting the interconnectedness of these cycles with the broader financial landscape.

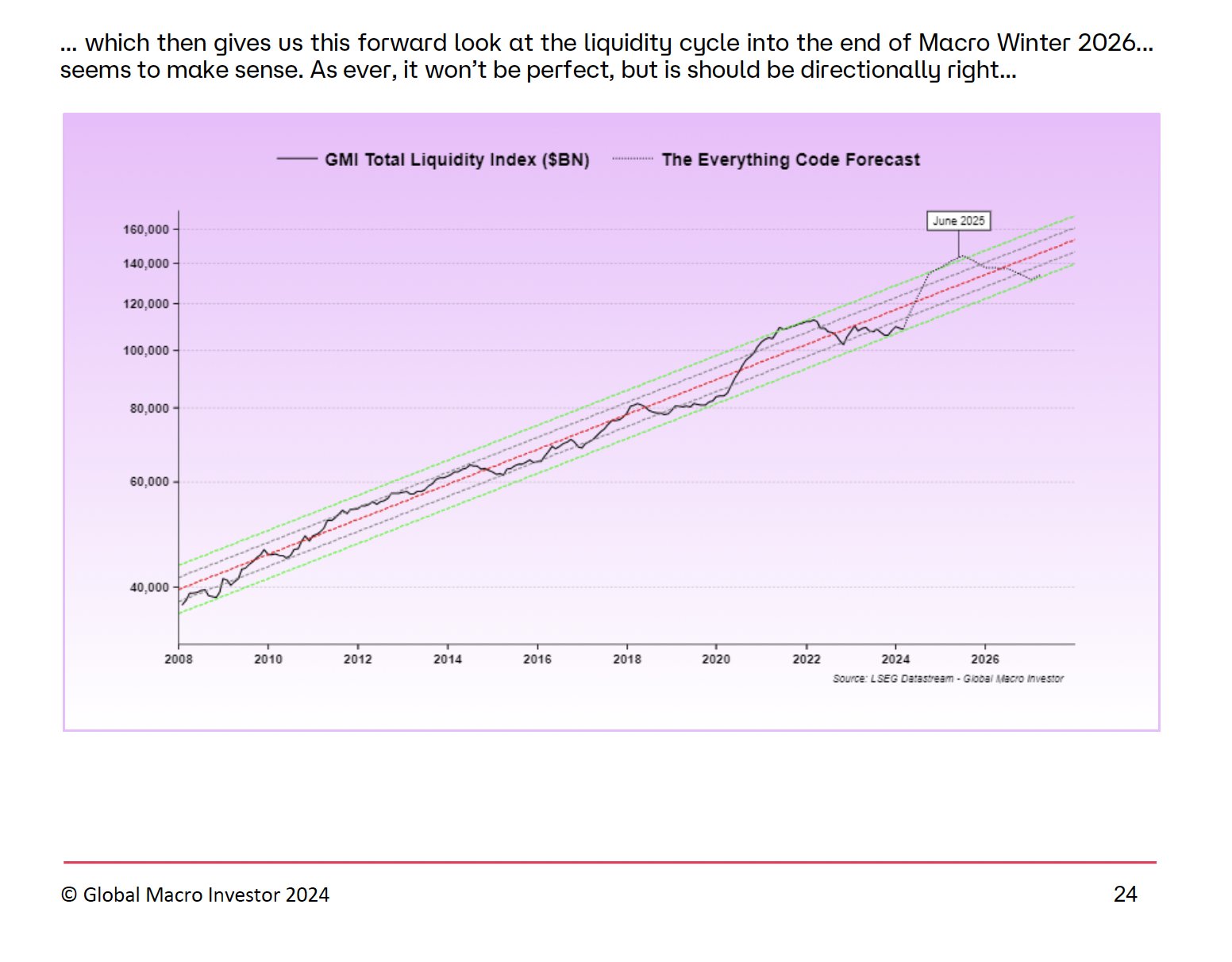

Notably, Pal’s analysis doesn’t stop at the past; it looks forward, suggesting that liquidity is expected to rise all the way into the end of 2025. This anticipation is rooted in a complex interplay of global financial mechanisms, including the potential for increased US money printing in response to a massive ramp-up in interest payments and changes in Fed Net Liquidity and the Treasury General Account (TGA).

“Will the US join the summer party? […] I know it seems impossible now, but the US is on the verge of a massive ramp-up in interest payments. […] at some point – the balance sheet will stop shrinking, which is enough to unleash liquidity into the system. […] I cannot see how they don’t massively expand liquidity, one way or another.

Meanwhile, Pal predicts that it won’t be just the US injecting liquidity into the financial systems in the coming months. “I’ve no idea whether it’s China, the EU, Japan or the US that drives this or maybe a bit of all. Time will tell,” he remarked.

Pal attributes his investment strategies, especially in tech and crypto, to the insights gained from The Everything Code. This approach has prepared him for the unfolding Macro Summer, with a keen eye on the altcoin market and the so-called “Banana Zone.” He concludes:

But the bigger game is yet to be played out as Alt season arrives and we fully enter the Banana Zone. The Banana Zone cometh, and it is a huge wealth-generating machine. Patience will be rewarded. In the meantime, don’t fuck this up. #DFTU

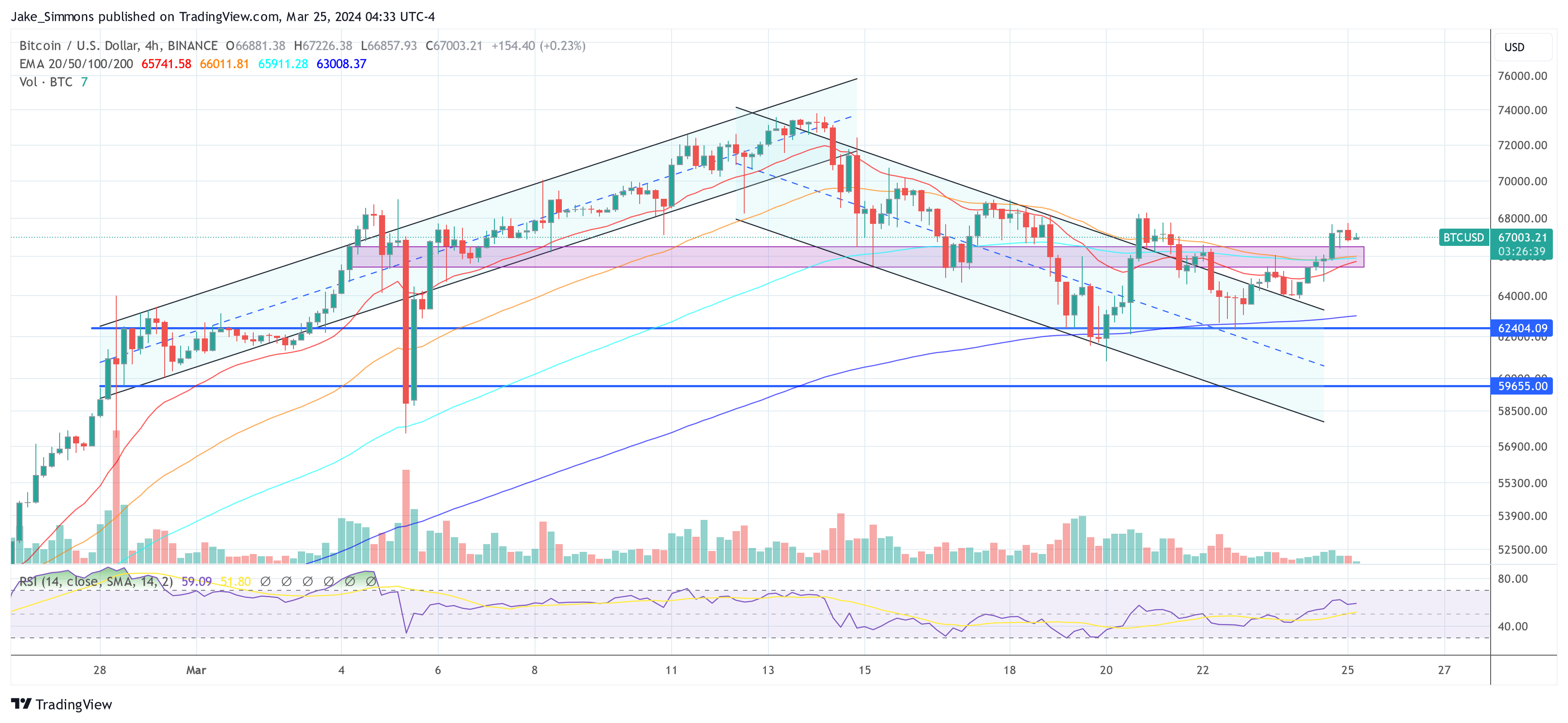

At press time, BTC traded at $67,003.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Comments (No)