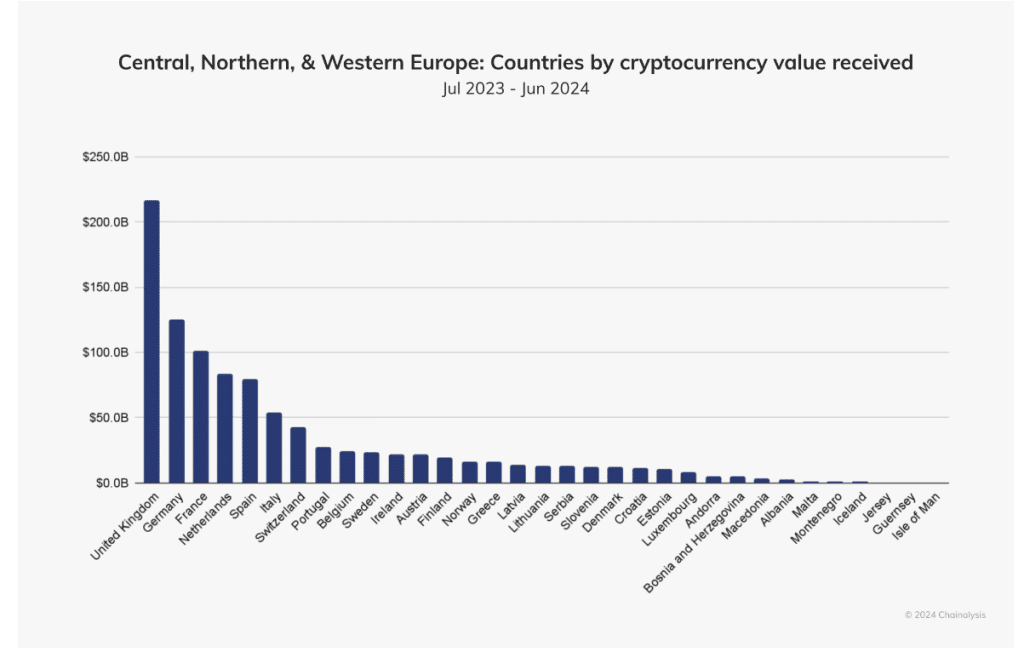

Chainalysis found that the UK has solidified its position as the largest cryptocurrency economy within Central, Northern, and Western Europe (CNWE).

The UK received $217 billion in on-chain value between July 2023 and June 2024. CNWE, the second-largest cryptocurrency economy globally, saw approximately $987.25 billion in transaction volume during this period, accounting for about 21.7% of the global total.

This positions the UK as a key player in the region’s crypto landscape, ranking 12th on the global adoption index.

Read more: UK Crypto Tax Could Jump to 39% As Italy Reveals 42% Crypto CGT

CNWE’s Growth Driven By UK’s Stablecoin Adoption

Stablecoins have emerged as a dominant force in CNWE, comprising nearly half of all inflows. Their use has surged among both retail and professional sectors, with the euro representing 24% of stablecoin purchases worldwide. This shift highlights a preference for stablecoins over bitcoin in fiat currency trades.

The regulatory environment in CNWE is undergoing transformation with the EU’s Markets in Crypto-Assets (MiCA) framework set to foster innovation and adoption.

UK financial regulator says no more

starting October, any crypto company marketing to UK consumers must comply with anti-money laundry and KYC rules

companies will need to apply for registration and pay a fee if they are approved

those that do not will be punished with 2 years… pic.twitter.com/JbKF2pog3i

— Crypto Tea (@CryptoTea_) July 4, 2023

The UK and other countries are also progressing with their own regulatory initiatives. The aim is to provide clarity and encourage traditional financial institutions to engage with digital assets. In fact, the country’s Treasury is also exploring the use of the blockchain in issuing bonds.

Read more: UK Treasury Is Next Major Economy to Push for Blockchain Bonds

Pressing Need For Regulatory Clarity

Talking to Chainalysis, Sophie Bowler, Group Chief Compliance Officer at Zodia Custody, emphasized the importance of regulation for mainstream adoption and innovation in digital assets.

“Regulatory clarity will not only enable digital asset firms to develop new products with confidence but will also encourage more traditional financial institutions to engage within a well-defined regulatory framework,” she stated.

Also, the UK government recently introduced new legislation aimed at clarifying the legal status of cryptocurrencies, non-fungible tokens (NFTs), and carbon credits under domestic law.

In fact, recently Dante Disparte, global head of policy at Circle—a leading issuer of USDC—spoke to CNBC and said that he believes the UK will introduce stablecoin law. According to Disparte, the UK government plans to introduce this legislation within months. The move is expected to provide much-needed regularity clarity.

Read more: Is UK Ready To Introduce Stablecoin Laws? Circle’s Head Of Policy Says Yes!

Comments (No)