While an OpenAI stock is still a dream, as the company remains private, AI is a 5—to 10-year growth story, perfect for a mid-20s drowning-in-debt burnout… or anyone really.

Like a psychedelic trip, AI promises a kaleidoscopic future full of vivid, strange, and thrilling possibilities.

Here are the AI winners that we’re betting on for the long haul despite the treacherous terrain of projects underpromising and overdelivering.

“The computer industry is going through two simultaneous transitions — accelerated computing and generative AI.” — Jensen Huang, CEO of NVIDIA

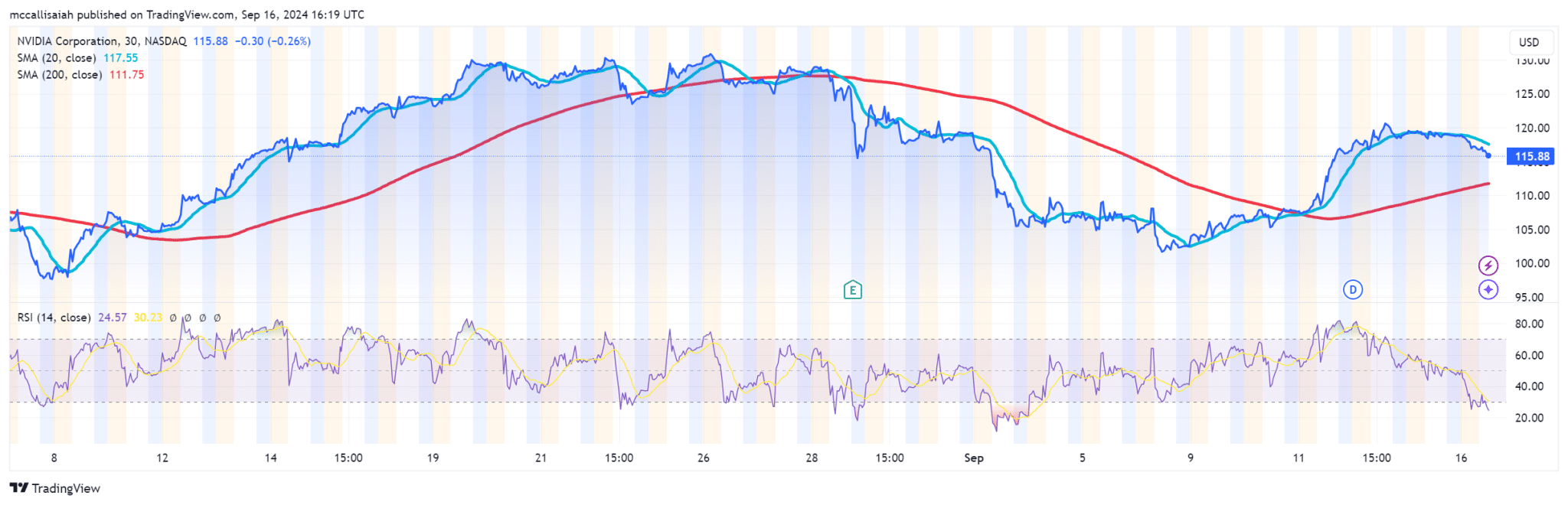

As more companies stake their fortunes on AI, they’ll need the right graphics cards designed for AI’s heavy lifting. Today, Nvidia fills that void. But this is leading their stock price to spiral into the realm of lunacy.

Ask yourself: how does one peg the worth of such a thing as a stock?

To use round numbers, Nvidia made $26 billion in 2022 and is worth $2.8 trillion today. So the question becomes, would you shell out $2.8 trillion for a company that only coughs up $26 billion?

This means Nvidia must not merely do well or very well. To meet the market’s expectations, they must outpace all others by a wide margin. A single quarter of “good” but not “exceptional” performance could send the stock price tumbling.

Nvidia will continue to grow for the next decade, though, like all things, not without interruptions. It’s prudent to wait for clear dips in Nvidia’s price before investing any more in it. It’s like Warren Buffett says, “Wait for the hype to last six months until it reaches an all-time high, then buy.”

Strike that. Reverse it.

Comments (No)