This year has seen multiple crypto narratives and emerging sectors come to the forefront. Meme coins and AI have dominated for the most part – yet top analysts are calling VitaDAO, Landshare, and ValiDAO as three low-cap gems within the RWA, DeSci, and DePIN sectors that all look set to explode in 2025.

However, Real World Assets (RWA), Decentralized Science (DeSci), and Decentralized Physical Infrastructure Network (DePIN) all had a great 2024, and 2025 looks to be even better.

If you’re wondering how early you are in crypto, here’s your answer:

– Stock Market: $120T

– Crypto Market: $3.5TConnect the dots.

DYOR into:

RWA, AI, Gaming, DeSci, DePIN, Cybersecurity. pic.twitter.com/n5ilhdwUsi

— Mr Brondor (@MrBrondorDeFi) December 1, 2024

DePIN, RWA’s And DeSci: What Are These Three Emerging Sectors In A Nutshell?

DePIN is a blockchain-based concept that uses tokens to incentivize people to participate in the development and maintenance of physical infrastructure. The idea is to use blockchain technology to create decentralized networks that allow participants to contribute resources like bandwidth, energy, or storage. These resources are then aggregated and distributed according to the network’s protocols.

RWAs are crypto tokens representing physical assets outside of the digital realm. These assets include real estate, vehicles, commodities, intellectual property, royalties and art. Tokenization of real-world assets allows for the fractional ownership of said assets, which can then be traded or transferred on the blockchain.

DeSci applies blockchain technology to research and innovation. It creates open, secure, and transparent systems for sharing data, funding projects, and collaborating globally. DeSci’s main aim is to provide open access to science, breaking down traditional barriers that exist within research.

Here, we will look at a standout project within each of the three sectors. These tokens should be monitored closely as we head into 2025 and the bull market gets into full swing:

RWA Project Spotlight – Landshare ($LAND)

Another milestone reached ✅

➡️ Coming up next:

• Tokenization Hub

• New property

• Major real estate partnership

• LSRWA Referral Program

• CEX ListingStay tuned! https://t.co/38JK7EvqX9

— Jordan @ Landshare (@FriskeJordan) November 23, 2024

Landshare (LAND)

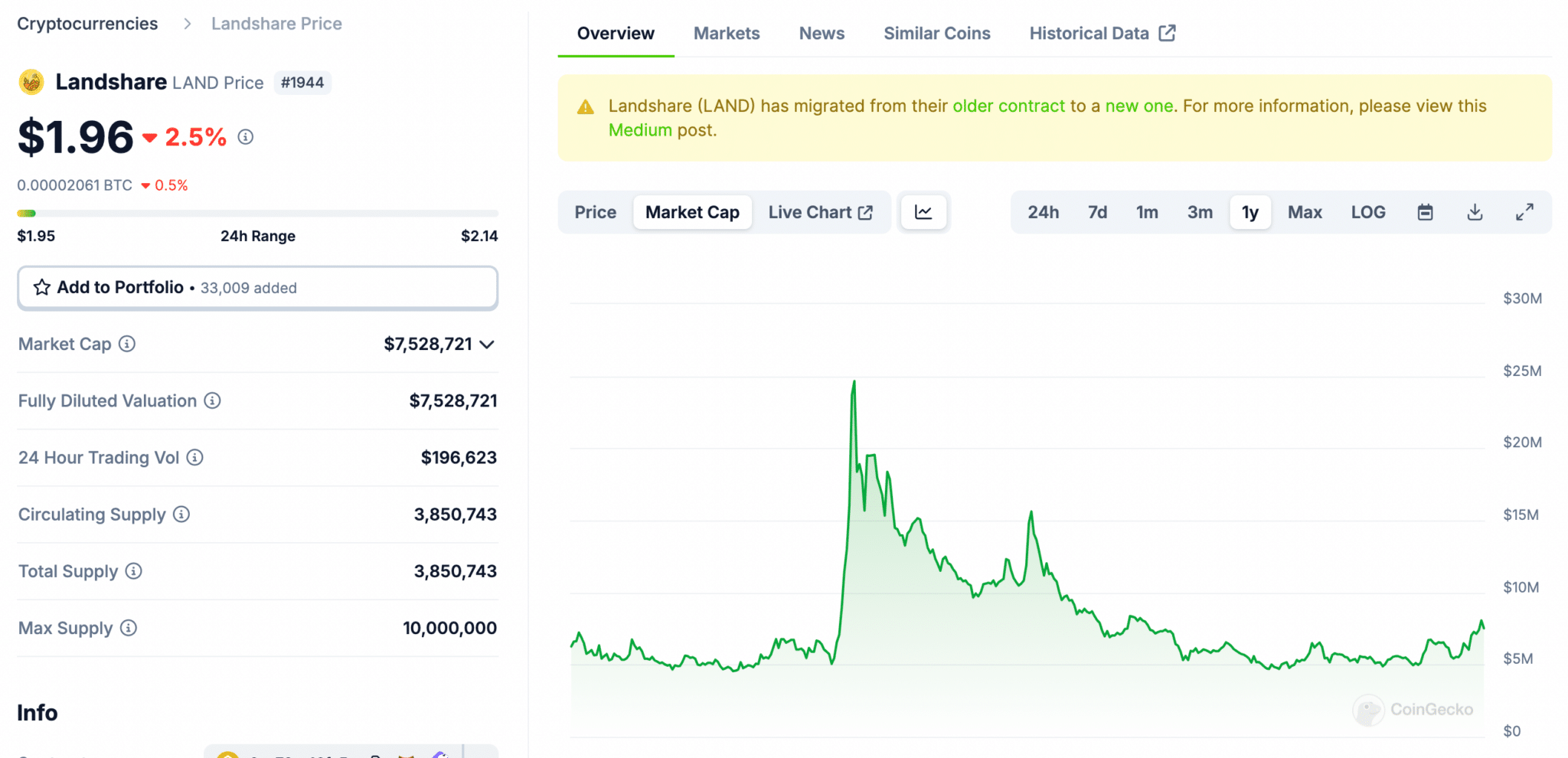

has over four years of real estate tokenization behind it and is still a low-cap gem. Sitting at just $7.5 million by market cap, Landshare is a low-supply RWA token built on the Binance Smart Chain (BSC). On a blockchain known for low-effort meme coins, LAND stands out as a premier utility-based token on BSC.

As we approach 2025, Landshare looks set to ride the RWA hype. It enables retail investors to participate in crowdsourced real estate buys, renovations, and eventual sales. Investors can buy and hold shares in rental properties by simply holding the token. This is a seductive proposition for those looking for decentralized passive income and real estate exposure.

LAND is currently trading for around $1.95 per token and has a market cap just shy of $7.5 million. Given the team’s experience and time in the market, Landshare represents a truly undervalued microcap within the RWA sector.

LAND is up nearly 40% in the past month, however, if you zoom out you’ll see that LAND hit an all-time high earlier this year. At that point, it briefly touched $25 million market cap, meaning a return just to that level means a near 4x ROI.

From there, LAND will be entering price discovery, likely during the peak of the upcoming bull market. Therefore, potential price targets could easily reach the triple-digits if the RWA sector continues to explode upwards, as many analysts predict 100x returns.

DISCOVER: Is Ripple’s RLUSD Stablecoin Close To Getting NYDFS Approval? Rumours Float Amidst XRP Surge

DePIN Project Spotlight – ValiDAO ($VDO)

ValiDAO

operates infrastructure services for an on-chain world. It runs validators, RPCs, IBC relayers, DA nodes, and other services. The services are offered from bare metal in Iceland and other underrepresented jurisdictions worldwide.

It is a self-funded start-up DePIN project with a small team and a loyal community. It validates multiple high-profile chains despite ValiDAO being a small player in the space. This includes; Celestia (TIA), Dimension (DYM), Axelar (AXL), and Eigenlayer (EIGEN).

The ValiDAO website has an open and transparent page that shows a complete breakdown of its treasury holdings and assets under management (AUM). Over $28 million has been delegated across all ValiDAO validators. This includes $150,000 of self-stakes and their own assets worth $1.5 million.

The AUM for ValiDAO will likely skyrocket soon as the DePIN firm will be a validator for Hyperliquid, which was recently launched, and its upcoming liquid staking protocol. There is currently over $1.35 billion in Total-Value Locked (TVL) on Hyperliquid, and ValiDAO was one of the biggest contributors to the test net.

This is a truly under-the-radar project within the DePIN space. VDO’s market cap is less than $7 million, which seems incredibly undervalued when considering this project has over $28 million in AUM. With the decentralized infrastructure sector heating up, do not be surprised to see VDO’s market cap start to bridge the gap toward its AUM value.

Every day before $HYPE TGE is another day to accumilate $VDO.

If you think Hyperliquid is going to melt faces, then this one should be a no brainer, still sub 10m mcap.

The universe is giving you a final chance.

0x2ef8a2Ccb058915E00E16aA13Cc6E36F19D8893b pic.twitter.com/EkmsXOXbCd

— dab1rd (@Daab1rD) November 27, 2024

DeSci Project Spotlight – VitaDAO (VITA)

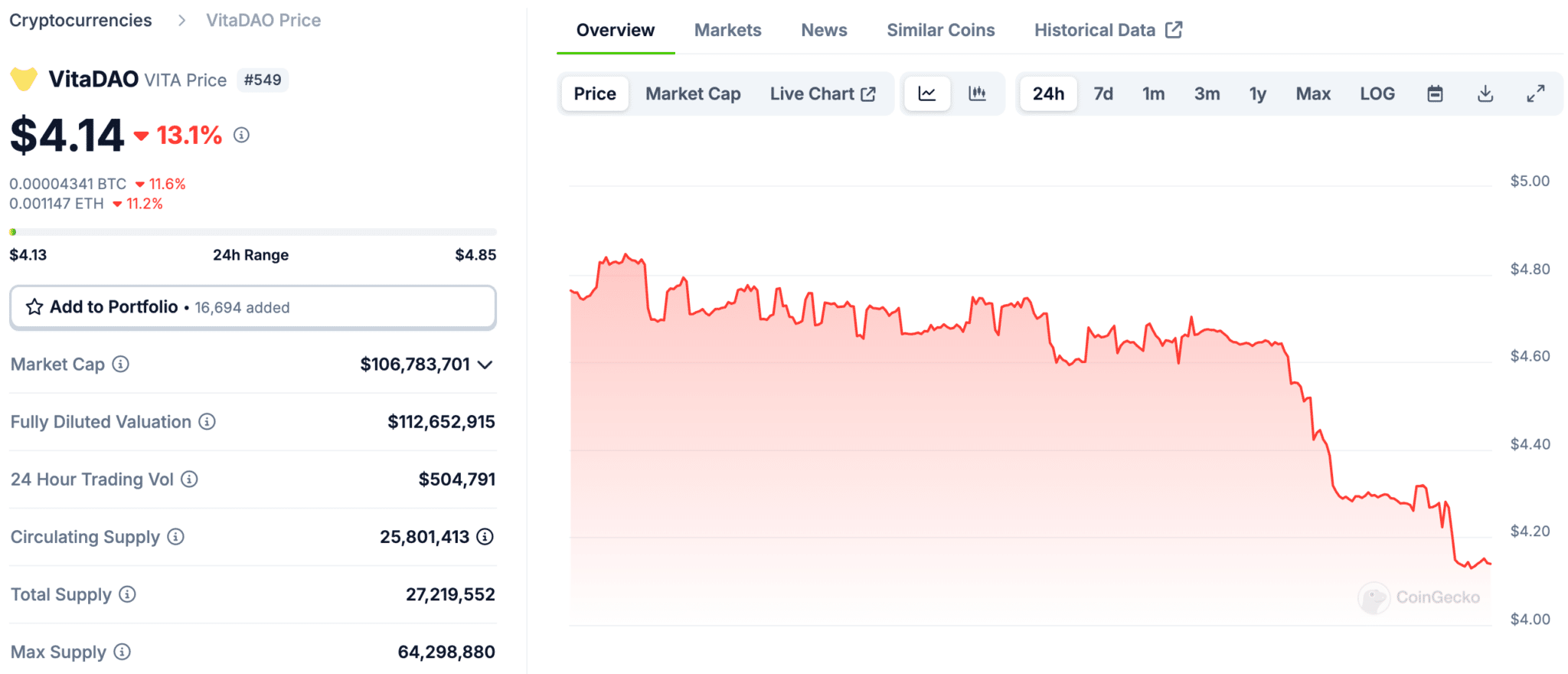

According to CoinGecko data, VITA

is currently the second-largest DeSci project by market cap. This may lead you to believe that VITA is too established and doesn’t represent a good risk/reward ratio. However, even being the second largest project in its sector, VITA’s market cap is just over $100 million.

It is a community-owned collective that funds early-stage longevity research and is governed by holders of the VITA token. VitaDAO transparently displays its project grants and overall metrics on the project website dashboard.

The firm has deployed more than $4.2 million across 24 different research projects thus far. Over $6 million in liquid funds are still ready to be granted to future projects.

At a recent DeSci gathering hosted by Binance Labs, Vitalik showed the attendees his sample of VitaDAO’s first longevity product, VD001. It is a natural high-dose spermidine supplement approved by the Thai FDA.

Learning at a small gathering of DeSci entrepreneurs organized by Labs. pic.twitter.com/ebiaI0uRoJ

— CZ 🔶 BNB (@cz_binance) November 13, 2024

This fuelled speculation about the Ethereum co-founder’s seemingly deep ties with VitaDAO. He has been following their social media accounts for some time and is a known proponent of longevity research.

With increasing attention shifting toward the DeSci sector and CZ calling for thousands of scientific-based projects in 2025, the odds look favorable for VITA to become a $1 billion+ token by the end of this bull market cycle.

EXPLORE: HBAR Up More Than 20% As Some Are Calling For An Incoming Supply Shock For Hedera’s Native Token

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

99Bitcoins may receive advertising commissions for visits to a suggested operator through our affiliate links, at no added cost to you. All our recommendations follow a thorough review process.

We hate spam as much as you do. You can unsubscribe with one click.

Comments (No)