One of the key topics linking cryptocurrencies to all Americans, regardless of whether they are in crypto, could be the prospect of a digital dollar — a version of the currency issued by the Federal Reserve that is traced on the blockchain.

The prospect of a digital dollar has sparked concerns about privacy, leading to bans in some US states and promises from candidates that they will never allow such digital currency to replace the traditional greenback.

Meanwhile, stablecoins issued by private companies have been filling this void, promoting the dollar’s usage globally. Stablecoin issuers like Tether have emerged as some of the largest holders of US debt.

Cointelegraph spoke with Eswar Prasad about the role of central bank digital currencies (CBDCs) and stablecoins in crypto and fiat currencies. Prasad is the Tolani Senior Professor of Trade Policy at Cornell University, a member of IC3, and a research associate at the National Bureau of Economic Research.

Stablecoins: Complementary or competitors to CBDCs?

The Federal Reserve has been researching a digital version of the US dollar since 2020. According to data compiled by the CBDC Tracker, there are at least four research projects being carried out by the Fed’s members: the Digital Dollar, Project Hamilton, Project Cedar Phase II and Project Ubin+, along with the Wholesale Digital Dollar.

Although these research projects cover a range of topics, from offline settlements to cross-border currency transactions, for many Americans, the topic is still synonymous with less privacy in how they handle their money.

Republican candidate and former President Donald Trump has vowed on many occasions to “never allow” a CBDC in the country.

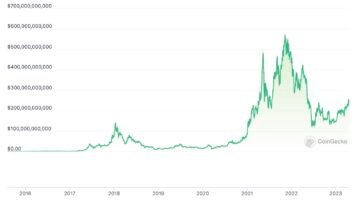

For stablecoin issuers, the absence of a US dollar means a market opportunity. Over the past few years, Tether has gained a market share of nearly 70% among stablecoins pegged to the US dollar. The company has also strengthened its ties with US authorities over the same period, onboarding the Federal Bureau of Investigation (FBI) to its platform.

Tether’s reserves were backed by a pile of $97.6 billion in US Treasurys as of July 31, surpassing the holdings of Germany, the United Arab Emirates and Australia.

In 2021, the US Commodities and Futures Trading Commission (CFTC) fined the company a $41 million civil monetary penalty for misrepresenting the stablecoin’s backing.

[embedded content]

Related: Investors claim Tether’s $118B reserves may face audit and liquidity risks

For Prasad, programmable stablecoins may still have a place in decentralized finance, but CBDCs could be a substantial competitor to cryptocurrencies as a medium of exchange for common transactions:

“Stablecoins and central bank digital currencies could be seen as complementary payment mechanisms, even if they might step on each other’s toes in that function,” he said.

According to the economist, if stablecoins undermine central bank money’s medium of exchange function, this conceivable harmonious coexistence between stablecoins and a possible digital dollar could represent a risk to the efficacy of monetary policy.

“Stablecoins that undermine the medium of exchange function of central bank money could add to already substantial uncertainties in the transmission of monetary policy to economic activity and inflation,” Prasad added.

The increasing merger of crypto and traditional financial systems could also represent systemic risks for market stability. In March 2023, the US banking crisis that culminated in the shutdown of Silicon Valley Bank led to shockwaves that resulted in the brief depegging of Circle’s USD Coin (USDC), which is currently holding nearly $30 billion in US Treasurys as reserves.

Despite the growing adoption of stablecoins and the natural risks associated with them, the United States Congress has yet to adopt a framework to bring regulatory clarity to stablecoin usage within the financial system.

The most recent initiative from lawmakers is the Clarity for Payment Stablecoins Act of 2024, introduced by Senator Bill Hagerty in early October and built on previous proposals.

The bill introduces state-level regulatory pathways for stablecoin companies, allowing issuers with less than $10 billion in market capitalization to be regulated at the state level, while larger issuers can seek waivers to remain under state jurisdiction instead of federal oversight.

Related: a16z exec: Stablecoin regulatory clarity needed to avoid ‘FTX-level issue’

Stablecoins and the US dollar dominance

A recent report by venture capital firm a16z noted that stablecoins amounted to $8.5 trillion in volume across 1.1 billion transactions worldwide in the second quarter of 2024 — more than doubling Visa’s $3.9 trillion in transactions over the same period.

Source: CBDC Tracker

According to Prasad, stablecoins could, in principle, reduce the dollar’s preeminence as an international payment currency by facilitating the use of other currencies. However, stablecoins have so far moved in the opposite direction.

As per a16z data, about 99% of stablecoin currency shares are backed by the US dollar. Prasad explained:

“Here, too, matters have taken an unexpected turn. Stablecoins backed by dollars are the only ones getting any real traction, thereby indirectly making the dollar more prominent as a payment currency.”

The current environment reveals that although new technologies are enabling new forms of money, it doesn’t necessarily lead to decentralization.

“It is equally likely, however, that these new forces end up creating even more centralization, with some currencies accreting even more power and influence. Paradoxically, many of these changes might reinforce rather than weaken the dollar’s dominance,” noted the economist.

Around the world, around 50 countries have CBDC projects in the works at different stages of development, targeting either domestic use or cross-border settlements for international trade.

China is one of the countries leading this race. Its digital yuan could potentially enhance the renminbi’s role as an international payment currency. However, to become a reality, reforming the country’s financial markets to remove capital flow restrictions would be needed.

“The notion that digitization of the yuan will increase its role in international finance is, however, a chimera,” said Prasad. “The dollar’s strengths lie not just in the depth and liquidity of US financial markets but also the institutional framework that underpins the currency’s status as a safe haven.”

The rise of the digital yuan, the DREX in Brazil, and many other CBDCs across large economies could “marginally improve” their status as an international payment currency. Fundamentally, however, they do not threaten the dollar’s status as the principal global reserve currency.

“Digital technologies are enabling new forms of money that could challenge fiat currencies, setting off a new era of domestic and international currency competition.”

Cointelegraph reached out to Tether and Circle for comment but received no response.

Magazine: How Chinese traders and miners get around China’s crypto ban

Comments (No)