In the first quarter of the year, Solana-based meme coins have emerged as the frontrunners, surpassing Ethereum’s meme coin ecosystem and artificial intelligence (AI) tokens, according to a recent report by market data platform CoinMarketCap.

This shift in popularity signifies a change in dynamics within the cryptocurrency market, with meme coins gaining traction and challenging previously dominant narratives such as smart contracts, decentralized finance (DeFi), and non-fungible tokens (NFTs).

Solana Ecosystem Dominates Growth Chart

The CoinMarketCap report highlights that the Solana ecosystem has consistently topped the growth chart for the past eight months, with over 20 new tokens introduced in Q2 alone.

Ethereum’s ecosystem followed closely behind with 14 new tokens, while Derivatives and Stablecoins witnessed relatively lesser growth with 5 and 4 new tokens, respectively. This surge in Solana-based token offerings indicates a growing interest in the network and its potential.

Related Reading

Solana’s meme coin ecosystem, in particular, has gained significant momentum in price performance and popularity since October 2023. Although Ethereum remains the dominant blockchain, Solana’s growing prominence suggests a noteworthy trend in the crypto space.

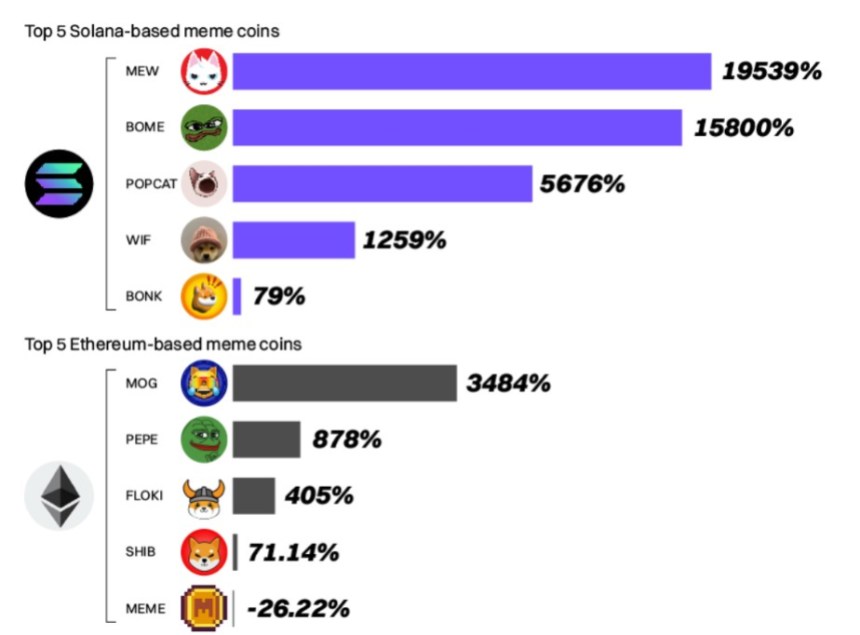

Interestingly, SOL memes have significantly outperformed ETH memes, delivering an average return of 8,469% compared to 962% for Ethereum, as seen in the chart below.

As “speculative capital” from other chains rushed into Solana, attracted by the explosive rallies of tokens like dogwifhat (WIF) and Bonk Inu (BONK), more meme coins experienced price surges, attracting additional attention and capital.

The top winners in the meme coin space include the cat characters MEW, POPCAT, and Book of Meme (MEME). These tokens have outperformed even the most popular ones like WIF, BONK, Ethereum’s Pepe coin (PEPE), and Shiba Inu (SHIB).

Notably, political memes also emerged as a popular subcategory, with the leading MAGA (TRUMP) meme coin gaining over 5100% year-to-date, largely due to vocal support for crypto from former President Donald Trump and the acceptance of crypto for campaign donations.

Ethereum Tops Fee Income Rankings

Despite Solana’s significant gains, Ethereum continues to dominate the Layer 1 (L1) smart contracts market, representing 62.11% of the major L1s. The report notes that Ethereum’s recent milestone was propelled by the SEC’s approval of Ethereum Spot ETFs.

However, Binance Smart Chain (BNB) and Solana have also gained traction, adding $42 billion and $18 billion to their market share among L1 networks. Solana currently leads with over 1.6 million active daily addresses, followed by BNB with 1 million active addresses.

Related Reading

In Q2, Ethereum experienced record low gas fees, reaching levels not seen since 2020 due to the growing adoption of Layer 2 solutions and the market excitement surrounding Solana-based meme coins.

Despite representing 62% of the market cap among major L1s, Ethereum accounted for 70% of the daily revenue, generating approximately $2.7 million. Solana ranked second with around $900,000 in daily revenue.

According to Lookonchain, Ethereum topped the fee income rankings in the past year with $2.728 billion, followed by Bitcoin with $1.302 billion.

Other notable networks include Tron ($459.39 million), Solana ($241.29 million), Binance Smart Chain ($176.56 million), Avalanche ($68.83 million), zkSync Era ($59.77 million), Optimism ($40.4 million), and Polygon ($23.91 million).

Despite both platforms experiencing success in various financial metrics and growth charts, Solana’s native token, SOL, has significantly outperformed Ethereum’s ETH token.

As of the current trading price, SOL is valued at $143.25, showcasing a year-to-date growth of 650%. ETH has seen a more modest surge of 68% during the same time frame, currently trading at $3,310.

Featured image from DALL-E, chart from TradingView.com

Comments (No)