The first production update of 2023 from publicly listed Bitcoin (BTC) mining companies shows a steady increase in hash rate and a surge in BTC production compared to the previous month, according to a new analysis from Hashrate Index.

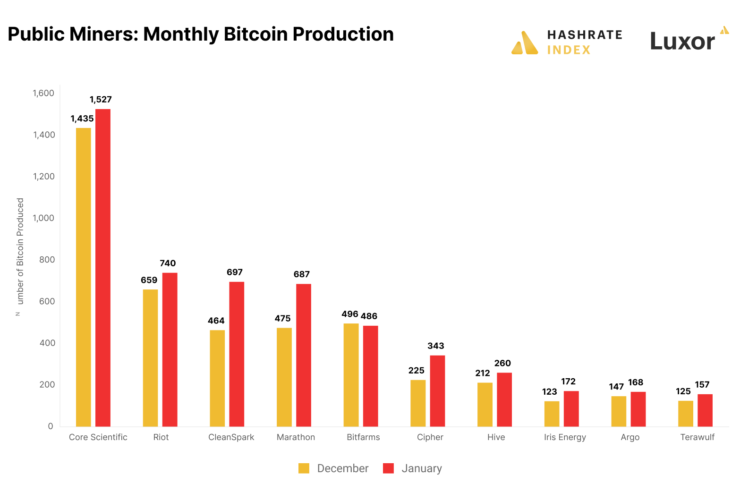

The majority of public miners increased their bitcoin production in January, with CleanSpark boosting it by 50%, reaching a record monthly production of 697 Bitcoins. Leading the BTC production, Core Scientific reached 1,527 coins mined in January, followed by Riot, the second-biggest producer, mining 740 Bitcoins in the month.

Marathon and Cipher have seen significant increases in Bitcoin production, reaching 687 and 343 Bitcoins generated, respectively, compared to 475 and 225 in December.

According to Bitcoin mining analyst Jaran Mellerud, better weather conditions in January and stable electricity prices helped miners boost production.”In December, a winter storm swept the North American continent and led to surging electricity prices that periodically forced many of these companies to curtail operations. With the weather more benevolent in January, electricity prices stabilized, and miners were able to achieve a higher up-time.”

Hash rate increased for most public miners in January, but at a slower pace than expected. The exception is the Texas-based Cipher that boosted its hash rate by more than 50%, with a 4.3 EH/s. “Cipher has been building hard during this bear market, and I expect the company to reach its hashrate goal of 6 EH/s of self-mining capacity by the end of Q1 2023,” noted Mellerud.

CleanSpark also grew its hash rate to 6.6 EH/s from 6.2 EH/s in December, following a series of acquisitions in late 2022. Hive also recorded growth in January, with its hash rate increasing by nearly 30%, from 2.1 to 2.7 EH/s. “The company keeps replacing its GPU fleet with ASICs, primarily with its in-house designed Buzzminers,” commented on Hive performance.

Core Scientific continued growing its hash rate, reaching 17 EH/s in January from 15.7 in December. The figures, however, are expected to be impacted by the company’s bankruptcy proceedings, which include a deal with the New York Digital Investment Group (NYDIG) to pay off an outstanding debt of $38.6 million by handing over more than 27,000 mining machines used as collateral – representing 18% of Core Scientific rigs.

Core Scientific filed for Chapter 11 bankruptcy on Dec. 21, seeking to reorganize its debts after months of financial distress due to increased electricity costs and low Bitcoin prices.

Mellerud also pointed out that “these companies have, on several occasions, extended the timeline of their lofty hashrate expansion goals. Most of them have plans to drastically increase their operating hashrate by the end of Q2 this year. At the current rate, most of them will likely have to push their expansion plans further into the future.”

Comments (No)