Layer 2 (L2) scaling solution Optimism reported a series of strong network metrics in the first quarter (Q1) 2024, with its native OP token surging 9% on the back of this bullish momentum.

Optimism Sees Higher Activity And Rising Transaction Fees

According to a recent Messari report, Optimism’s circulating market cap increased 11% quarter-over-quarter (QoQ) to $3.7 billion, while its fully diluted market cap rose 1% to $15.7 billion.

Despite the broader crypto market rally, with Bitcoin (BTC) and Ethereum (ETH) gaining 69% and 53% QoQ, respectively, OP’s market cap ranking slipped from 26th to 39th among all blockchain networks. However, within the Ethereum ecosystem, OP remains one of the top four rollups by market capitalization.

Driving this growth was a significant uptick in Optimism network activity. Daily active addresses reached 89,000 in Q1 2024, a 23% QoQ increase, while daily transactions surged 39% to 470,000 over the same period. These metrics approached, but did not quite reach, their all-time highs in Q3 2023.

Related Reading

The network’s revenue also saw a substantial 78% QoQ increase to $16 million, driven by higher activity and a 48% rise in the average transaction fee to $0.42. However, this average fee dropped significantly in the latter half of March due to the implementation of Ethereum Improvement Proposal (EIP) 4844, which reduced L1 submission costs by 99%.

Total Value Locked Jumps 18% In Q1

Despite the fee reduction, Optimism’s on-chain profit for Q1 2024 increased 14% QoQ to $2 million. The network’s Total Value Locked (TVL) also grew by 18% to $1.2 billion, though its TVL ranking among all networks fell to 11th place.

Within Optimism’s TVL, the DeFi sector dominated, accounting for 86% of active addresses. According to Messari, non-fungible token (NFT) applications and gaming followed with 6.9% and 6.7%, respectively.

TVL’s leading protocols included Synthetix ($307 million, +4% QoQ), Aave ($270 million, +52% QoQ), and Velodrome ($171 million, +10% QoQ).

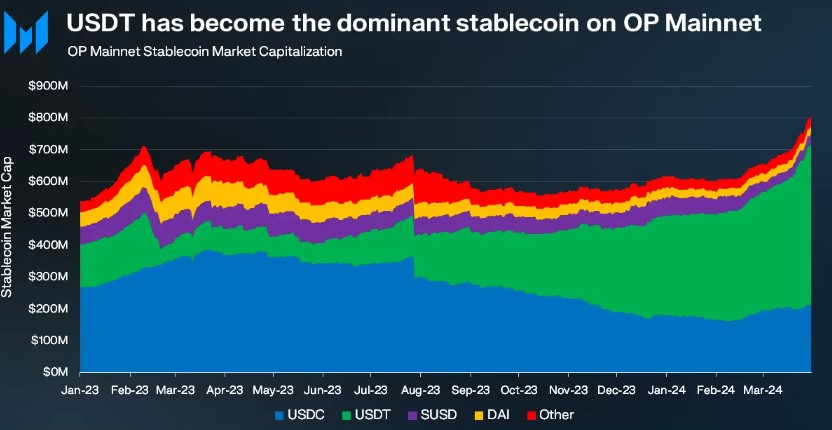

Optimism’s stablecoin market capitalization also grew significantly, reaching $809 million (+32% QoQ) by the end of Q1 2024. Circle’s USDC stablecoin and Tether’s USDT made up most of this, with USDT seeing a 64% QoQ surge to $512 million, or 63% of the total stablecoin market cap on Optimism.

OP Rebounds Alongside Crypto Market Resurgence

Despite Optimism’s strong performance across key metrics in Q1 2024, the network’s native token, OP, did not see a corresponding price increase at the end of Q1. Instead, OP followed the broader market downtrend, hitting an annual low of $1.80 just one month after hitting an all-time high of $4.84 in March.

However, OP has followed suit as the overall cryptocurrency market has seen a resurgence of bullish momentum in the past few days. In the past 24 hours, the token has recorded a 9% price increase and a 3% uptick in the past week, currently trading at $2.56.

Furthermore, CoinGecko data shows a 19% increase in OP’s trading volume over the past 48 hours, reaching $290 million.

Related Reading

While this renewed bullish sentiment is encouraging, OP still trades 46% below its all-time high and faces significant resistance levels soon before a potential retest of this milestone.

The first key resistance is at $2.65, followed by $2.90, which must be overcome before the token can push towards the $3.00 level. Conversely, the $2.34 support level has proven crucial and must be monitored closely in case of any bearish resurgence.

Featured image from Shutterstock, chart from TradingView.com

Comments (No)