Ethereum (ETH) has been showing a solid performance lately, leaving investors both ecstatic and wary. The world’s second-largest cryptocurrency, boasting a market capitalization of nearly $480 billion, recently surpassed the coveted $4,000 mark for the first time since December 2021, igniting a flurry of bullish predictions. But is this a genuine resurgence, or are we witnessing a temporary blip before a potential correction?

Let’s dissect the forces at play. Proponents of a sustained uptrend point to a confluence of positive factors. The long-awaited approval of a US-based Ethereum ETF is a hot topic, with speculation swirling that a green light could trigger a significant influx of institutional capital, potentially injecting billions into the Ethereum ecosystem.

Additionally, the upcoming Bitcoin halving, an event that cuts Bitcoin’s mining reward in half, is expected to have a positive spillover effect on the entire cryptocurrency market, potentially propelling Ethereum further.

Surge In Short-Term Ethereum Holders Signals Optimism

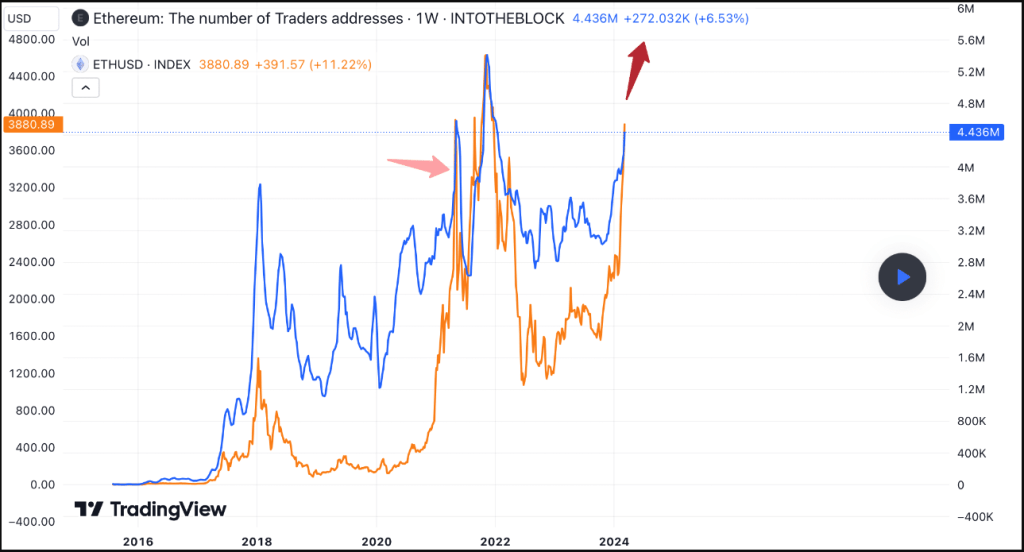

This optimistic outlook is bolstered by a surge in on-chain activity. Data from IntoTheBlock reveals a significant increase in the number of short-term Ethereum holders.

Source: TradingView/IntoTheBlock

Historically, this trend, with its 60% monthly price surge for ETH, aligns with bull markets, signifying an influx of new users entering the crypto space and actively participating in the network. Think of it as a crowded party – the more people show up (currently approaching the highs of the last bull cycle), the livelier the atmosphere becomes (and potentially the higher the price goes).

But, there’s more to the story. A closer inspection of technical indicators paints a slightly different picture. The Relative Strength Index (RSI) and Chaikin Money Flow (CMF) are currently hovering in overbought territory, with RSI specifically nearing the 70 mark.

Total crypto market cap is currently at $2.677 trillion. Chart: TradingView

In simpler terms, this suggests that Ethereum’s price at slightly above $4,000 might be stretched a bit thin and due for a potential pullback. Imagine a jump rope competition – if you’re swinging too hard and fast (like an RSI over 70), eventually you’ll trip yourself up.

Source: Coingecko

Ethereum’s Future: Balancing Act

Adding a layer of intrigue, the sentiment among investors seems geographically divided. While the “Coinbase Premium,” a metric reflecting buying pressure, is thriving in the US, its Korean counterpart indicates ongoing selling activity.

This regional disparity could be attributed to diverse market dynamics and investor preferences. Perhaps American investors, with a green Coinbase Premium, are more optimistic about the regulatory landscape surrounding crypto, while their Korean counterparts, with a red Korea Premium, are taking a more cautious approach.

So, what does this all mean for Ethereum’s future? The answer, unfortunately, isn’t as clear-cut as we’d like. The confluence of positive factors like potential ETF approval, increased network activity with a surge in short-term holders, and a potential Bitcoin halving boost paint a bullish picture.

However, technical indicators hinting at an overbought market and contrasting investor sentiment across regions introduce a note of caution. Ethereum is currently walking a tightrope – will it maintain its momentum or face a reality check in the form of a price correction? It’s anybody’s guess.

Featured image from Pixabay, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source:

Source:

Comments (No)