Why is Crypto Crashing? Why is crypto down today? Will crypto recover? These are the panicked searches of FUD, once again fuelled by alleviated tensions between Iran and Israel – but it’s a nothing burger – here’s why.

Paper-handling every volatile news event is nothing new in the crypto market, yet that hasn’t stopped a widespread panic (largely fuelled by KOLs) ripping through the crypto community—to the tune of a $1Bn sell-off of BTC positions.

Imagine trying to hedge against war by selling #Bitcoin to buy paper gold that you can’t move anywhere in the event of actual war. https://t.co/KX6WDaBJiM

— Samson Mow (@Excellion) October 2, 2024

This comes hot on the tails of major positive signals from both the Federal Reserve in Washington and the Central Bank in Beijing over the last two weeks, who’ve both announced interest rate cuts in a massive risk-on message to global markets.

Why is Crypto Crashing? Why is Crypto Down Today? Will Crypto Recover?

At the heart of the latest scare is a retaliatory move by the Iranian regime, which has been in the works for months following the targeted killing of Mohammad Reza Zahedi (a Senior Commander of the Islamic Revolutionary Guard Corps) back in April.

In the immediate aftermath of the Commander’s death, Iran’s Supreme Leader Ayatollah Ali Khamenei promised to make Israel ‘regret’ this decision – yet, amid a foiled drone attack on Israel, for an entire Summer, the world has waited with bated breath.

This all changed last night when, in retaliation for the killing of Hezbollah Leader Hassan Nasrallah at his underground headquarters in Beirut, Iran launched more than 180 missiles into Israel and Palestine – amid a declared ‘state of war’ by Iran.

Many traders believe this situation could mitigate upside for Bitcoin on the short-time frame, with the reactive move stemming from the idea that the market is now in-fact ‘risk-off’ – but a closer look at the interplay between this conflict and the Bitcoin chart shows this is unfounded.

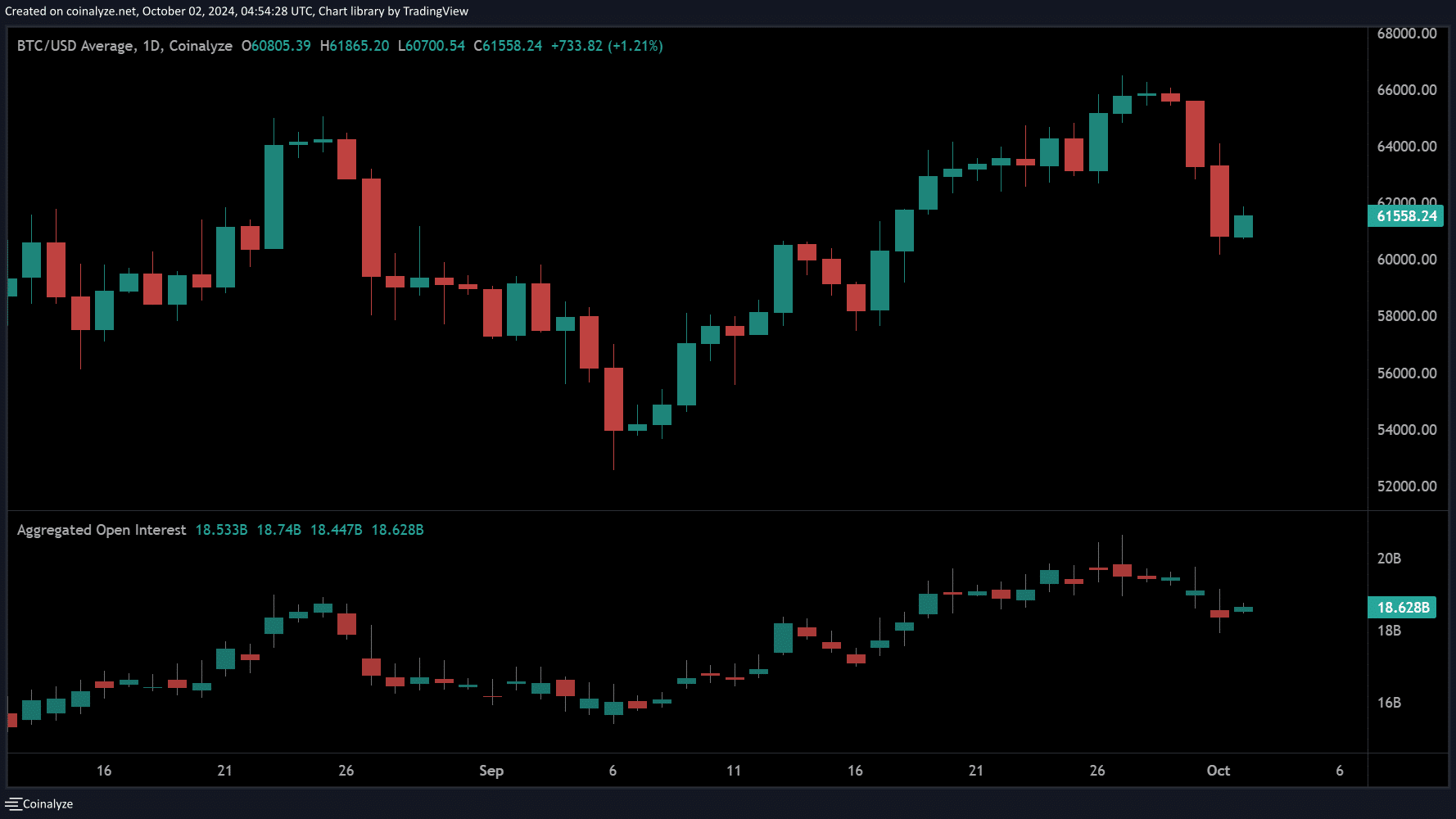

(BTCUSDT)

For a start, the recent Bitcoin price drop has only seen the market correct to well-established consolidation levels above $60,000, and this is well-precedented – with the $61,000 price level forming the resting point for BTC price amid almost every flare-up in Iran-Israel tensions this Summer.

Notable still is the emerging trend in September, which sees Bitcoin prices pump into Israeli military actions and retreat from Iranian retaliations. Indeed, the recent ‘Pager Attack’ on Hezbollah by Israel inspired an impressive +6.3% rally in BTC price.

This suggests that crypto markets are bullish on Israeli aggression, likely due to its perceived maintenance of the status quo in the Middle East. On the other hand, crypto markets are fearful of Iranian aggression due to the uncertainty surrounding any challenge to the status quo.

Simply put: uncertainty breeds caution.

Market Makers Take Advantage of Tensions to Clear Over-Leveraged ‘Uptober’ Open Interest

However, there’s more at play than the emotions of traders, and much of this has to do with the concept of ‘Uptober’.

For many years now, October has been one of the most bullish months for crypto prices. Everyone’s back at their desks and ‘locking in’ for the final quarter of the year, and in 2024, the stakes are higher than ever.

After a long Summer, the supply shock dynamics stemming from Bitcoin’s most recent Halving Event in late April are beginning to bite. All but the biggest Bitcoin miners are under pressure from the reduced rewards, and following the risk-on signaling from major central banks in the USA, EU, and China, demand for Bitcoin ETF products is surging.

This has got everyone’s hopes up, with bullish sentiment on parade as the #Uptober trend went viral on X Yesterday, but this euphoria hasn’t been contained to social media – it has bled into derivatives markets.

(Source)

Open interest had stacked up above the $20B mark in recent days as traders amassed taker-buy positions in anticipation of October upside, and this couldn’t go on much longer.

The sudden drop in BTC price amid the Iran-Israel FUD was exactly what opportunistic market makers needed to punish over-leveraged markets.

This is what happened today – nothing to do with wars.

This is the heatmap on #Bitcoin. The yellow lines were long traders. They got swept. Price makes narritive. pic.twitter.com/jzttlhEkBa

— MartyParty (@martypartymusic) October 2, 2024

The -$4,000 drop appears to have worked, forcing the closure of more than $1Bn worth of open interest in the market Yesterday.

Yet, as previous instances have shown, Bitcoin price has always recovered from Iran-inspired drops, and any successful response by Israel is likely to stimulate an upside in BTC price (as shown by September’s event-movement interplay).

So, why is crypto crashing? Well, it seems likely that the market FUD was opportunistically a chance for the house to clear the table before serious upside moves toward $70k could occur – surprisingly bullish indeed.

DISCOVER: Best Things to Invest in Right Now! And Three New Ways to Buy Bitcoin!

Putting the FUD to Bed: Here’s Why Iran and Israel Aren’t Going to War (Yet)

But for those of you still fearful that these tensions could evolve into a wider regional conflict, let me dispel this myth.

It’s no secret that Iran and Israel foster hatred toward one another. Still, it’s important to remember that there is a higher motivation for both Netanyahu and Khomeini – both of whom are under significant domestic political pressure to justify their participation in these tensions.

The most important thing to both leaders is regime survival.

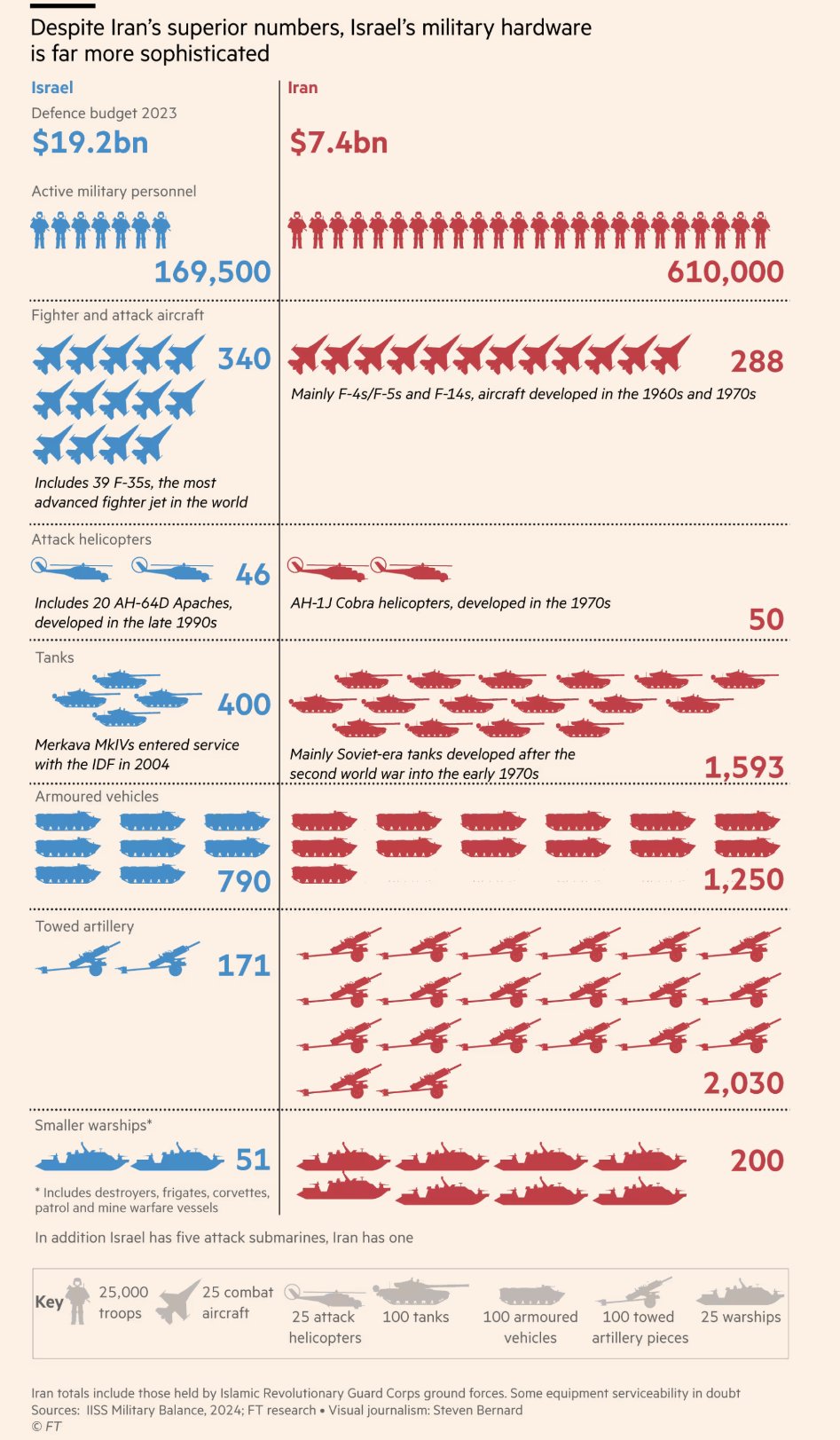

Neither Israel nor Iran stands to benefit from a wider regional conflict. In fact, if either nation entered a true ‘total war’ footing – it would likely spell the end of their regime at an incredible cost in bloodshed.

What does this mean for all these incidents? At its core, this conflict is much like a chess game, and every move is a carefully calculated and measured aggression.

For Israel, this is about removing strategic direct threats to its security; for instance – localized ground operations in Lebanon are much more focused on removing missile batteries in the Golan Heights than an attempt to capture the state of Lebanon.

At the same time, these missile attacks by Iran are about diplomatic signaling – to both Iranian allies and Israel – that Iran does have the capacity to defend itself and isn’t afraid to use its military assets.

In both instances, these are calculated moves aimed at signaling a deterrent but not at triggering a total war situation, which would result in regime demise.

(Source)

This certainty stems from the limited composition of both nations’ military forces. Neither has the logistical capacity to project power as an expeditionary force. Both nations lack aircraft carrier groups, supply ships, or overseas bases, and neither would be able to support a sustained ground operation over 1,000 miles away.

With these limitations, it’s almost impossible for this conflict to escalate beyond a missile-oriented war, and with the US election on the horizon – this is a key situation for the Biden administration to control – something that can be done effectively with the extensive deployment of US Navy Destroyers in the Mediterranean and Strait of Hormuz.

In fact, more reassuring is that the US strategically allowed the launch of 180 missiles over the Middle East last night without shooting them all down (only intervening on a few to remind both parties of their regional air-defense capability).

This is a strategic calculation from Biden’s administration: that permitting the Iranians to send their retaliatory message was the best way to defuse immediate tensions – reducing the aggressiveness of Israeli actions and enabling Iran to save face.

Overall, don’t panic, don’t be FUD’d out of your bags, remember Bitcoin is a digital safe haven asset, and that the Middle East represents no substantial share of global BTC hash rate – HODL!

EXPLORE: Top 17+ Best Crypto to Buy Now in September 2024

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

Comments (No)