Why is Ethereum going down? According to Circle Squared Alternative Investments CEO Jeff Sica, Bitcoin is the Mick Jagger of crypto. At the same time, Ethereum plays Keith Richards—a comparison as bold as their influence on the market.

BTC’s

role as a digital gold store is well-trodden territory. Still, Ethereum’s emergence as a flexible, use-case-driven player has some calling it “digital silver.” Another to call ETH “Digital Silver,” Deutsche Bank economist Marion Laboure says together, BTC and ETH are carving out distinct paths in the new financial order.

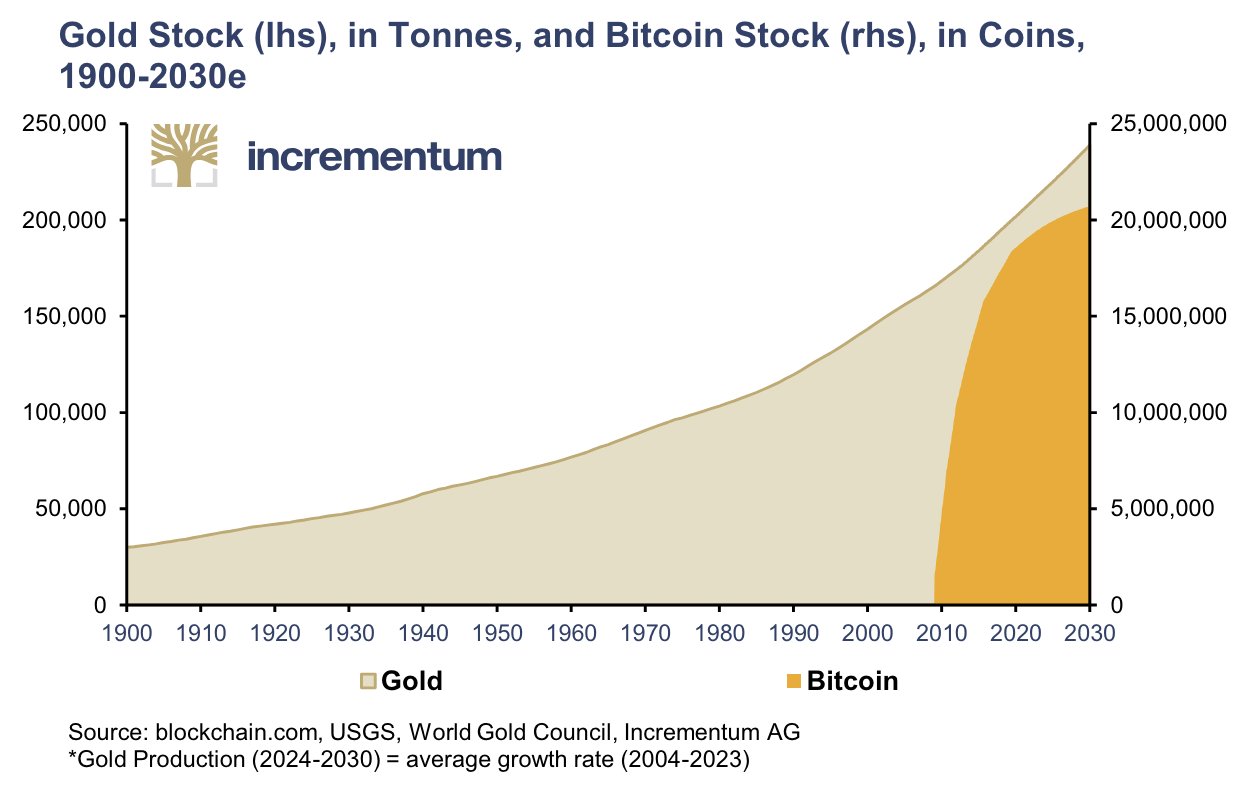

Can Bitcoin Replace Gold as a Safe-Haven Asset?

Throughout history, people have sought to protect their wealth in assets unlinked to government control, with gold becoming the ultimate safe haven. According to Laboure, Bitcoin could achieve a similar status in the digital age due to its decentralized nature and finite supply.

“Until recently, gold has been this primary asset. So I could envision bitcoin to be a kind of digital gold where people can store their value as well,” Laboure said.

This perspective isn’t new. Bitcoin is stepping into gold’s shoes, fast becoming the go-to inflation hedge for a new wave of investors navigating an unstable economy. J.P. Morgan strategists add weight to the shift, arguing that the younger crowd’s appetite for digital assets might push Bitcoin into gold’s territory in modern portfolios.

Moreover, Jerome Powell recently said that Bitcoin is a competitor to gold.

Ethereum Isn’t Digital Silver, It’s Digital Oil

Where Bitcoin locks itself in as a value store, Ethereum stretches out as the backbone for a new digital ecosystem. It’s digital oil, if anything. Ethereum still runs the show for DeFi projects, NFT marketplaces, and beyond, giving it far more utility than just moving money.

This has earned it the second slot by market value, half of Bitcoin’s, but powered by more than speculation—it’s the foundation of decentralized applications and a whole new wave of technology.

Deutsche Bank has arrived late to the crypto party, taking the podium with a take so basic it’s like hearing a freshman explain Ethereum after watching one YouTube video.

Their soundbite, rooted in market cap comparisons, smacks of the “silver to gold” cliché that’s been tossed around since Litecoin slugged its way onto the scene. But here’s the rub—Ethereum isn’t silver. It’s oil fueling a vast ecosystem of smart contracts and decentralized innovation.

The Digital Silver Debate

If anything, Litecoin, one of the earliest cryptocurrencies, is more so the silver to Bitcoin. However, its lack of innovation left it sidelined as other protocols surpassed its functionality and relevance.

Whether Bitcoin solidifies its place as digital gold or Ethereum truly becomes the digital silver, one thing is certain—their roles in the financial ecosystem are just beginning to take shape. They both remain central to shaping the future of decentralized finance and investments.

EXPLORE: Elon Musk’s Hedgehog SHRUB Meme Coin Pumps +30%: Is This Best Animal Coin HODL?

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

99Bitcoins may receive advertising commissions for visits to a suggested operator through our affiliate links, at no added cost to you. All our recommendations follow a thorough review process.

We hate spam as much as you do. You can unsubscribe with one click.

Comments (No)