Decentralized finance (DeFi) has emerged in 2021 as one of the fastest-growing trends in the crypto sector and as the unique features of DeFi begin to work their way into traditional finance, executives from crypto and conventional business circles warn that regulation could be on the way if the protocols don’t take steps to self-regulate.

On June 23, Mike Novogratz, CEO of Galaxy Digital, warned that DeFi protocols will soon need to decide if they want to incorporate know-your-customer and anti-money-laundering procedures to gain acceptance from regulators or “pay the piper later.”

Starting to think that major DEFI protocols are going to have to decide if they are going to play by the rules that most countries want them to (KYC/AML), or if they are going to flip the middle finger at them. Invest in a compliance layer now or pay the piper later.

— Mike Novogratz (@novogratz) June 23, 2021

On June 17, billionaire investor and DeFi advocate Mark Cuban called for stablecoin regulation after losing money during the Iron Finance ‘bank run’, highlighting the growing calls for regulation in the Wild West world that is DeFi.

In several follow-up tweets, Novogratz expounded upon his position and warned that governments have developed tools to help deal with this growing threat and that it would be wise to work with regulators for the long-term success of the ecosystem.

Novogratz said:

“It’s not wise to think governments have no tools in their kit to go after the bad guys… they do. If we want this ecosystem to grow we need to recognize we need to operate within the rules society sets.”

While the idea of adding KYC and AML features to DeFi goes against the ethos of anonymity and decentralization that many in the crypto community hold dear, it might be something worth considering as the number of DeFi users grows and scam projects proliferate on many protocols.

Related: Beware of ‘soft rugs’ — A growing menace in decentralized finance

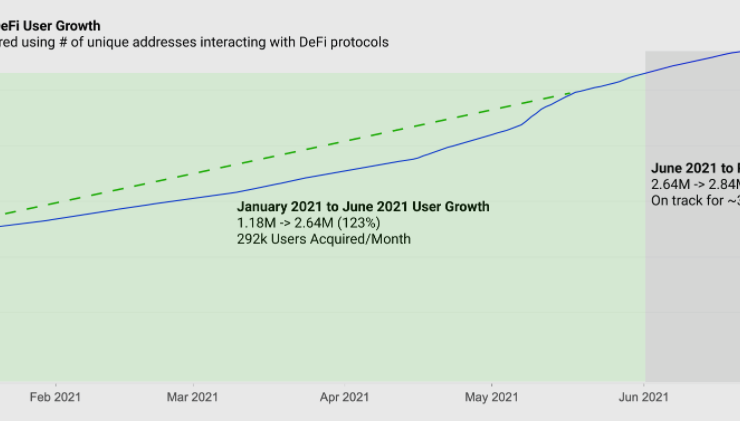

Data from Glassnode shows that while the DeFi userbase continues to grow, the month-over-month gains have been declining lately, down from 25% gains in May and 18% gains in April. Currently, June is “on pace to do 12%.”

As new users enter the ecosystem, it is important for them to have a positive first experience in order for them to want to continue to engage with DeFi protocols and it’s possible that regulation and accountability could help.

Regarding user concerns related to privacy, Novogratz said that the latest protocol upgrades under development could make privacy and compliance a real-world possibility.

Novogratz said:

“Zero-knowledge compliance and other systems need to be developed for DeFi to scale. I am confident they will be.”

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Comments (No)