DIA, a cross-chain Oracle Network, launches on Binance Perpetual, fueling its market momentum alongside the DIA Lumina upgrade.

DIA Lumina,

Price Trading volume in 24h Last 7d price movement , is leading a new generation of trustless oracle solutions by leveraging Layer 2 blockchain technology. This rollup-enabled oracle network delivers real-time data feeds for various assets, including tokens, liquid staking tokens (LSTs), real-world assets (RWAs), and more, to any blockchain environment.

With its decentralized, permissionless infrastructure, DIA Lumina enhances speed, scalability, and security across its entire data pipeline.

At the core of Lumina’s operations is Lasernet, an Ethereum Layer 2 rollup responsible for executing Oracle operations. It ensures trustless computation and full data verifiability.

The platform offers decentralized data sourcing through Feeders and uses cryptographic tools like zero-knowledge proofs (ZK-Proofs) for security. The data is then processed and delivered through Spectra, a cross-chain messaging protocol.

Better load all the $DIA you can before mickey mouse YouTubers find out that $LINK initial funder is an investor and backer of $DIA. DIA is a web3 oracle that outperforms Chainlink + better tech. You better get in before mainstream gets all over it. ⏳🌊 pic.twitter.com/nNK1R0ZtSL

— TalisTrades (@talistrades) October 3, 2024

DIA Crypto Performance And Market Overview

DIA has struggled to regain its January 2021 all-time high, with its 2023 performance lagging behind broader market recovery.

However, the launch of DIA Lumina in September marks the project’s biggest upgrade, potentially shifting its market position. The introduction of staking and gas fee mechanisms within the Lumina network could drive further utility and demand for the DIA token, adding a burn mechanism and locking up supply.

The recent partnership with Termina and the launch of DIA Futures on Binance, with up to 75x leverage, have increased interest in the token.

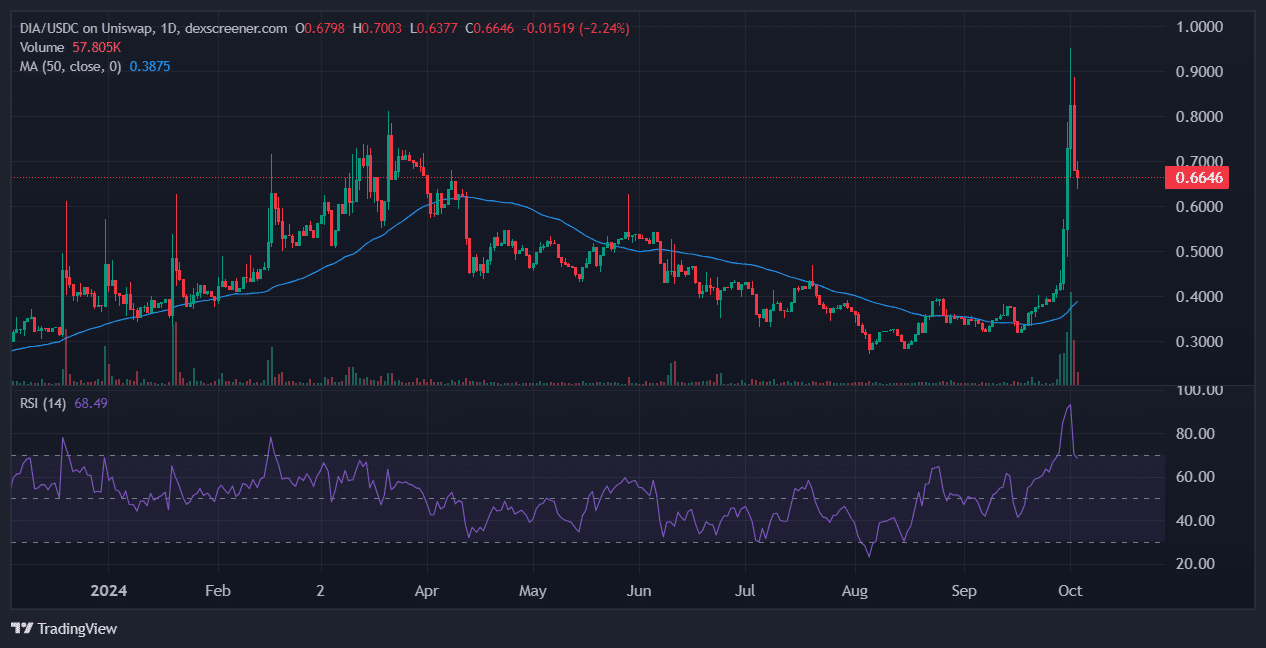

(DIAUSDC)

DIA’s recent 16% drop ahead of Binance’s perpetual futures launch could signal a potential near-term downside. Longs could be liquidated before a sustained rally occurs. When new perpetual futures contracts are introduced, volatility often increases as traders adjust their positions.

$DIA futures longs needs to get liquidated before seeing upside again pic.twitter.com/jULB2NuYG1

— Tommm (@TomSmiley12) October 2, 2024

On the daily chart, DIA shows a strong upward movement over the past few days, currently trading around $0.64. The next critical resistance area lies at $0.75, which has been a significant barrier since May 2022.

Previously, DIA attempted to break this level in March but failed. However, the Moving Average and Relative Strength Index (RSI) indicators are now turning bullish, adding confidence to the current upward trajectory. If DIA successfully breaks the $0.75 mark and confirms it as support, the next target will be $1.15, with the potential to reach $1.20.

What is next? With the release of DIA Lumina and key partnerships driving momentum, DIA is positioning itself for a major comeback. If the $0.75 resistance is broken, DIA could reclaim its standing in the oracle sector and regain a portion of its lost market dominance.

EXPLORE: XRP ETF News And Crypto is Now a Security: What Happens Next?

Comments (No)