Dilution-proof, July 1, 2021

Cycling On-Chain is a monthly series that uses on-chain and price-related data to better understand recent market movements and estimate where we are in bitcoin’s larger market cycle. After providing a broader look back and forward in the previous edition, we’ll now look at Bitcoin’s on-chain data through the lens of June’s two most impactful events that introduced Bitcoin to the geopolitical stage: China cracking down against Bitcoin while El Salvador accepts it as legal tender.

China Crackdowns

Since mid-April, China has played a large role in Bitcoin-related news. Following some coal mine accidents in Xinjiang, the Chinese government instituted a power blackout for a ‘comprehensive power outage safety inspection’ on April 15, 2021. Because that area was accounting for a relatively large part of Bitcoin’s overall hash rate (the computational power of miners that is used to create new blocks and secure the network), the blackouts severely slowed down the Bitcoin network for one or two weeks.

A month later on May 18, when Bitcoin’s hash rate had largely recovered, China banned its financial institutions from offering Bitcoin services. This drove further fear into a market that was already anxious after Elon Musk tweeted the prior week that Tesla would stop accepting bitcoin for payments out of environmental concerns.

China’s offensive stance against Bitcoin continued in early June. Reports emerged that China started actively censoring bitcoin and cryptocurrencies exchanges to slow down their adoption and, more importantly, shut down Bitcoin mining operations in Xinjiang. This was later followed up by similar reports in the Yunnan province on June 14, as well as in Sichuan four days later.

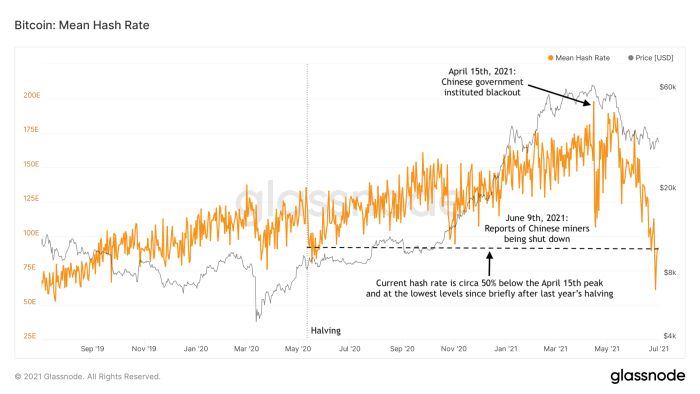

There is no fundamental reason why price should decline along with hash rate; hash rate follows price since that drives incentives by increasing or decreasing profit margins, but not the other way around. Nonetheless, the recent bitcoin price drop further cut into miners’ profit margins. This possibly exacerbated the hash rate drop due to miners that are running on older equipment and/or more expensive energy (temporarily) pulling their own plugs.

Figure 1 shows that since the blackouts instituted on April 15, Bitcoin’s hash rate has fallen by ~50% and is now at levels not seen since briefly after the May 2020 halving.

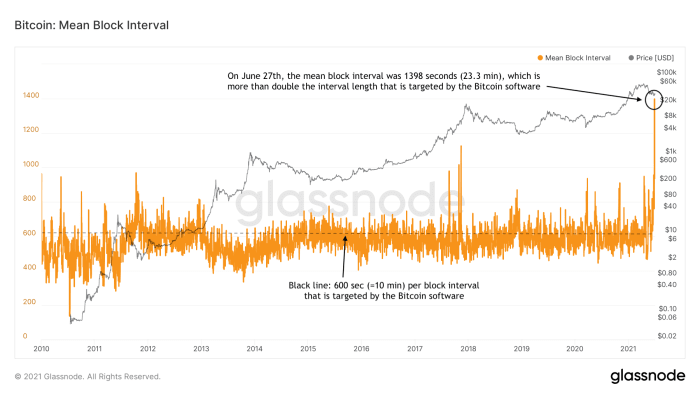

The hash rate drop means that there is much less computational power trying to guess the same difficult random number, which significantly slows down the creation of new blocks. The magnitude of this can be seen in figure 2, which shows that the block intervals on June 27 were by far the largest since the start of 2010, illustrating how much Bitcoin has slowed down as a result of the hash rate drop.

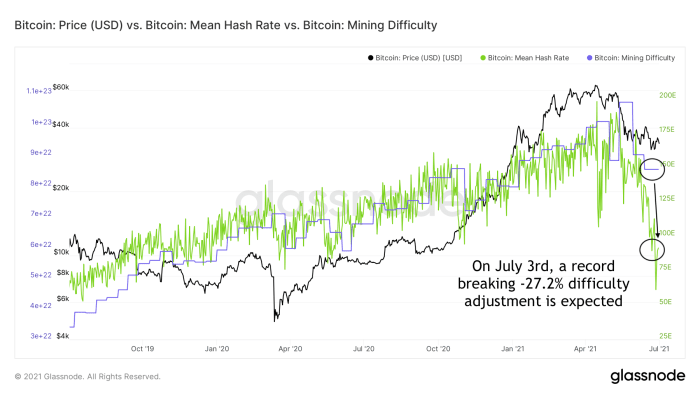

The next difficulty adjustment, projected to happen on July 3, is expected to be a record-breaking -27.2% (figure 3), which provides a large and immediate increase in miner profitability, incentivizing miners to start or restart mining operations. Bitcoin will therefore continue to function as normal and will only have been temporarily slowed down as the result of these recent negative actions by China.

Experienced Bitcoin market participants know not to trust every report that comes out of China, but recently reports of Chinese miners relocating to more mining-friendly jurisdictions like Kazakhstan and Texas are piling up. However, with China now actively working on the implementation of their own Central Bank Digital Currency (CBDC) that increases their surveillance and control, a case can be made to take their current moves against Bitcoin more seriously.

While these actions surely have a large economic impact on Chinese miners, those miners will have no problems finding a new home. Due to global supply chains being severely slowed down during the COVID-19 pandemic, there are large worldwide chip shortages. The recent actions by the Chinese government actually exacerbated the Bitcoin mining equipment shortages as Bitmain, a Chinese company that is one of the largest producers of mining equipment, had to halt their sales.

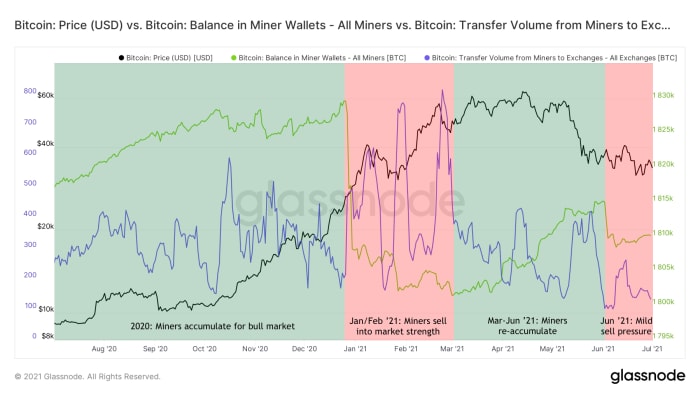

Figure 4 shows that since the start of June, the amount of bitcoin in miner wallets (green line) dropped by 6,701 BTC (-0.37%), but that drop is quite modest compared to the 28,266 BTC (-1.54%) decline in miner wallets in the first months after breaking the $20,000 previous all-time high, selling into market strength. The amount of bitcoin that are being sent from miners to exchanges (blue line) is also very low right now, further illustrating that the impact of the Chinese crackdowns on miner sell pressure has been modest – at least so far.

Figure 4: Miner wallet bitcoin balances (green), miner wallet to exchanges bitcoin transfers (blue) and the bitcoin price (black) over time.

While this event certainly is very important from a fundamental perspective, its (potential) impact on the bitcoin market is overblown by many. Hash rate may stay low or even further decline as more Chinese miners shut down or relocate elsewhere, but it will likely come back sometime in the coming weeks to months as there is massive demand for their equipment and services. Even if hash rate doesn’t come back, Bitcoin’s beautifully designed internal difficulty adjustment mechanism will ensure that blocks will continue to be produced, while current hash rate levels are likely more than enough to keep the network secure. As the popular meme goes: honey badger don’t care.

If the Bitcoin network does indeed remain strong, China’s crackdowns against it will actually go down as a great example of Bitcoin’s anti-fragility. The whole point of a truly decentralized system is that you cannot ban that system – you can only ban yourself from using it. Hash rate moving away from China also lowers the impact of future recurring China FUD (Fear, Uncertainty & Doubt), as their potential control over the system will have actually decreased.

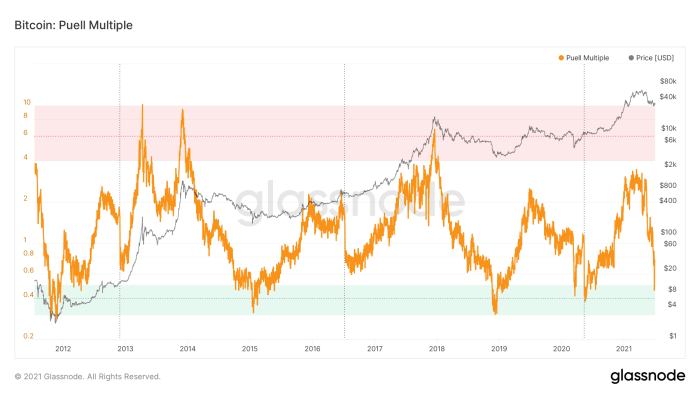

The magnitude of how historically abnormal the current situation is can also be seen in the Puell Multiple, which is a measure for how many bitcoin are issued on a given day in comparison to how many were issued on an average day over the previous year. As can be seen in figure 5, the large hash rate drop and resulting slowdown of Bitcoin block creation have caused the Puell Multiple to make its steepest decline ever. The Puell Multiple is now in the green zone, which has historically only been seen around market cycle bottoms and the 2020 halving.

Although the long-term fundamental impact of these events is limited, they do have a very real impact on the bitcoin market – at least in short-term. China banning their institutions from offering Bitcoin services and actively censoring exchanges mean that Chinese investors will have a higher threshold to participate in the market. Another appropriate concern is that these actions could set an example for other governments to take similar actions.

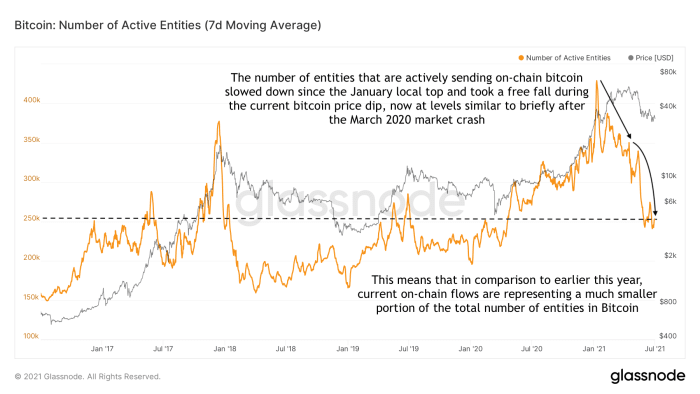

One thing is quite clear though: the number of entities that are (on-chain) active on Bitcoin have declined a lot after the recent turn of events. This number was already mildly trending down since the January local top, but dropped dramatically after these events and is now back to levels not seen since briefly after the March 2020 market crash (figure 6).

It is likely that fear and anxiety drove out investors with low confidence, but this activity decline could also mean that others are waiting to see how this plays out.

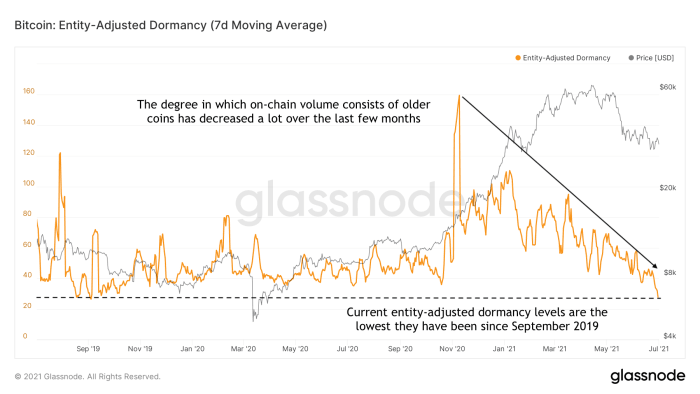

On-chain data suggests that, in reality, we’re likely seeing a combination of both. The first chart to support that thesis is displayed in figure 7. Over the last few months there has been a clear downtrend in “dormancy,” which means that an increasing proportion of the bitcoin being moved on-chain consists of relatively “young” coins; weaker hands are moving their more recently acquired coins. The weekly averaged dormancy per entity on the network is now back to levels not seen since September 2019 – well before the recent bull run started. Longer term holders aren’t selling.

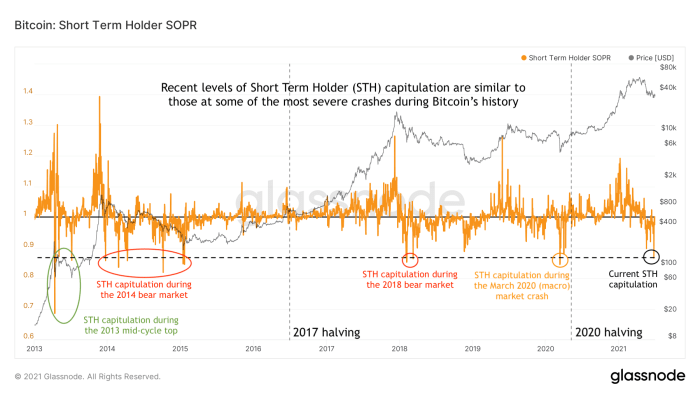

Another chart that clearly shows that it is particularly the newer market participants that are in pain right now is shown in figure 8. The Spent Output Profit Ratio (SOPR) is a measure that represents to what extent the average of all coins that moved at a certain time were in profit (above the solid gray line) or at a loss. Figure 8 shows this metric for the bitcoin of short-term holders (STH), which is defined as coins that are less than 155 days old.

Current STH-SOPR levels clearly show that short-term holders are in a lot of pain right now and are moving their coins around on-chain at losses only seen during some of the more painful downturns in Bitcoin history. The main question on everyone’s mind right now is whether the current capitulation will end up like the ones during the bear cycles that followed after reaching a halving cycle blow-off top (red ovals) or more like a mid-cycle market flush (green and orange ovals).

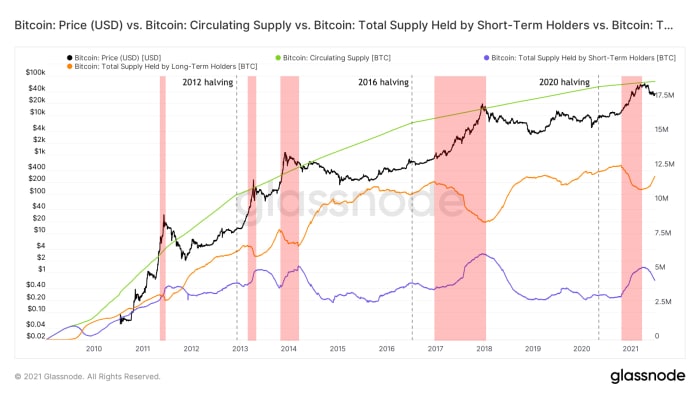

Figure 9 shows that, overall, bitcoin is being accumulated by long-term holders (recent uptrend in orange line). During strong run-ups towards new all-time highs, these long-term holders tend to sell some of their coins to take profit (temporary declines in orange line). As price runs up, new market participants rush in and start to accumulate bitcoin (increase in blue line), but they either end up selling their coins after the market turns or they turn into long-term holders themselves (decrease in blue line + increase in orange line).

Figure 9: The bitcoin price (black), circulating supply (green), long-term holder supply (orange) and short-term holder supply (blue) over time.

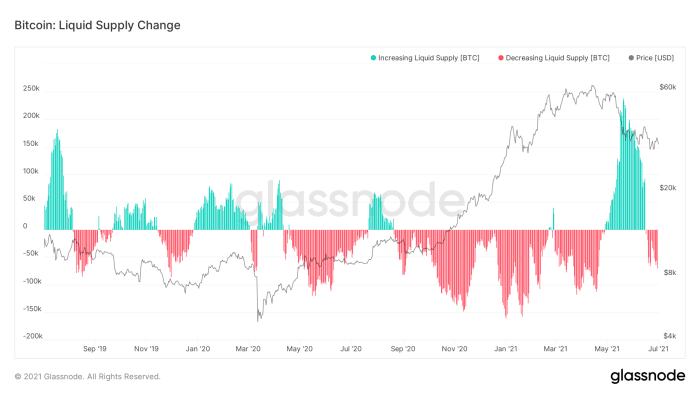

During the recent market downturn, bitcoin’s liquid supply increased a lot, as some existing holders were scared out of their positions (figure 10). The trend in the daily change of the liquid supply turned around after the May 19, 2020 capitulation event (red area), where bitcoin traded down more than $10,000 within a single day for the first time. Since June 16, the daily change flipped negative again, which means that the liquid supply of bitcoin that is available on the market is now decreasing again (green area), building towards the next potential supply shock. This could be an early sign of sell pressure exhaustion (as we saw before, mostly from short-term holders).

El Salvador Adopts Bitcoin As Legal Tender

On June 5 Jack Mallers and the President of El Salvador, Nayib Bukele, surprised the world with an announcement at the Bitcoin 2021 Conference that El Salvador would make bitcoin legal tender in the country. A few days later the law was approved with a vote of 62 out of 84 congressional votes.

With this historic move, El Salvador became the first country in the world where bitcoin can be used as a legal form of payment. This step means that the about 70% of the country that is unbanked now has a digital payment option. Merchants in the country are required to accept bitcoin, but will be able to instantly swap the received bitcoin for U.S. dollars, the other legal tender in the country. To achieve this, the country will provide an official wallet called Chivo, which runs on the Lightning Network and is based on Jack Mallers’ strike. However, Salvadorans will be free to use any other bitcoin wallet available on the market as well. To further support its adoption, the government of El Salvador will be giving each of their 6.8 million citizens thirty dollars worth of bitcoin upon opening the Chivo wallet.

El Salvador’s bitcoin adoption also means that citizens will have a much cheaper option for remittances, which represented 20.8% of El Salvador’s Gross Domestic Product (GDP) in 2019. The country also sent out its invitations to Bitcoin corporations and individuals that are considering moving to the country due to its now more Bitcoin-friendly tax regime, offering full residence to anyone that spends three BTC in the country. To top things off, El Salvador is incentivizing Bitcoin miners to come to the country, offering them access to 100% carbon-free geothermal energy powered by volcanoes.

An ironic confluence of circumstances meant that while China pushed Bitcoin and its miners away from its country, El Salvador opened its arms to it as far as it could. El Salvador’s move and the worldwide responses to it have triggered politicians in a large number of other countries to publicly advocate for Bitcoin as well. An opposition party in Paraguay has already taken it as far as to announce their plans to introduce a similar law in their country in July.

Since El Salvador’s legal tender law doesn’t fully go into effect until September 7, 2021, its impact on Bitcoin on-chain metrics is likely to gradually come into place over the months leading up to it. While it is too early to draw any firm conclusions at the time of this writing, there are at least some indications that new people are coming onto the network.

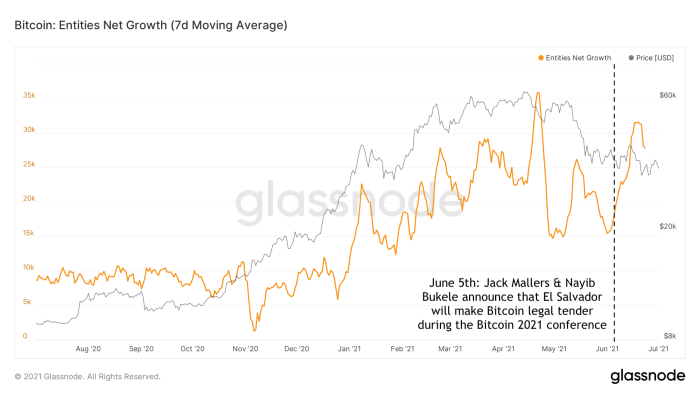

Figure 11 shows that over the last few weeks, the net growth of entities on the Bitcoin network has seen a steep rise. Even if this turns out to be completely unrelated to the developments in El Salvador, it is encouraging to see this type of new adoption,especially during a period when price has fallen.

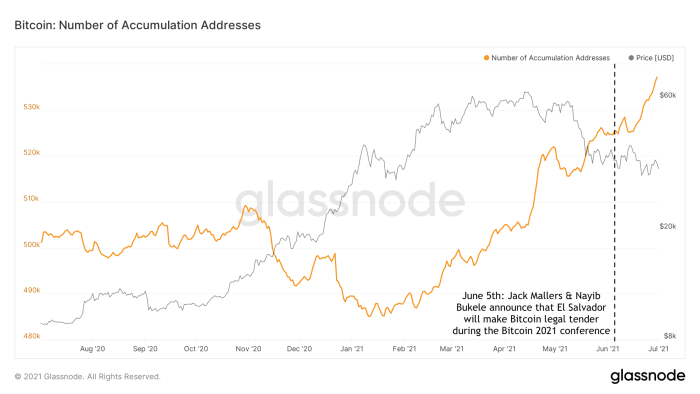

Another metric that suggests increased Bitcoin adoption is the number of accumulation addresses (figure 12), which are Bitcoin addresses with at least two inputs and no outputs. The clear uptrend that was already present before the El Salvador news suggests that those are unrelated, but will be interesting to follow over the upcoming months as well.

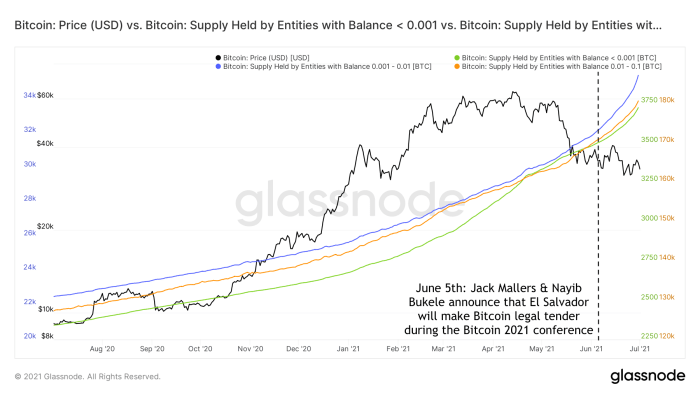

Another possible sign of adoption by citizens of El Salvador would be to see the supply held by entities with relatively small balances increase – which is exactly what is happening right now for entities holding up to 0.1 BTC (figure 13). Like in figure 12, this uptrend was already present before the news which means that it may be unrelated to the events in El Salvador, but an interesting trend to see during a price decrease nonetheless.

Figure 13: Bitcoin price (black) and supply held by entities holding <0.001 BTC (green), 0.001 to 0.01 (blue) and 0.01 to 0.1 BTC (orange).

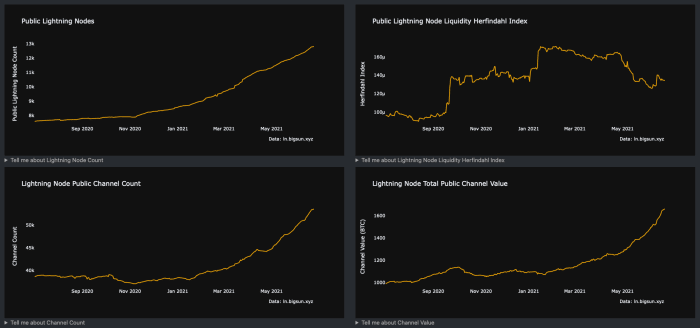

Since El Salvador’s government wallet will run on Lightning and any bitcoin use for day-to-day payments is likely to utilize Lightning as well, it will also be interesting to see what their new law does for Lightning Network adoption. Figure 14 shows that while it is unclear if the recent events in El Salvador changed anything, Lightning Network adoption has been going incredibly well throughout this bull run, as the number of nodes, public channels and total value on the network have been steeply rising.

Figure 14: The number of public lightning nodes (top left), lightning network liquidity dispersion (top right), number of public lightning channels (bottom left) and total BTC value on the lightning network (bottom right).

The big question on everyone’s minds is whether the current bitcoin bull market is now over, or if we will see a double top like scenario like we saw in 2013.

Bitcoin bulls will look for the El Salvador legislation to go into full effect after the summer, possibly combined with a hash rate recovery and improved miner decentralization if the Chinese miners indeed successfully relocate, to provide a tailwind for a shift to a more bullish market sentiment. Bears, on the other hand, will point out the market craze during Q1 as a clear market mania top, expecting to see bearish sentiment prevail from here on out.

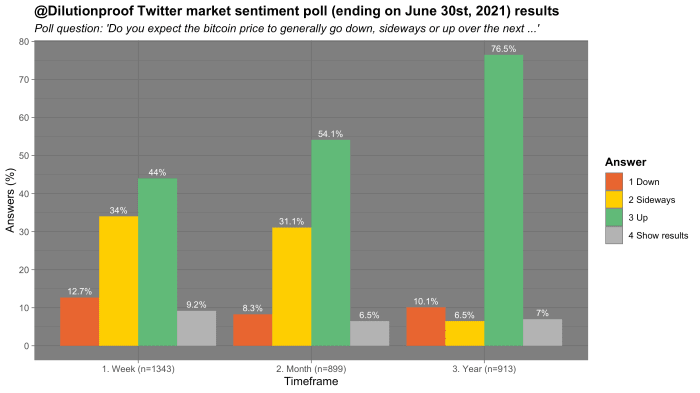

Figure 15 shows the results of a bitcoin market sentiment poll taken on Twitter on June 30, 2021. As can be seen, respondents are leaning bullish on all timeframes – especially the longer ones. Polls like this are unscientific and rife with selection bias and need to be taken with a grain of salt, but these results at least illustrate that there is still hope amongst a certain segment of Bitcoin Twitter that prices may go back up again throughout the upcoming period.

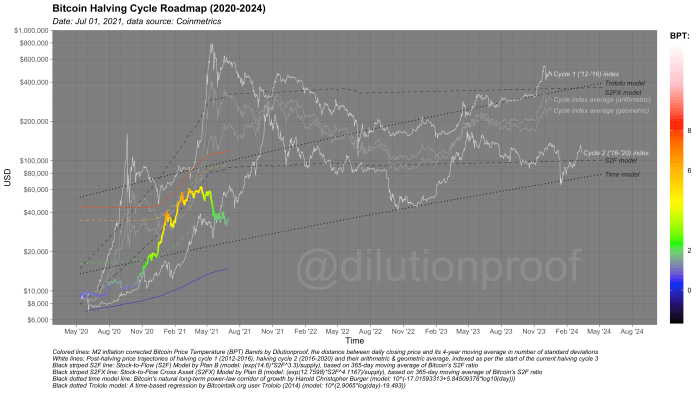

We like to close off this monthly column with the “Bitcoin Halving Cycle Roadmap” that combines several popular prediction models that are based on time, the Stock-to-Flow models, cycle indexes and the Bitcoin Price Temperature (figure 16). Will this be the most underwhelming halving cycle in Bitcoin’s existence (and thus basically the end of several of these models), or are we still in for a treat later?

Previous editions of Cycling On-Chain:

Disclaimer: This article was written for educational, informational and entertainment purposes only and should not be taken as investment advice.

This is a guest post by Dilution-proof. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.

Comments (No)