This is an opinion editorial by Anita Posch, founder of Bitcoin For Fairness.

Recently, one of my followers from Zambia asked, “Why has the price of bitcoin gone down in the last few months?” While I usually don’t talk about price movements, because I think the utility of Bitcoin as digital cash and a global financial rail is more important than the question of when bitcoin will reach $100,000, recent price events deserve some attention.

Why Did The Price Of Bitcoin Go Down 72% From The All-Time High?

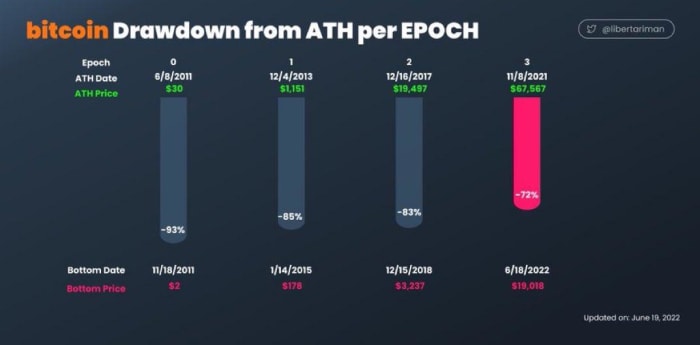

As you can see in the graph above, the recent bitcoin price drawdown is not the first of its kind in the history of Bitcoin. It’s not unusual that the price reaches a low in between two halving events, when the amount of newly-minted bitcoin is split in half, which occurs every four years.

Although the volatility of bitcoin has gone down over the years, these drawdowns have real-world implications if you can’t afford to lose money and are not able to hold bitcoin for the long-term.

Bitcoin is a free market. The price of bitcoin is not centrally controlled. It’s defined by the supply and demand of bitcoin. If more people want to buy bitcoin than there are sellers, the price goes up and vice versa. Since single events, news, sentiments and the general economic situation influence people’s perception and willingness to spend as well as the possibility to save money, they also can influence the price of bitcoin.

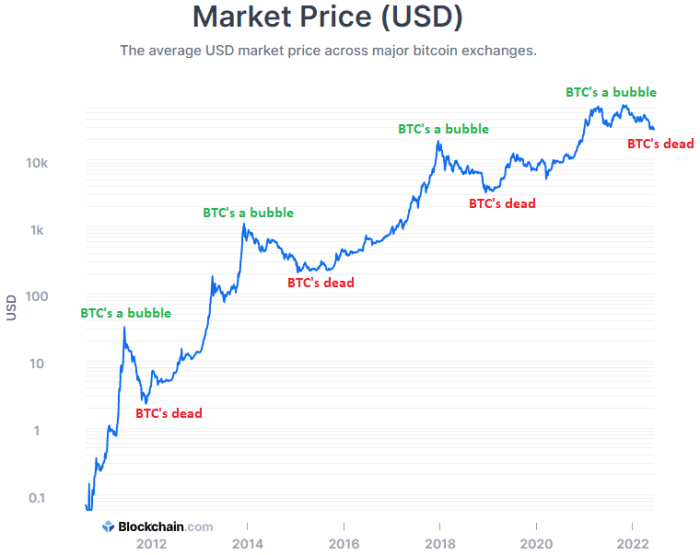

The below graph shows the price development of bitcoin on a logarithmic scale. At times of high price, many people and mainstream media outlets start to speak of bitcoin being in “a bubble.” When the price drops they say, “Bitcoin is dead.” As you can see, Bitcoin has survived more of these up and down phases in the last 13 years, while the price went up in general.

Below, you can see the same chart on a linear scale. The price is still on the level of its all-time high from 2017. I admit this doesn’t look good for new entrants. It’s bad for you if you obtained bitcoin the first time in late 2021, when the price was $60,000. But on the other hand, it’s a great opportunity to start using bitcoin now or to get more bitcoin to lower the price at which you bought it on average. Say you bought bitcoin at $60,000, if you have been holding it, you’ve lost 60% value on paper. If you get more bitcoin at $20,000, your entry price is $40,000, optimizing your investment and giving you the chance for higher profits, because Bitcoin will be stronger in a few months. It will rise from the dead as it has done many times before.

What’s The Upside Of The Current Bitcoin Price Drawdown?

These are turbulent times. First, we’re in a typical bitcoin bear market in between two halvings. The newly-minted supply of bitcoin will be reduced by half, from 6.25 to 3.125 bitcoin per block, in 2024. Additionally we’re seeing high inflation rates and rising prices for energy, food and living all over the world. People start selling assets to pay for their needs, which leads to more bitcoin being sold which drives the price down. On top of this, we’ve seen some big cryptocurrency companies go bust in the last few weeks, which caused panic and started a bitcoin sell off from holders who are not convinced that bitcoin’s price will bounce back sometime in the future.

First, the Terra/Luna ponzi blew up and forced a liquidation of about 80,000 bitcoin. Then, Celsius, a centralized cryptocurrency lending platform which held cryptocurrency with a value of around $3 billion more than 1 million customers, halted paying out funds to its clients and seemed to be insolvent.

Reckless lending practices brought the whole system down. These centralized services take customers’ bitcoin and promise monthly returns. They lend it out to other DeFi projects, which is risky in the first place, and, on top of that, they lend out more money than they hold in assets. This is essentially a practice that led to the global financial crisis of 2008, which was a reason that Satoshi Nakamoto released the Bitcoin software in the first place. Now, the cryptocurrency industry is building the same over-leveraged financial products and one has to ask: Did they not learn? Did they think they found a solution to magically make profits, where there is no underlying economic activity?

The failure of these yield-searching companies brought the whole market and bitcoin down in the last weeks. It’s a great reminder that one should have all assets in self custody and that there is no magical solution to money making by over-leveraging. Hopefully, investors and businesses learn from these busts.

Despite Price, Bitcoin Is Getting Stronger

Bitcoin is a decentralized technology which is unstoppable. No government nor any bank can change or control it. No one can take it away from you. This is especially important if you live in a country with authoritarian leaders or a broken banking system. Bitcoin has been declared dead several times, but it has been producing new blocks every 10 minutes anyway. It’s unstoppable, like a clock.

There is a phenomenon called the Lindy effect that proposes that the longer something has survived or been used, the more likely it is to have a longer remaining life expectancy. In short: the longer a new technology is working, the longer its life will be.

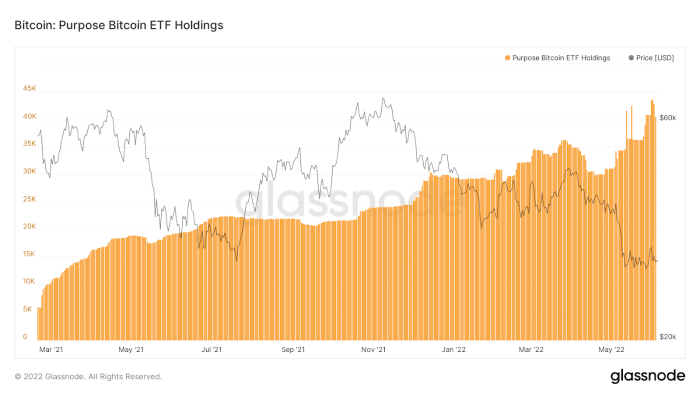

While many individual bitcoin holders sold their coins in panic, institutions are buying, as the Canadian Purpose Bitcoin exchange-traded fund (ETF) is showing.

This ETF fund “has witnessed consistent inflows over the last 30 days, precisely since the day the crash began,” stated AMB Crypto. “During these inflows, the total holdings of the ETF grew by 10,767 BTC and hit the ATH of 43,701 BTC ($1.3 billion).”Source

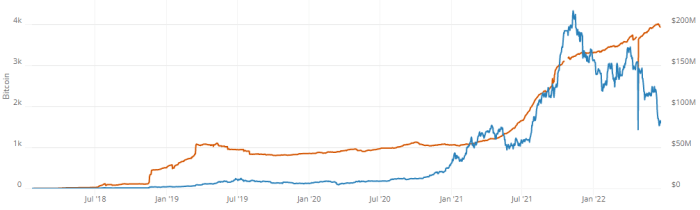

The Lightning Network, which enables the use of bitcoin for fast micropayments and opens the door for people with few financial means at their disposal, is getting stronger, too. Below you can see the red line is Lightning Network capacity, which indicates how many bitcoin are used within the network. It has been growing despite bitcoin’s price decrease.

Bitcoin’s utility is unbroken, it’s getting stronger with each new network participant, like Bitcoin Ekasi, a township with a circular Bitcoin economy in South Africa — it’s running its own Bitcoin and Lightning full node now.

Ways To Mitigate Your Risk

Always hold the keys to your bitcoin yourself, because then nobody can build risky lending pyramids on top of your money. Use bitcoin either as a medium of exchange or a tool to send and receive remittances from abroad and exchange it immediately to local currency to be able to spend it for your daily needs.

If you have the possibility to save and store bitcoin for the long-term, then do it. Start earning, saving and using it with a long-term perspective through the halving cycles. Remember, you can buy and send a fraction of a bitcoin, too. The sooner you get acquainted with this new form of money and technology which enables you to send it peer-to-peer without banks and borders the better you’ll be prepared for a frugal future.

This is a guest post by Anita Posch. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Comments (No)