The below is from the latest monthly report by the Deep Dive, Bitcoin Magazine‘s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

On quite the momentous occasion, a day when the first country officially adopted bitcoin as legal tender, the price plunged $10,000 from the recent prior highs, at one point down nearly 20% intraday.

So, what happened? Cascading liquidations.

During a day when bitcoiners around the world agreed to buy $30 worth of bitcoin in solidarity with El Salvador, it ultimately proved to not matter in terms of price action while going up against a nasty derivative market unwind.

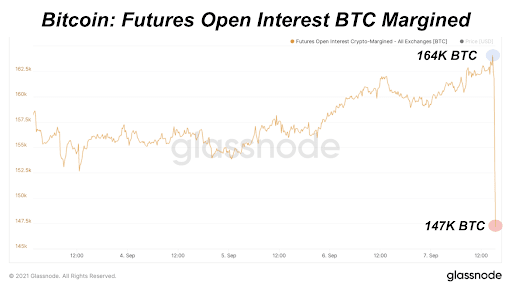

In particular, BTC-margined futures contracts can be blamed, due to convexity associated with declining trading profit/loss and declining collateral value. During the unwind, open interest in BTC-margined futures declined by 17,000 BTC (about $800 million) in a little over one hour’s time.

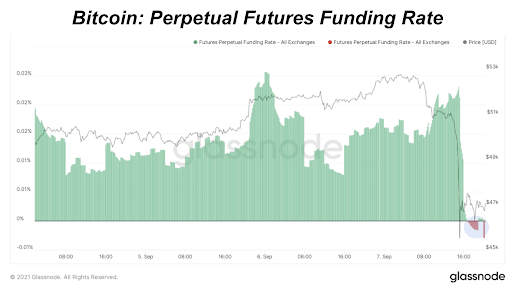

Also notable was funding on perpetual-swap contracts dipped negative for the first time in a little over a month.

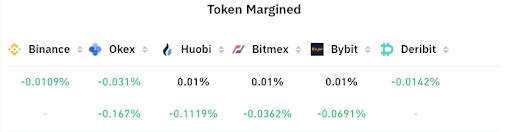

In particular, funding on bitcoin-margined contracts were the most negative, with USD-margined contracts witnessing less of a severe outcome.

Also noteworthy was the relative bid on Coinbase that followed the sell-off, with the basis between BitMEX XBT-USD and Coinbase BTC-USD hovering at around -0.25% for a meaningful amount of time.

This shows that North American buyers in particular were leading the charge in cleaning up the mess and scooping up coins on the spot markets (given that Coinbase does not have a derivatives platform).

Comments (No)