On-chain analytics platform Santiment has outlined a factor that could contribute to Cardano (ADA) and XRP enjoying further moves to the upside. Both tokens recorded relief pumps following the recent decline in the crypto market, but market traders believe this development is far from a bullish reversal.

Heavy Trader Shorting Could Lead To Price Rises For Cardano And XRP

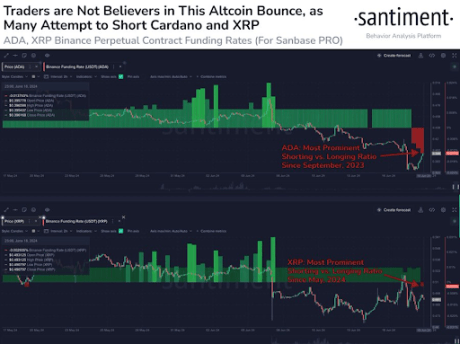

Santiment claimed in an X (formerly Twitter) post that the heavy trader shorting which Cardano and XRP are currently seeing could be the “rocket fuel” for continued price rises for these crypto tokens. Santiment had also revealed that Cardano and XRP were among the most notable altcoins that are heavily shorted following their relief bounces.

Related Reading

Interestingly, they called this a “good sign” for the patient bulls, as they believe that liquidation of these short positions could effectively be the momentum that these crypto tokens need to rise higher. Cardano and XRP being named among the most shorted altcoins isn’t surprising, considering that they are the most underperforming coins this year among the top 50 crypto tokens by market cap.

Cardano and XRP have also usually failed to enjoy significant relief pumps even when Bitcoin (BTC) and the broader crypto market enjoy a massive rebound. However, this time could be different, as Cardano and XRP have enjoyed a modest price recovery while some other altcoins lag.

Data from Coinglass shows that Santiment’s theory could already be in play, seeing how the Cardano and XRP bears have suffered significant losses in the last 24 hours. Over $50,000 in Cardano short positions have been liquidated during this period, while not a single cent in Cardano long positions have been liquidated. Similarly, over $30,000 in XRP short positions have been liquidated while XRP longs were unaffected.

A Major Move Might Be On The Horizon For XRP

Crypto analyst Egrag Crypto recently predicted that XRP could enjoy a price pump of around 1,700% starting in July. He alluded to XRP’s quarterly hammer formation between April and June 2016 and July and September 2017 before the crypto token enjoyed a major pump. The crypto analyst stated that XRP could form this bullish pattern again but needed to close the 3-month candle above the range between $0.55 and $0.58 in 10 days.

Related Reading

Egrag further claimed that if the hammer formation is similar to the one in 2016, the XRP could begin the projected 1,700% price rally in July, eventually sending the crypto token to $8. However, if the hammer formation is similar to the one in 2017, Egrag mentioned that XRP holders might have to wait another six months before the “epic” pump of around 5,500%, sending XRP’s price to $27.

Featured image created with Dall.E, chart from Tradingview.com

Comments (No)