Ethereum (ETH) price has struggled amid another market shakeout. The second-largest cryptocurrency by market capitalization fell below the $2,600 support zone for the third time in the past week, prompting crypto analysts to evaluate the next levels to watch out.

Related Reading

ETH’s Key Support Zone To Watch Out

The crypto market has seen several retraces throughout the cycle, with cryptocurrencies like Ethereum significantly decreasing from its Q3 opening. Since July 1, the “king of altcoins” has seen a 24% drop from the $3,400 support level.

Following its fall below the $2,100 mark during the ‘Black Monday’ crash, ETH has hovered between the $2,300 and $2,700 range. The cryptocurrency has recovered around 18% of its price while tries to reclaim the $2,600 level.

Nonetheless, the recent market shakeouts have made the price retest the strength of the $2,500 support zone three times in the last two weeks, which turned experts wary of ETH’s next step.

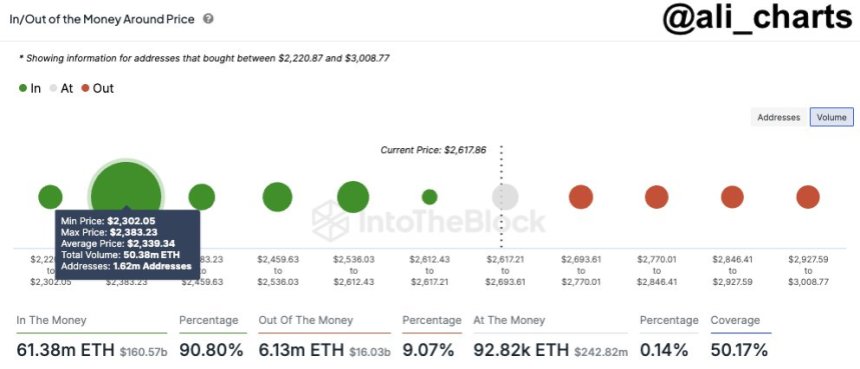

Renowned crypto analyst Ali Martinez stated that investors should pay attention to a key support zone after Ethereum’s performance. To Martinez, the $2,300 and $2,380 price range should be watched if ETH continues its downward trend.

According to the In/Out of the Money Around Price (IOMAP) chat shared by Martinez, 1.62 million addresses bought over 50 million ETH at this zone, making it the next wall of support for Ethereum’s price. If the cryptocurrency fails to hold this level, its price could drop to $2,200 and even levels not seen since February.

Will Ethereum Drop To $1,200 This Year?

Other experts have suggested that the second-largest cryptocurrency could see its price drop even lower, as “even giants will fall.” Top analyst Benjamin Cowen stated that the “collapse of ETH/BTC” is almost completed.

A year ago, Cowen forecasted that the collapse of the trading pair would “mark the end of the altcoin reckoning.” He explained that “altcoin reckoning” refers to the devaluation of the altcoins on their BTC pairs.

The analyst added that ETC/BTC was the “last one to rise in the bull and it can be the last to fall in the bear.” To him, this trading pair has four more months before it goes up next year.

Additionally, Cowen predicted that Ethereum’s price could hit the $1,200 price range in December if its performance is similar to the last two cycles.

Crypto investor Ted Pillows urged investors to hold on throughout the troubled waters, suggesting that a $10,000 is still possible. To the trader, the ‘King of altcoins’ is not dead based on different factors.

Ted highlighted that spot Ethereum exchange-traded funds (ETFs) inflows have increased while Grayscale outflows have progressively gotten smaller, and Jump Trading has only around $60 million in ETH to sell.

Related Reading

Moreover, ETH is “strongly holding its support level,” which he deemed the most important factor. Ultimately, the investor Predicts that the consolidation breakout will occur between November and December, while the “parabolic run” will start in Q1 2025.

Featured Image from Unsplash.com, Chart from TradingView.com

Comments (No)