A Bloomberg article claims that Americans are foregoing the safety of the dollar for more speculative assets like stocks, gold, and Bitcoin (BTC).

High saving rates, low yields

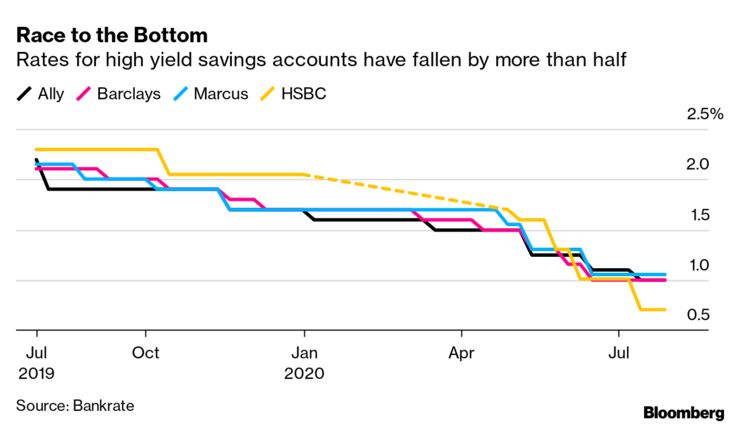

Because of the COVID-19 lockdown, the personal savings rate in the U.S. is at a historic high. The yield offered by the financial institutions on savings accounts, however, is close to zero. At the same time, assets as Bitcoin, equities, and gold, all have made double-digit gains since March. This is making them an attractive option for investors.

Source: Bloomberg.

The article mentions a 28 year-old Californian, who told the reporter that he is going to convert his $15,000 savings held in a high-yield savings account at Ally Bank into Bitcoin. He says that he is doing so because he expects long-term economic stagnation.

July was USD’s worst month in a decade

The reality is even worse than what the Bloomberg article posits. It is no secret that the dollar is rapidly depreciating against other leading fiat currencies. In fact, according to the Financial Times, July is the dollar’s worst month in a decade.

Bitcoin and U.S. Dollar Index (DXY) July 2020. Source: Trading Economics.

With another round of stimulus checks around the corner and most of the nation still affected by COVID-19 restrictions, it is possible that this problem will only get worse. Americans may likely have more depreciating fiat on their hands in the short term, and could seek to convert their holdings into higher-yielding assets. However, there is no such thing as a free lunch. In the investment world, high-return comes with high-risk.

Comments (No)