Mickey Koss is a West Point graduate with a degree in economics. He spent four years in the Infantry before transitioning to the Finance Corps.

In a recent article titled “Bitcoin Is Not a Store-of-Value,” an author going by the name of 0xStacker provided a seemingly well-reasoned critique of Bitcoin, equating its energy usage to a flaw in the system — a leak that precludes bitcoin from being classified as a sound store of value. I’m here to tell you that the energy use is not a flaw, but in fact, the aspect of bitcoin that will drive it forward as a reserve currency and store of value for the entire world. The solution touted in the article points to proof-of-stake, of course, but the flaws inherent to that system make it unsuitable as a long-term store of value or decentralized monetary base.

Bitcoin mining is about as competitive as it gets with markets: You’re either purchasing cheap-enough electricity to maintain profitability or you’re not. If you’re not, over time you will be forced to sell your bitcoin and be run out of business. The author seems to assume that energy prices will continue to climb over time, making it more and more expensive to mine, causing a network death spiral if price action doesn’t keep up. If you assume we remain on fundamentally scarce and perishable energy sources and a system reliant upon perpetual money printing and inflationary policy, then the author may have a point. But isn’t the entire purpose of Bitcoin to create a parallel system without a mindset of hostility to human flourishing?

Fear Uncertainty And Doubt Repackaged With Math

First and foremost, bitcoin miners selling bitcoin isn’t an issue to me. Why would we want a group of perpetual HODLers keeping every coin they ever mine? Coin distribution is essential for a healthy allocation of coins to go to people who want to opt out of the current system. Bitcoin is first and foremost about decentralization and individual empowerment. Do we criticize gold miners for selling gold? This criticism made so little sense to me that it barely registered as something to address.

The miners I know, including myself and those at the corporate level, only sell bitcoin as a last resort. They mine because they want bitcoin, not because they want fiat revenue streams. The selling pressure in my eyes is a non-issue. It is indicative of the marginal cost of producing bitcoin, which is one of the main aspects of bitcoin that give it value when compared to fiat currencies. What’s the marginal cost of producing an extra dollar? About five clicks and a couple of strokes on Jerome Powell’s keyboard.

In 0xStacker’s solution — proof-of-stake — stakers have no variable costs aside from perhaps income taxes. Because of the influence they have over the network from staking, the big boys are incentivized to hold onto their coin in order to exert more and more control over the network. Theoretically, a big staker or a cartel of them (like the big exchanges), could get together and completely take over a proof-of-stake network. The incentives drive centralization. The more you have, the more you get.

The author then attempts to equate current mining costs and iterate them out, using current numbers, to project a future market cap and the energy expenditure required. This methodology is so nonsensical that it took me a while to even understand it. What I finally realized is that his equation is simply a mathematical representation of classic Bitcoin energy FUD (fear, uncertainty and doubt). Luckily so many people have debunked this claim, it’s barely worth mentioning at this point. (Examples can be found here or here.)

A simple anecdote to combat some of his FUD points is the new Antminer S19 XP. Compared to its predecessor the S19 Pro, you get a 27% increase in hash rate with a 4% decrease in power consumption. A miner’s hash rate may grow exponentially, but power consumption certainly doesn’t.

He also attacks the Lightning Network as centralized and relying on companies like Strike. This is simply not true. Much like Bitcoin, the Lightning Network is permissionless, open-source software; It has nothing to do with Strike. The Lightning Network is a Layer-2 application. Strike should be considered Layer 3, using the Lightning Network as an enabling tool for its business. Strike relies on the Lightning Network, certainly not the other way around.

As the bitcoin price grows, yes, fees will grow as well. Small purchases will move onto Lightning; large purchases that need more security and finality will remain on-chain. The hash rate will move to whatever level that miners are incentivized to keep mining.

The author even contradicts himself when attempting to prove the benefits of proof-of-stake mining:

“This means network usage is a bit more expensive for the end user, but their usage of the network benefits all holders of ETH by burning some of the supply. Additionally, because there is no massive energy cost to staking, network validators do not have to sell the incoming supply of ETH in order cover costs. In fact, because the supply is deflationary, they are incentivized to hold.”

Bitcoin is too expensive but ETH being expensive is okay because they burn tokens and don’t use energy…? It doesn’t make sense. He even states that the validators are incentivized to hold tokens because they don’t have variable costs. The key difference here is that the amount of bitcoin you hold does not affect network consensus. So, if validators are incentivized to hold, please explain how the biggest bagholders won’t slowly take over the entire network? It’s a slow and steady march towards centralization.

He compares the return on investment into bitcoin mining to staking, but fails to mention that the accrual of bitcoin through mining:

- Happens at a decreasing rate with hash rate growth.

- Does not grow your influence over the network with the size of your bitcoin stack.

The miners need to provide value to remain viable. Stakers just have to stake.

The author’s article is littered with so many false points and comparisons that it’s honestly difficult to even address them all. Bitcoin has a $3 billion cost for a 51% attack — good luck getting your hands on all that hardware and electricity. You must have your own secret chip foundries and nuclear power plants nobody knows about.

The author’s original claim that he’s not simply publishing FUD, fact check: false.

Mining Incentives

In Bitcoin Magazine’s “To the Moon Issue,” Hass McCook III wrote a theoretical story titled “Bitcoin Mining in the 22nd Century.” The article culminates in a beautiful illustration of how Bitcoin’s incentives iterate into a world of human flourishing:

“On Earth, 25% of the world’s energy is dedicated to mining bitcoin, and due to the largely Bitcoin-driven intense competition in the energy markets, regular people effectively have access to very low-cost if not free energy … The world’s grid is emissions free. Of note is that humanity now uses a full 50 times more energy than we did a century ago — all clean.”

Bitcoin is the incentive that can help drive down energy costs and bring human flourishing to the world. In a recent article by Level39, he presents a technique that uses temperature differentials in ocean water to generate electricity. The technology has existed for over 100 years in theory, however the incentives for actual development have not existed until the development of a decentralized, energy-based monetary system that could monetize electricity existed. That system is bitcoin.

Profitability Assumption

One of the most flawed assumptions in my eyes is that bitcoin mining needs to be profitable in the first place.

Assuming that miners will always be giant warehouses full of computers, consuming energy second-hand from the power companies, then yeah, bitcoin mining companies will always need to remain profitable. An interesting discussion that I’ve heard floated on podcasts recently is the theory that energy companies will begin to acquire bitcoin mining companies or that bitcoin mining companies will begin to acquire energy producers. Either way, it’s a win-win and helps to alleviate the need for bitcoin miners to be profitable at all. The magic here lies in the electricity demand curve.

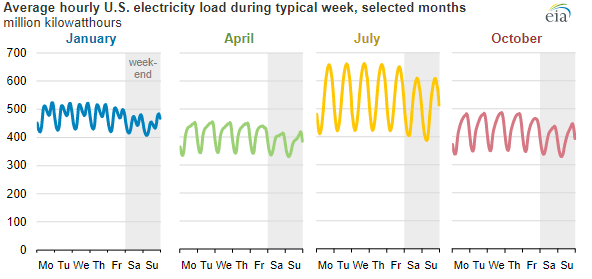

(Source): U.S. Energy Information Administration, U.S. Hourly Electric Grid Monitor.

The demand curve essentially illustrates the change in demand for electricity based on the time of day, at different points throughout the year. While this conversation could get very complicated, one of the big reasons that energy tends to get more expensive over time is that the price of your energy not only has to pay for the energy you use, but also for all the excess capacity that electric companies have but cannot use most of the time. You see, electric utility companies need to maintain the electricity capacity to meet the high demand for electricity as depicted in the month of July above — plus some excess safety margin — but that capacity goes largely unused for the rest of the year. Merging bitcoin mining and energy production could resolve this problem completely. Instead of energy consumers paying for unused capacity, utility companies would use nearly 100% of their capacity, ramping mining up and down based on energy demand throughout the day, charging customers only for the electricity that they actually use.

The incentives are still the same as far as renewable development and variable costs go, however it eliminates the necessity for bitcoin miners to be profitable. The act of mining bitcoin simply has to outweigh the opportunity cost of keeping the excess capacity offline. If there are near-zero variable costs associated with generating electricity, like in hydro and nuclear, why wouldn’t generators simply keep capacity at nearly 100% and soak up all the extra electricity into bitcoin? They wouldn’t even need to sell, but simply use bitcoin in the beautiful, monetary-battery capacity that Michael Saylor loves to talk about.

This could lead to a massive build-out of clean, baseload energies, such as nuclear, and lead to cheaper, more reliable and abundant energy for all. This energy-sponge concept is already helping to stabilize grids and reduce emissions in places like Texas, Utah, Kenya and Oman. So while Bitcoin is changing the world of energy, proof-of-stake coin-holders are incentivized to hold because the price might go up, I guess.

Furthermore, ASIC chips can be used to replace the heating elements for applications, such as HVAC systems and water heaters. Why would you simply want to produce heat when you could mine bitcoin at the same time? Sounds like a really stupid waste of electricity to me, and guess what, this is already happening in Canada on a pretty large scale, delivering heat to 100 residential and commercial buildings. Why would you not want a water heater or furnace that mines bitcoin?

Came For The Number Go Up, Stayed For The Freedom Go Up

The author also seems to focus greatly on price, ignoring the freedom-oriented aspects of the decentralized and immutable ledger that is Bitcoin. Fundamentally, proof-of-stake is a system where the more money you have, the more money you get and the more control you gain.

The author asks:

“Why would an investor choose to store value in a token system that leaks value when they could choose one that doesn’t leak value, has higher demand potential due to being more eco-friendly, and has a deflationary supply that leads to value accrual in the token (number go up tokenomics)?“

Simply stated, it’s because I don’t believe in your system. It’s not and can never be decentralized based on the price to run a node alone. I reject the premise that anyone has the authority to dictate my energy usage in the first place, let alone that your notions of what’s eco-friendly have any sort of objective or useful definitions in the first place. Do you want to live in a post-freedom, eco-fascist, dystopian society? This is how you get there. Energy usage is not bad. You can have your cake and eat it too, all while saving the environment and running your AC at full blast.

At a current token price just below $2,000, the cost to spin up an Ethereum node right now is just shy of $64,000, or 32 ETH. This is a steep price tag for self-sovereignty and the ability to confirm your own transactions. A cost that frankly most of the world will never be able to pay. Furthermore, the staking reward ensures that the biggest bagholders can always accumulate more and more of the network.

Bitcoin has no such problem. You hold your bitcoin as long as you are able to. No amount of bitcoin will ever allow you to exert more influence on the network than anybody else. From the pleb with a few thousand sats to Michael Saylor sitting on his seven-figure mountain of coin, we are all equal. The cost of setting up and running a bitcoin node is about $500 for a premium out-of-the-box solution. The hurdle to become a sovereign individual is much more attainable for the average person with Bitcoin than with Ethereum. The nodes maintain the ledger; the nodes enforce the rules. A much cheaper barrier to entry ensures that Bitcoin remains decentralized with the ability for many more people to run their own node and ensure decentralization.

In my eyes we have two paths forward:

Give in to the energy FUDsters, accept rising prices and do everything we can to cut consumption and increase reliance on intermittent and unreliable sources because using electricity is bad.

Or:

Leverage the Bitcoin network to bootstrap a new age of human flourishing and abundant energy for everyone.

I’ll go with option number two. Bitcoin is a powerful and decentralized network in a way that proof-of-stake can never be and will never become. Bitcoin’s energy use is a feature, not a bug.

This is a guest post by Mickey Koss. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.

Comments (No)