Rule V: Bitcoiners Do Not Do What We Hate

A reimagination of “Beyond Order” by Jordan Peterson through the lens of Bitcoin.

Preface

These essays mirror the exact chronological structure of “Beyond Order” by Jordan Peterson, offering a reflection through a Bitcoin lens. This is chapter five of a 12-part series. If you read the book it adds a second dimension. All quotes credited to Jordan Peterson. All reflections inspired by Satoshi Nakamoto.

Pathological Order In Its Day-To-Day Guise

“When do you stop participating in a worrisome process that you see, or think you see, unfolding in front of you?”

All national currencies have an inflationary pathology. It is incurable because our nations regard inflation to be the solution rather than the problem. Robert Breedlove and Jeff Booth cover this in The Booth Series. Debt-based inflation steals from our future so we can live larger in the present. Yet we know the future is coming, and a debt that could once be repaid is now beyond hope. Many debt holders give off an aura of success when theprojectionn couldn’t be further from the truth. This is the “fake it till you make it” crowd. Social media is full of faces projecting images of success from one side of a screen while debt eats them alive on the other side.

Many people have fallen permanently behind because of these debt cycles. When we know the future is ugly and we are overcome by fear it is natural to keep our eyes fixated down at our feet — safety. The treadmill of life’s rat race continues to move faster while we convince ourselves we can keep up instead of hopping off the machine, causing our suffering. Inspirational coaches tell us to put in 110% and there is truth in that message. It is very un-American to admit defeat and call it quits. This ethos was formed partly because, until recently, there was no way to quit the system without physically exiting. Now you can exit the system peacefully without packing up your bags.

This may still be an unpopular decision, but it’s one gaining attention as the current system continues to dig itself a deeper hole. And when you’re involved in a pathological game that no longer serves you, you would be wise to look for alternative options. Put another way, it is easy for us to get stuck on a treadmill looking down at our feet whipping ourselves to run faster. If you’re willing to detach — take pause, step back, and look at the bigger picture — Bitcoin offers a new truth for those willing to understand its value proposition. We are all witnessing the debasement of our money, time, freedom and security. When will you stop participating in this worrisome process unfolding in front of you?

“Tyranny grows slowly, and asks us to retreat in comparatively tiny steps. But each retreat increases the possibility of the next retreat.”

Free markets, privacy and money have retreated in small steps. Those steps are getting larger as our situation deteriorates, with each crisis being worse than the last. Billions turn into trillions. From shoes off at the airport to a surveillance state which tracks phone calls and text messages. Many programs are sold as temporary but become permanent fixtures in our lives. And the process repeats because we continue to retreat.

Sound money is a radical concept because of its refusal to retreat or bend its standards according to the moment. This high-quality idea is so uncommon as to be completely foreign. Think about how sad this is. We are addicted to easy-bake cash machines and have forgotten entirely what high-quality money looks like. If you find your finances diminishing, perhaps it isn’t your work ethic that’s to blame but the money itself which is losing purchasing power (and taking your motivation down with it).

“Some dragons are everywhere, and they are not easy to defeat.”

Money is the root of all evil. At least that’s what people say. The biblical verse is conveniently abbreviated to turn wisdom into ideology. The full verse from Timothy 1:6 reads: “For the love of money is the root of all evil…” Money itself is not evil, it is a key building block of society that enables humans to trade productively and build civilizations. Hard money strengthens order. But money surfaces questions of morality within each of us. That is the dragon within each of us. And when money is soft it lends itself to morally questionable behavior. People have money as much as money has people. When the money is rigged it incentivizes the players to cheat, creating a toxic positive feedback loop.

Bitcoin restores balance within ourselves and society. Bitcoin raises the standard for quality, morality and stability. That’s not to say it is immune from greed, lust or love. But compare the standard the dollar sets against the standard bitcoin offers. Bitcoin restores faith in humanity by nourishing what we need in order to feel fulfilled instead of the empty pursuit of what we want. Compare what we need against what we want. The world is awash in soft money and the degradation of quality in products and people reflect this. Fiat currency is the dragon that is everywhere and is not easy to defeat. If bitcoin is money does that make it evil by association? A true tragedy is misjudging a heroic offering for just another dragon.

Fortify Your Position

“When culture disintegrates — because it refuses to be aware of its own pathology; because the visionary hero is absent — it descends into the chaos that underlies everything.”

Many Americans believe monetary collapse is exclusive to third-world countries and therefore could never happen stateside. The US dollar’s world reserve status gives credence to this attitude, yet wielding such a powerful weapon is a double-edged sword. Is it possible we’ve become too reliant on status and thus complacent when it comes to actual work? America has no shortage of cultural heroes, but we’ve fallen in love with our heroes and their trophies while ignoring the burden required to maintain the top spot.

The reality is that trophies are lagging indicators. Only those hoisting trophies know how much damn work went into standing at the top of a podium, which can’t be faked. That is the case for Bitcoin mining. The person hoisting the trophy, just like the miner that wins the block reward, must suffer a tremendous sacrifice to be considered a winner.

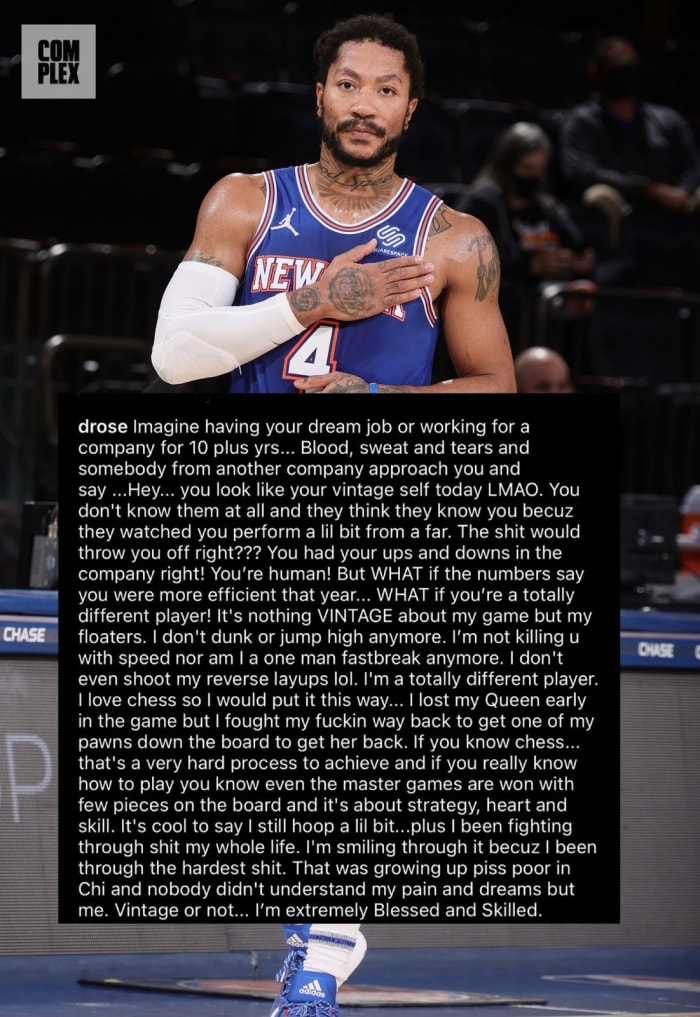

Pre-coiners often flock into bitcoin at all-time high prices and then complain when experiencing their first hard dip like the casual fair-weather fan. Then these same soft-minded people complain about mining being bad for the environment, when in reality they never put in the work to understand the process and in the grand stage of life they don’t even qualify to sit in the cheap seats. The formula to arrive at success in Bitcoin is bearing the mental burden of holding through a major dip. That separates the Bitcoin maximalist from the tourist. Bitcoin doesn’t lose, it only teaches. Whichever path a person chooses fortifies Bitcoin’s position. We drop the dead weight or we add new believers.

Putting in the work matters in Bitcoin as it should in life. This is something China understands all too well and is hopefully something America has not forgotten — work ethic matters. Bitcoin knows this. Proof-of-work (PoW) is the sacrifice. Bitcoin takes no shortcuts. Money without impurity is the trophy but what most normies have a hard time swallowing is that PoW is the battle testing that hardens the network.

We love watching highlights of Michael Jordan and Tom Brady playing hero ball and hoisting trophies, but few people are interested in the hours of gym time required to put them in a position to win. There are no guarantees for our athletic heroes, they earn their place everyday. Are you earning your keep? Or do you expect a fancy algorithm, AI or machine to solve your problems? Modern Americans expect the victory and the spoils of war even though we are on aggregate morbidly obese and educationally stunted. In Bitcoin there is no free lunch. Get it right.

“… you remain a marionette, with your strings pulled by demonic forces … and one more thing: it is your fault.”

There is a pervasive misconception about good guys and bad guys. Most of us cast ourselves as good when in reality most of us are neither. Most of us are nice guys — neutrals. Good guys, by definition, must have the capacity to confront bad guys. And if you’ve ever met a real malicious bad guy you probably know being good is easier said than done. Ironically, the good guy is equally dangerous as any bad guy. What differentiates the good guy is his or her capacity to harness and channel that danger productively to create order. It is far easier to use danger to create chaos. Morality and effort are required to be good. Note that the good guy may not necessarily be nice. Nice guys waffle on their beliefs when it serves them and are victims of circumstance waiting for the good guy to save them. Bitcoiners hold strong positions based on a provable belief system whose members refuse to be victims of circumstance. This is why Michael Saylor describes the community as a swarm of cyber hornets. Bitcoin is full of unapologetic good guys, not nice guys. Bitcoin is the only group capable of standing up against dangerously centralized sources of power.

Governments use national currencies like a puppeteer, and you are the marionette being manipulated. And now that you’ve been warned: it is your fault. Everyone is hedging their bets waiting for Superman. Everyone is structuring one-sided deals thinking they’re clever when in the long run it is mutually assured destruction. Fiat brings out these bad behaviors because as people near their zero bound they become increasingly desperate. And when money abuses you it’s easy to become jaded, dangerous and open to the idea that chaos is preferable to order. Bitcoin is money that honors its owner and can only be kept if handled with respect in return. It is the light at the end of the tunnel that makes choosing order over chaos a natural decision.

Practicalities

“But it is once again worth realizing that staying where you should not be may be the true worst-case situation: one that drags you out and kills you slowly over decades.”

A staggering 37% of British workers believe their job makes no meaningful contribution to the world. The inference is that people don’t believe their work matters yet they are duty bound to collect fiat currency in order to exist. A third of Brits don’t find purpose at their workplace where they spend the majority of their life. If money is the only reason to go to work and money is inflating your salary away that is a real drag. Imagine the path where you don’t get dragged out and killed by inflationary money. It happens gradually, then suddenly. And we are closer to the suddenly part than no-coiners like to admit. What is your plan? Do you expect the same government that is diluting your purchasing power to restore it out of benevolence? If you are waiting for someone else to save you and you find yourself in a pit, it is your fault.

“If you must cut off a cat’s tail, do not do it half an inch at a time.”

There are a lot of Bitcoiners stuck in traditional cubicle jobs dreaming about making the leap into a Bitcoin career. Around the previous halving in 2016, hiring in the space was nearly exclusively in engineering. Now the market is maturing and a diversity of careers are opening. Here are some resources if you’re seeking to make the leap:

“And there is no doubt that the road to hell, personally and socially, is paved not so much with good intentions as with the adoption of attitudes and undertaking of actions that inescapably disturb your conscience.”

The internet is a battlefield of psychological warfare. Bad behavior gets rewarded with clicks and views. Good behavior is considered mundane and rarely gets attention. Experts in the attention economy are dopamine dealers turning us into digital junkies. We’re wired to respond first to that which is grotesque, shocking, unbelievable, outrageous or insane. Good intentions rarely get ranked in popular or internet culture. This may explain why so many people living on the internet have mental health issues. Our minds desire another hit of dopamine but that does not fulfill what our conscience needs. It’s an empty pleasure.

The modern dollar behaves the exact same way. The dollar once symbolized dependable worth that could be stored but it has turned into dopamine dollars meant to provide short-term hits of pleasure leaving you destitute in the long term. When the US dollar was tied to gold it had good intentions. It represented quality because it held real value. Today’s dollar is an addictive drug turning citizens into junkies. Bitcoiners watch in horror as fiat currency marches its citizens down this dark road.

Do we keep sliding or do we dig in our heels and climb uphill? Bitcoin fixes money so we have no excuses now. The Cattle Co-op is leading the charge in Bitcoin-inspired agriculture. Fiat debt systems have systematically strip-mined America’s soil bank but Untapped Growth and Cows and Bitcoin are on the vanguard restoring its nutrient richness. The knock-on effects of poor building blocks like fiat currency unsurprisingly affect everything upstream. You may not be able to dictate monetary policy but you can select your money, thanks to Bitcoin.

Bitcoiners do not do what we hate.

This is a guest post by Nelson Chen. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.

Comments (No)