A Decemeber 2024 report by Kaiko and Bitvavo has highlighted the significant growth of Markets in Crypto-Assets Regulation (MiCA)- compliant stablecoins in the European Union (EU).

Is MiCA successfully reshaping the regulatory landscape for digital assets? The European cryptocurrency market has experienced a transformative year in 2024, driven by increased euro-denominated trading volumes and the rise of MiCA-compliant stablecoins.

Meanwhile, Bitvavo and Kraken remained the largest cryptocurrency exchanges for euro trading by volume.

Explore: Quantoz Debuts Two Stablecoins EURQ and USDQ: Tether, Kraken, Fabric Ventures Back Launch

BTC-EUR Trading Pair Played A Pivotal Role

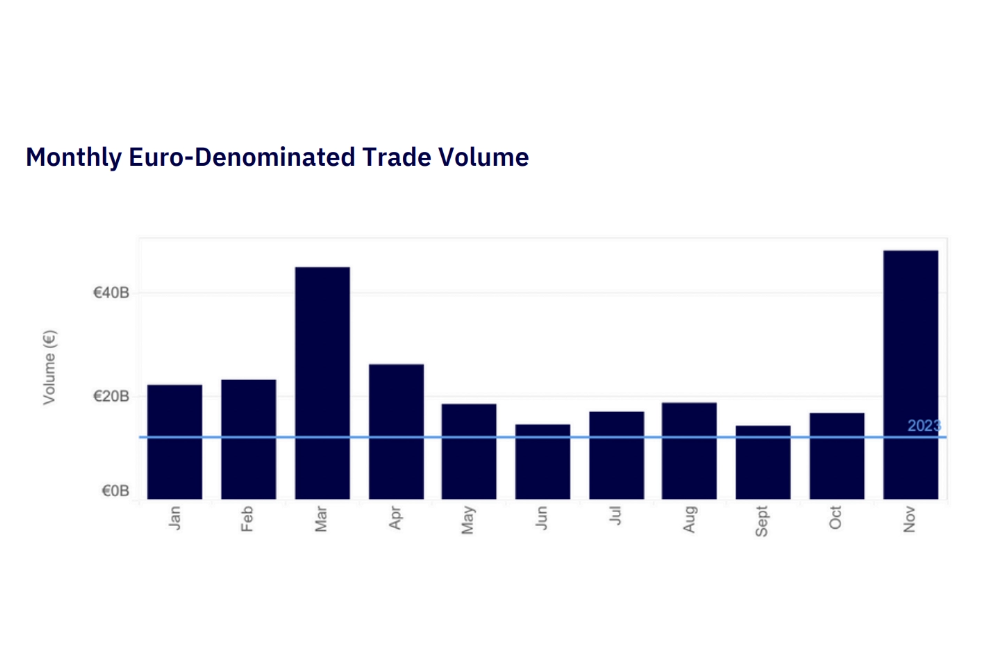

Throughout 2024, euro-denominated trading volumes consistently surpassed the average levels of 2023, reflecting growing demand for euro-based cryptocurrency transactions.

Importantly, monthly euro trade volumes peaked at over €50 billion in November, more than doubling October’s levels.

This surge was fueled by Bitcoin’s record-breaking price highs and increased institutional adoption across Europe.

Furthermore, the euro has solidified its position as the third most-traded fiat currency in global crypto markets. It accounts for 7.5% of fiat-based trading volume, trailing only the US dollar (49.9%) and the Korean won (33.4%).

The BTC-EUR trading pair played a pivotal role in this growth. Its share of global Bitcoin-to-fiat volume climbed from 3.6% to nearly 10% over the year. This trend underscores the euro’s increasing prominence as a preferred currency for cryptocurrency transactions.

Is MiCA A Game-Changer For Stablecoins?

The introduction of MiCA has been a turning point for stablecoins in Europe. The regulation, which began rolling out on 30 June 2024, with full implementation expected by 30 December 2024, establishes clear compliance standards for asset-referenced tokens (ARTs) and electronic money tokens (EMTs).

These rules aim to enhance consumer protection, improve market integrity, and foster innovation within the EU.

MiCA-compliant stablecoins have quickly captured a dominant share of the European market.

Notably, Tether announced in November that it would discontinue support for its euro-pegged stablecoin EURT across all blockchains.

The decision was attributed to Europe’s evolving regulatory frameworks under MiCA and Tether’s strategic shift toward other initiatives.

Once a dominant player in the euro-stablecoin market, EURT saw its supply drop significantly from its peak market capitalization of $500 million to just $27 million by late 2024.

Explore: Singapore’s Dtcpay Decides To Embrace Stablecoins, Phase Out Bitcoin, Ethereum

Disclaimer

Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

99Bitcoins may receive advertising commissions for visits to a suggested operator through our affiliate links, at no added cost to you. All our recommendations follow a thorough review process.

Comments (No)