Coincheck Group, the Dutch parent company of Japan’s leading cryptocurrency exchange, Coincheck, has made its public debut on the Nasdaq Global Market.

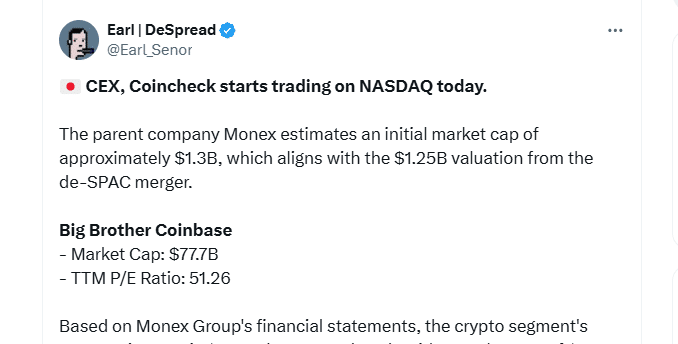

The move marks a significant milestone as Coincheck becomes the second crypto exchange operator to list on Nasdaq, following Coinbase’s 2021 debut.

The debut comes after a year-long delay in Coincheck’s merger with Thunder Bridge Capital, valued at $1.3 billion.

The merger, a special acquisition merger (SPAC), was initially slated for completion earlier but was finalized only recently. With the listing, Coincheck Group is now poised to be the first Japanese exchange to be listed on a U.S. trading venue.

EXPLORE: Gate.io Banned In India, Users Unable To Access Funds

Coincheck Shares to Begin Trading on Wednesday

Coincheck Group’s shares will begin trading on Wednesday under the ticker CNCK as U.S. markets open. The listing is seen as a major step toward enhancing the company’s visibility and transparency with global investors.

In a statement, Coincheck Group CFO Keigo Takegahara emphasized that the public listing would foster more open communication with investors, thereby strengthening Coincheck’s services and reliability.

Founded in 2012, Coincheck gained recognition as one of Japan’s first major cryptocurrency exchanges. It grew popular for its user-friendly interface, which appealed to younger traders.

However, the exchange faced a setback in 2018 when a major security breach hit it. Following the incident, Monex Group acquired Coincheck for ¥3.6 billion ($33.6 million) and worked to bolster its security, leading to regulatory approval in 2019.

(Source)

The merger was facilitated by several major financial institutions, including Galaxy Digital, Barclays Capital, and Cantor Fitzgerald & Co., with Monex engaging J.P. Morgan Securities as its sole financial advisor.

Coincheck remains dominant in Japan’s retail crypto market, maintaining a five-year streak as the most downloaded crypto trading app from 2019 to 2023.

EXPLORE: 17 Best Crypto to Buy Now in 2024

Bitwise Forecasts 2025 as ‘Year of the Crypto IPO’

Bitwise Asset Management, a leading issuer of crypto exchange-traded funds (ETFs), has forecast that at least five major cryptocurrency firms, often referred to as “crypto unicorns,” will go public in 2025.

These firms include stablecoin issuer Circle, cryptocurrency exchange Kraken, “crypto bank” Anchorage Digital, blockchain analytics company Chainalysis, and crypto trading platform Figure.

According to Bitwise’s report, “10 Crypto Predictions for 2025,” which was released on December 10, these companies are expected to launch Initial Public Offerings (IPOs), offering their shares to the public for the first time.

Bitwise Chief Investment Officer Matt Hougan and Head of Research Ryan Rasmussen dubbed 2025 the “Year of the Crypto IPO,” citing factors such as increasing investor demand, higher institutional adoption, a positive macroeconomic environment, and improved regulatory conditions.

These elements, they believe, will pave the way for these crypto firms to make their market debut and attract significant public interest.

EXPLORE: Crypto Tax Guide 2024

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

99Bitcoins may receive advertising commissions for visits to a suggested operator through our affiliate links, at no added cost to you. All our recommendations follow a thorough review process.

We hate spam as much as you do. You can unsubscribe with one click.

Comments (No)