Bitcoin has smashed $90K and Donald Trump is fuelling crypto bull run, but when to sell crypto? When to sell altcoins? When to sell Bitcoin?

It’s not a popular subject, but I think it’s time we talk about when to sell your digital assets. Not because they aren’t going up – we mean, hell, Donald Trump’s not even in yet! – but because everyone should have an exit strategy. Unless you’re one of those freaks from r/WSB, that is.

Before you start looking at selling your altcoins, you should be familiar with the characteristics of an altcoin cycle. This will put you in a much better position to know when to sell both your Bitcoins and your altcoins.

Disclaimer: This article will get a little nerdy

When to Sell? Altcoins Follow the Bitcoin Four-Year Cycle

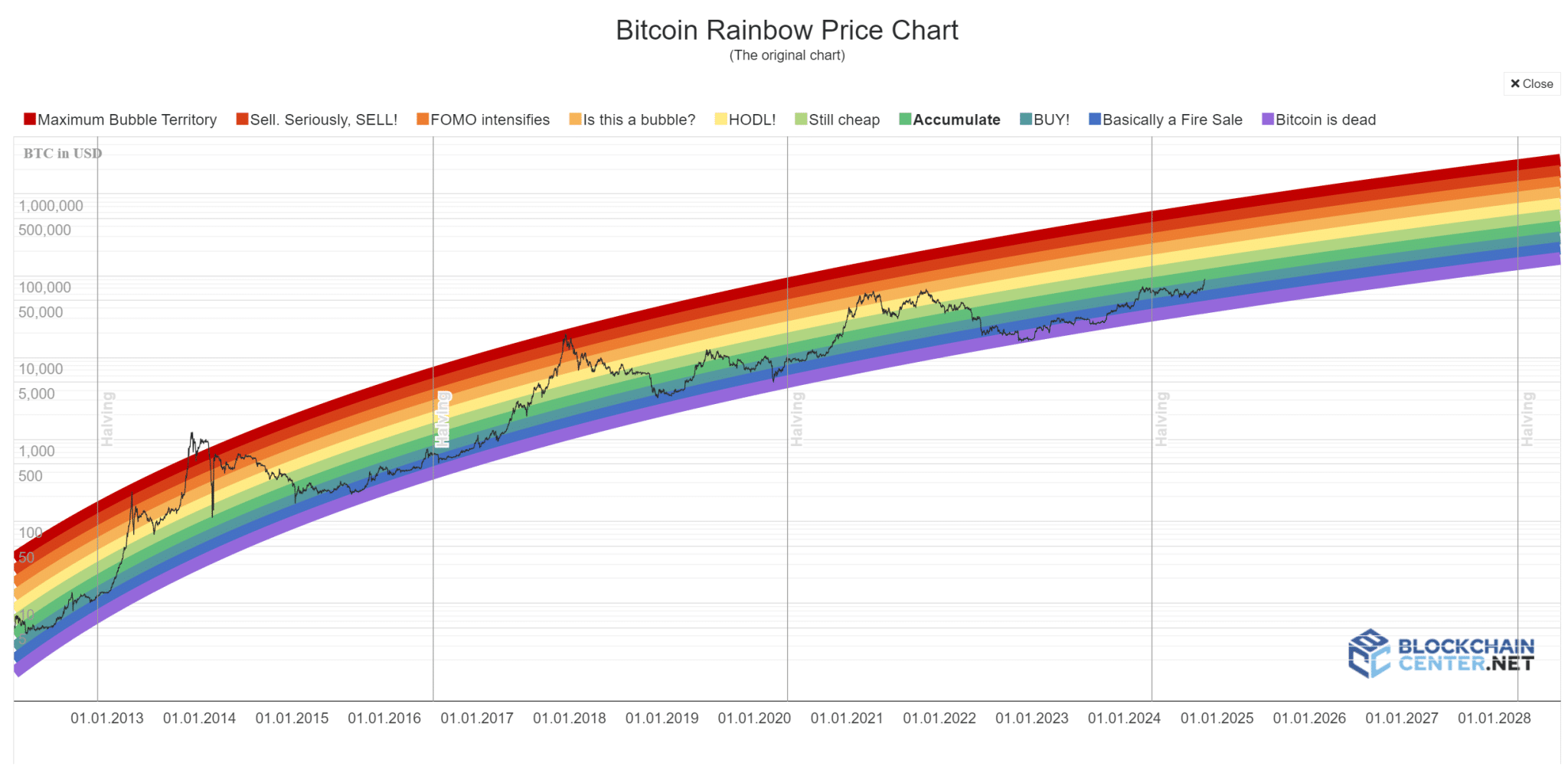

Altcoins tend to follow the four-year cycle of moving up after a Bitcoin halving event. Bitcoin

has a fixed supply of 21 million. So upon a halving event, the last of which happened this year in April, a little less Bitcoin is released into the market until all of is out by 2140.

After the halving, Bitcoin’s price will rise for about 16 to 18 months, and altcoins follow Bitcoin’s lead.

However, it’s important to note: where altcoins usually perform best is once BTC slows down a bit. Crypto investors call this “Altcoin season.”

Although Bitcoin is the initial market mover, you should always wait for BTC to die down a bit in price action before selling your altcoins.

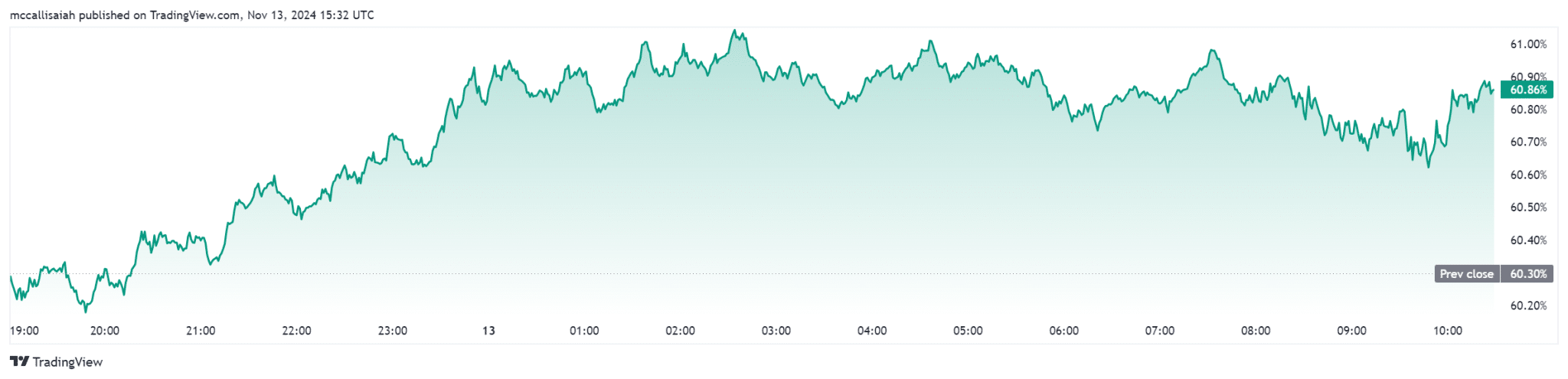

Bitcoin dominance also plays a big part. BTC dominance refers to how much of the total cryptocurrency market cap is in Bitcoin. Simply put, the Bitcoin Dominance Chart is an indicator that demonstrates the percentage of Bitcoin’s market cap relative to the entire crypto market cap.

When Bitcoin dominance falls, more money is going into altcoins. To see where altcoins are headed, check the Bitcoin dominance chart to see if it is trending up or down.

DISCOVER: How To Buy Bitcoin With Apple Pay Before It Hits 100K

How to Exit an Altcoin Trade

Now that you know how the altcoin market moves, let’s look at the various ways you can exit an altcoin trade. You will want to integrate one or more of these approaches in your trading:

1). Profit Target

One of the most common ways to exit an altcoin trade is to have a profit target.

For example, if you purchase Sui at $3, you may decide to take profits at $10. You can put in a sell order at $10 and wait for the price to hit your sell order target.

2). Sell Signals

You can also use what are known as “Sell Signals.”

There are a number of websites that have buy and sell signals on various assets — including altcoins.

3). Technical Indicators

You can also use technical indicators such as the 200-day moving average to determine when to sell your altcoins.

For instance, if an altcoin falls below the 200-day moving average of the crypto market leaders (e.g., Bitcoin, and Ethereum), it could be time to sell. This is especially true if we’re in a bear market.

But Bitcoin LOVES macro summer and fall even more.

Crypto summer has started and fully develops post-halving…it’s all the same Everything Code cycle… pic.twitter.com/9ZDQH5jOdG— Raoul Pal (@RaoulGMI) March 24, 2024

Cryptocurrencies die during prolonged bear markets as investors are more likely to invest in trusted and more secure projects. If you’re holding for the long term, you’ll have to endure the crash.

4). Portfolio Rebalancing

My preferred way to sell an altcoin is to rebalance my portfolio while doing it.

Let’s say you buy five altcoins for $5,000 each. Three of the altcoins have risen in value a month later, while two have fallen.

You can sell off a part of the positions on the three winning altcoins and increase your positioning in the falling altcoins — buy that fucking dip — until all five altcoins have the same value. This allows you to lock in profits on winning altcoins while buying the dip on falling altcoins.

5). Consider the Tax Implications

Death and taxes. Altcoins aren’t an exception either.

Altcoins held for less than 12 months are taxed at your regular tax rate. Altcoins held for over 12 months are taxed at 0%, 15% or 20% based on your filing status and income.

8). Dollar Cost Average Your Way Out of Position

One more smart way to sell your altcoins is to use the dollar cost average out of a position. This method allows you to avoid panic selling.

Just as you can put $500 into a trade over a period of time, you can also slowly withdraw that money when you hit your price target.

As Benjamin Graham, Warren Buffet’s mentor, once said, “[DCS] is a policy that will pay off ultimately, regardless of when it is begun, provided that it is adhered to conscientiously and courageously under all intervening conditions.”

One More Thing to Remember About Taking Profit

Don’t fall for the cryptocurrency fervor of holding until the end of the day and never selling a cent. Make an exit strategy and lock in your gains.

With the right strategy, you can realize incredible profits from your altcoins and maybe even change your life.

EXPLORE: Former FTX Digital Markets Co-CEO Ryan Salame Sentenced To 7.5 Years In Prison

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Comments (No)