Bitcoin price,

, is steady when writing but one analyst wants to see more even as Google trend search related to BTC remains low in volumes.

Bitcoin appears to be turning the corner. After racing to register a 2-month high over the weekend, the coin has not retraced, sliding below $65,000.

Nonetheless, optimism remains high; some traders expect the coin to print higher. However, not everyone is bullish, especially considering price action.

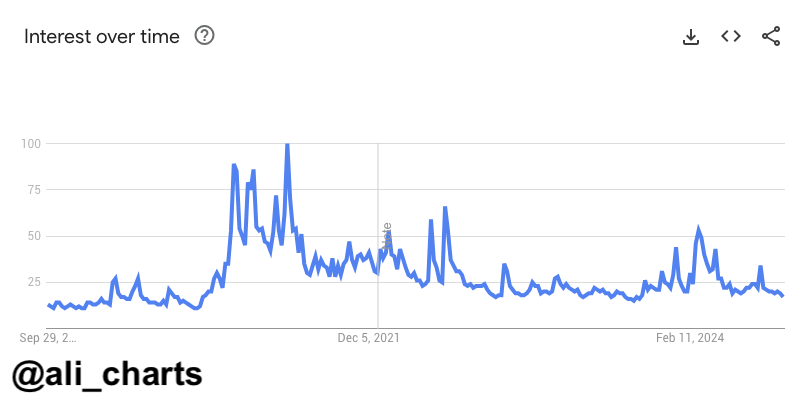

Why Is Bitcoin Organic Search Via Google Low?

In a post on X, one trader thinks the current Bitcoin price action is just “noise,” and worse, there is no organic interest in BTC, as seen by Google searches.

If Bitcoin is forming a cup-and-handle pattern, then the trader predicts even more gains in the coming days.

The technical pattern is usually bullish and used to gauge the strength of reversals. As things stand, the resistance is around $70,000, an all-time high.

If there is a solid breakout above this zone, the probability of Bitcoin floating to a fresh high remains.

(Source)

According to the analyst, the coin will likely hit $194,000 on the lower end and $352,000 if the upside momentum is maintained.

The long-term price targets could be substantial if Bitcoin forms a cup-and-handle pattern, a technical analysis chart pattern often associated with bullish reversals.

According to the trader’s analysis, the target range for Bitcoin could be between $194,000 and $352,000.

All the same, for this leg up to take shape, there must be a solid backing.

Besides fundamental factors, traders use organic search interest in Bitcoin from Google.

Presently, even with Bitcoin trending higher, interest in Bitcoin appears to be non-existent–and even decreasing.

(Source)

What this suggests is that there is no FOMO, and bulls are drawing benefits from fundamental factors.

DISCOVER: The Simplest, Easy Way to Get Bitcoin With Apple Pay

From Halving To Elections: BTC Demand Likely To Rise

Indeed, this appears to be the case. Besides the expectations that Q4 2024 will be bullish, as seen from trends in the past, the fact that there is rising demand from institutions after Halving in April may prop up bulls.

(BTCUSDT)

Usually, prices tend to recover sharply a few months after Halving. It has been nearly six months since this event happened, and buyers expect prices to correct higher as a result.

At the same time, regardless of the outcome of the presidential election in the United States, Bitcoin may draw benefits. Both parties are eager to address the mounting debts and rising deficits.

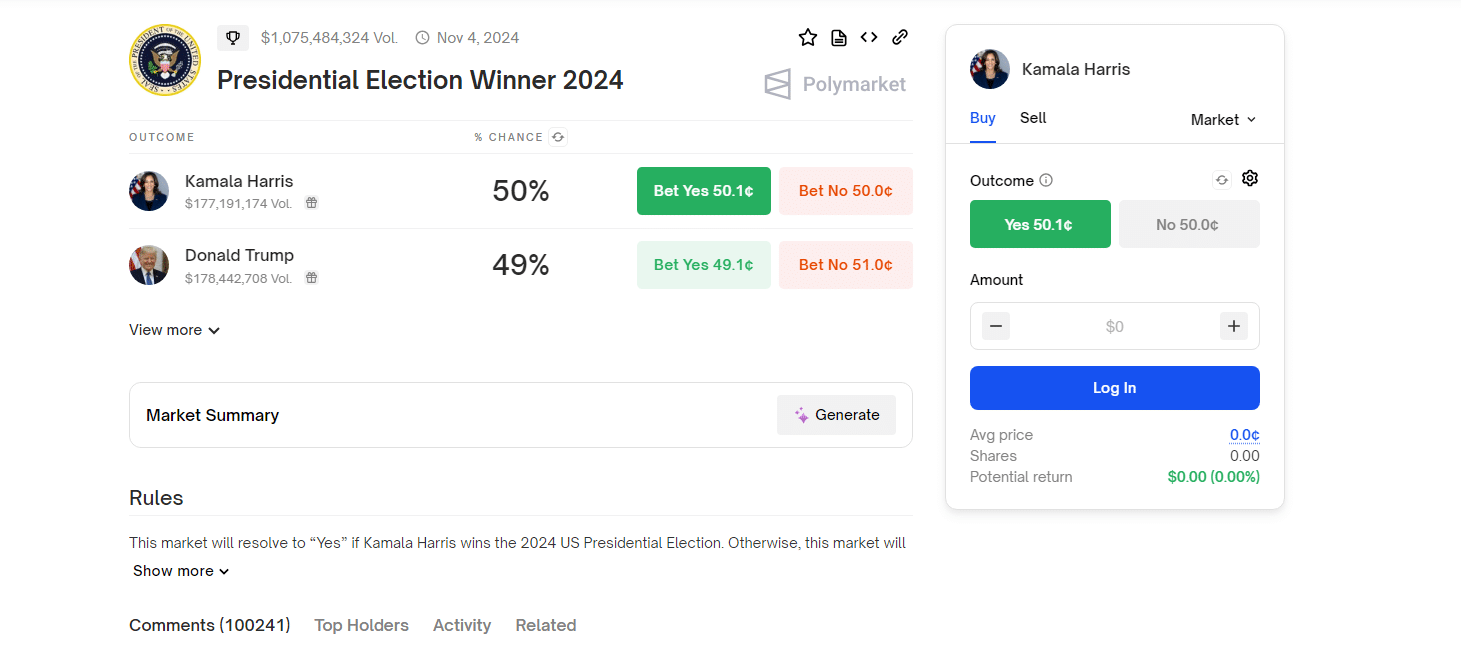

As of September 30, Polymarket places Kamala Harris ahead at 50% versus Donald Trump, 49%.

(Source)

A Trump win might see the United States establish a BTC reserve and foster growth in Bitcoin mining activity.

EXPLORE: ICP Up 50% In 6 Weeks As On-chain Fees and Development Activity Explodes: Time For dFinity To Shine?

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

Comments (No)