As the Consensys 2024 conference commences this week in Austin, Texas, the LINK community is abuzz with anticipation over a potential pivotal announcement from Chainlink in collaboration with SWIFT. Speculations are rife that this announcement, set for May 30 during a session on tokenization, could significantly influence LINK’s market performance.

Chainlink And Swift Partnership Going To The Next Level?

The session titled “How Swift and Chainlink Are Working Together to Unlock Tokenized Assets At Scale” will take place on the Mainstage at the Austin Convention Center. It features Jonathan Ehrenfeld, Head of Securities and Digital Assets Strategy at SWIFT, and Sergey Nazarov, Co-Founder of Chainlink.

The session aims to explore how the two entities are collaborating to connect traditional financial infrastructure with the burgeoning multi-chain economy. This partnership is crucial for enabling a global system of on-chain finance for tokenized assets, which could streamline and enhance the security of cross-chain transactions.

Related Reading

This development follows a series of successful experiments conducted in June 2023, where SWIFT, alongside major financial institutions like BNP Paribas and BNY Mellon, demonstrated SWIFT’s potential as a unified access point for various blockchain networks. These tests included token transfers within and across different blockchain platforms, showcasing a stride toward integrating digital assets globally.

Chainlink’s role as a leading provider of on-chain data and cross-chain interoperability solutions makes it a strategic partner for SWIFT, which has historically been the backbone for global financial communications across over 11,000 banks. The potential announcement is speculated to revolve around further advancements in this collaborative effort, which may include launching new protocols or a mainnet launch.

Furthermore, Sergey Nazarov’s participation in another significant discussion at the conference, scheduled for May 29, titled “Building the Tokenized Asset Economy | Chainlink and Securitize,” adds to the gravity of the week’s events. Here, Nazarov, alongside Carlos Domingo, Co-Founder and CEO of Securitize, will delve into the multi-trillion-dollar tokenization opportunity, discussing strategies for blockchain projects and capital markets institutions to optimize their approaches to tokenization.

Related Reading

The recent $47 million strategic funding round led by BlackRock for Securitize, which coincided with the launch of BlackRock’s first tokenized fund (BUIDL) on Ethereum, underscores the accelerating interest and investment in blockchain and tokenization technologies. With Securitize, Chainlink could ink another major player in the field of tokenization.

LINK Price Is Ready To Skyrocket

The outcomes of these sessions and the anticipated announcement could significantly impact the LINK price. Notably, the LINK price is in a good position in the daily chart.

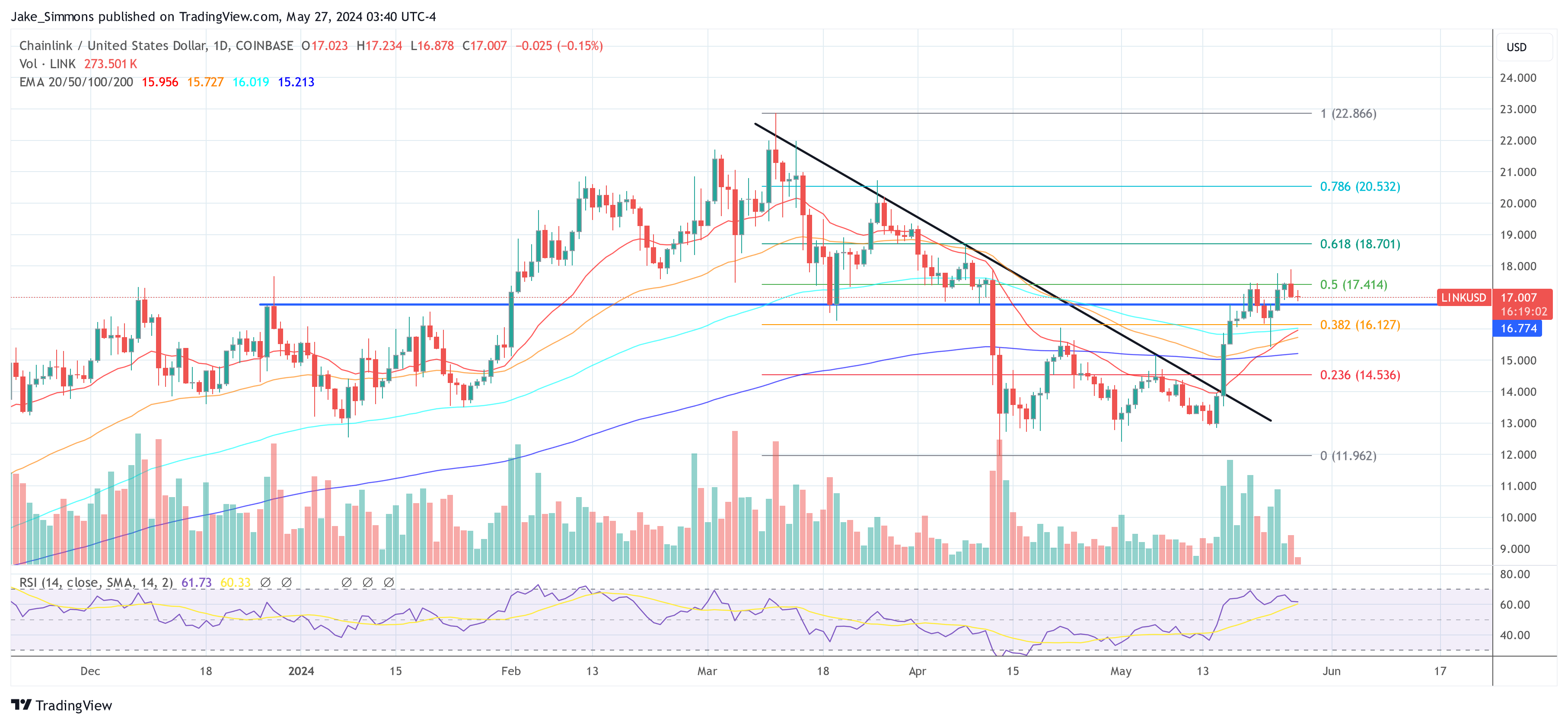

On May 16, LINK’s price successfully broke above a descending trend line that had previously capped its price action for approximately two months. This trend line, originating from early mid-March, had been a barrier for any bullish momentum, with the price consistently rejecting this dynamic resistance until the mentioned breakout.

Following this pivotal breakout, LINK’s price trajectory shifted as it began a rally towards higher price levels. Notably, the price rallied to the 0.5 Fibonacci retracement level, which is calculated from the local high in early March to the significant low in mid-April. This level, sitting at approximately $17.41, has become a crucial focal point for both traders and analysts.

Since reaching the 0.5 Fibonacci level, LINK’s price has entered a phase of consolidation, fluctuating within a narrow range defined by the 0.5 and 0.382 Fibonacci levels—the latter at around $16.13. This price behavior indicates a tug-of-war between buyers and sellers, trying to establish a more defined market direction.

A convincing break above this level could signify a continuation of the bullish momentum, potentially leading to further gains. Technical traders might be closely watching this level, as a breakout could validate the bullish sentiment further and could see the price aiming for the next Fibonacci levels at $18.70 (0.618), $20.53 (0.786) and 22.86 (1.0).

Featured image created with DALL·E, chart from TradingView.com

Comments (No)