Solana, like many Proof-of-Stake (PoS) cryptocurrencies, relies on a decentralized network of validators who secure the network by staking their SOL coins. In exchange for staking, validators earn rewards.

However, as Solana’s price began its recent ascent, a noticeable decline in staked SOL was observed. This suggests that some validators are choosing to unstake their coins, potentially to capitalize on the price surge and book some early profits.

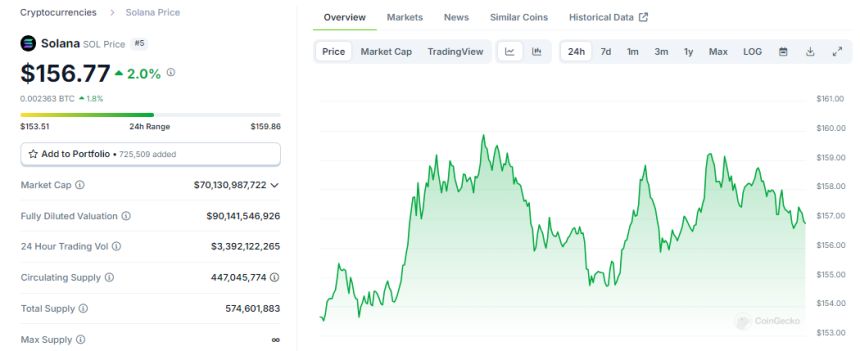

Solana Market Cap And Price Soar

Meanwhile, on Tuesday, Solana enjoyed a stellar day, surging 17% and adding over $11 billion to its market capitalization, which now stands at over $70 billion. This impressive performance saw Solana outperform industry giants like Bitcoin (BTC) and Ethereum (ETH), which remained entangled in their own price gyrations. With its market capitalization now totaling an impressive $80.7 billion, Solana’s surge has caught the attention of the crypto world.

This unstaking activity has drawn the attention of analysts, with the unstaked amount reaching a significant 5 million SOL over the past week. With Solana currently trading around $157 per coin, this translates to roughly $780 million worth of tokens re-entering the market. The influx of such a large volume in a short period could lead to a temporary oversupply situation on exchanges.

SOL price action in the last 24 hours. Source: Coingecko

Pullback Or Power Through?

The potential impact of unstaked SOL on the price is a matter of debate. Without a corresponding surge in demand to absorb this additional supply, there’s a risk of an initial price correction in the coming days. This could see Solana retreat from its current perch and settle around the $150 mark before potentially resuming its upward trajectory towards $200.

Total crypto market cap currently at $2.3 trillion. Chart: TradingView

The $200 Target

The coming days will be crucial for Solana. The bulls need to maintain strong buying pressure to absorb the unstaked coins and push the price above the $160 resistance zone. If successful, this could propel Solana towards its $200 target. However, a failure to do so, coupled with a large-scale sell-off from unstaked SOL, could trigger a correction down to $150.

Solana Breakpoint 2024

In another development, Solana Breakpoint 2024 is set to take place in Singapore, from September 20 to September 21. This event will provide attendees with full access to the heart of the Solana community, including insightful talks and exclusive events.

Special subsidized rates are available for developers, creators, artists, and students, ensuring that a diverse range of individuals can participate in this transformative event. The Solana Campus, located just a short 15-minute journey from downtown Amsterdam, offers a variety of stages for insightful talks, networking areas to build connections, and complimentary transportation for attendees’ convenience.

Solana Breakpoint is an important event for the Solana community, providing a platform for developers, validators, and other ecosystem participants to discuss the latest developments, share insights, and showcase their achievements. The annual conference highlights the network’s potential and its role in the broader blockchain space, with a focus on performance, reliability, and innovation.

Featured image from Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

SOL price action in the last 24 hours. Source:

SOL price action in the last 24 hours. Source:

Comments (No)