Decentralization is a core ethos of Bitcoin. In this article, I will discuss the importance of keeping Bitcoin mining decentralized with widespread, small-scale mines.

The future is competitive.

Large Bitcoin mines have economies-of-scale advantages and are able to be set up in jurisdictions with the lowest power costs. While large-scale mines do play an important role in the scaling of hash power, it is important to have large- and small-scale mines. Currently, the incentive structure favors relative centralization of mining to large mines.

If mining becomes too centralized, there are several risk vectors that come into play.

- 51% attack: It is easier to coerce 100 large mines to cooperate or shut down, than it is to coerce 1 million small mines to cooperate or shut down.

- State/government compliance: Large mines become beholden to government policies or political pressure.

- Anti-fragility: The higher the centralization, the less robust the network. If Bitcoin is to become the base layer of the global monetary system it needs to be able to withstand any potential threat coming in the foreseeable future. Events such as widespread power outages, world war, global economic collapse, coordinated EMP or nuclear attacks could cause denial-of-service or 51% attack opportunities.

Non-democratized: Bitcoin is for the people. Miners and nodes work together to protect the blockchain and “vote” on changes to core functionality. Individual control of miners and nodes ensures more people are in control of “voting” for Bitcoin’s future.

Along with pressure from large-scale mines, small mines also have to compete with the simple economics of reducing bitcoin rewards over time. As the network hash power increases and the block reward decreases, staying competitive in the long run is not a simple task.

Small-scale mines will have to find areas where they can compete among the much larger, industrial-scale mining farms operated by large entities. And there are two key advantages that small-scale mines can employ to maintain competitiveness relative to large-scale mines.

The first is establishing grid stabilization with dynamic power curtailment. Power plants are large, expensive operations. They have to be sized to accommodate peak demand of the jurisdiction they serve, otherwise blackouts would occur. Peaks happen in only small periods of any given timeframe, i.e., in a few hours of a day, or during extreme weather events. The rest of the time, much energy is lost because the plants cannot scale up and down fast enough. Since miners can power up and down quickly, Bitcoin mining is positioned perfectly to scale up in the low demand times and scale down during the peaks.

Some large mines are doing this now, but how can a small-scale miner do this? Here is how I am doing it.

Scaling Home Bitcoin Miners With Energy Peaks

Here in Southern Nevada, peak energy use is in the summer afternoons when 100-plus degree fahrenheit heat forces heavy usage of air conditioning in homes and businesses.

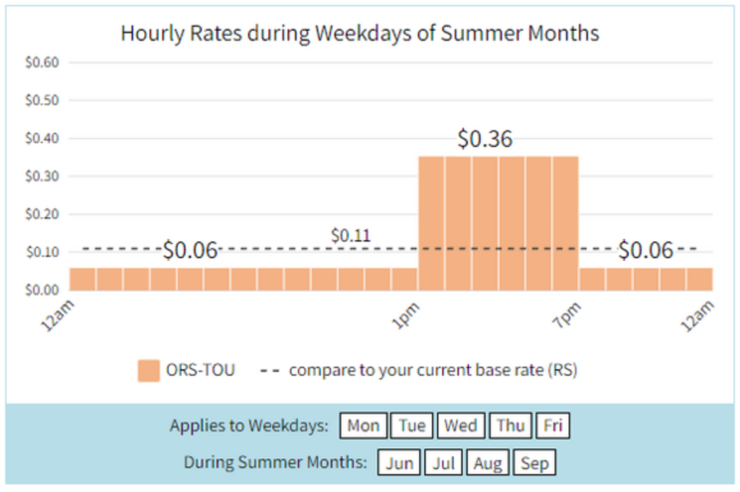

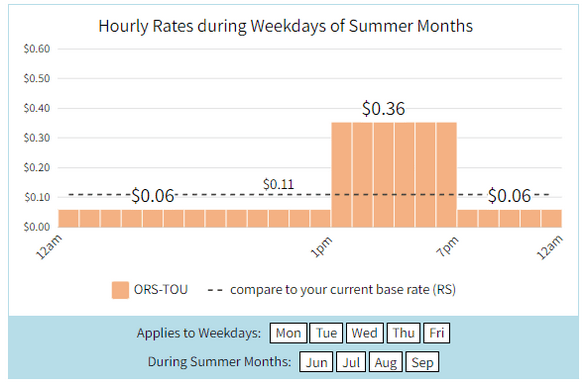

To incentivize off-peak usage, an opt-in power plan is offered by the local utility. These rate plans are often referred to as time of service (TOS) or time of use (TOU). Instead of paying $0.11 per kilowatt hour (kWh) at all times all year, the rate becomes $0.06 per kwh at all times except for 1:00 p.m. to 7:00 p.m. on weekdays from June to September, where the rate is $0.36 per kWh. This infographic shows this rate breakdown more clearly:

Prior to having solar panels with battery backup, I would optimize my energy usage by doing the following:

- Automatically shutting down Bitcoin miners during peak time with use of home automation

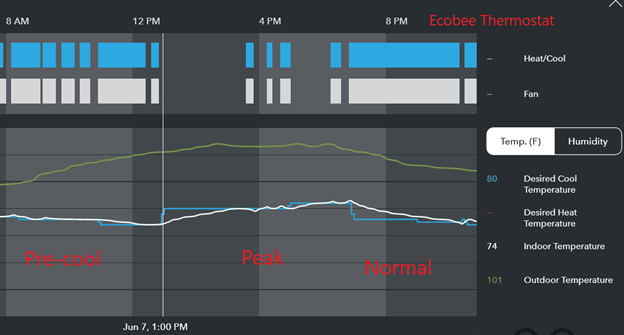

- Pre-cooling my house by a couple of degrees prior to peak energy consumption time, then raising the air-conditioning setpoint during the peak to minimize air conditioning usage during the peak. Essentially, the house acts as an energy battery of cooled air. In the figure below, you can see how the air conditioning barely runs during the peak events:

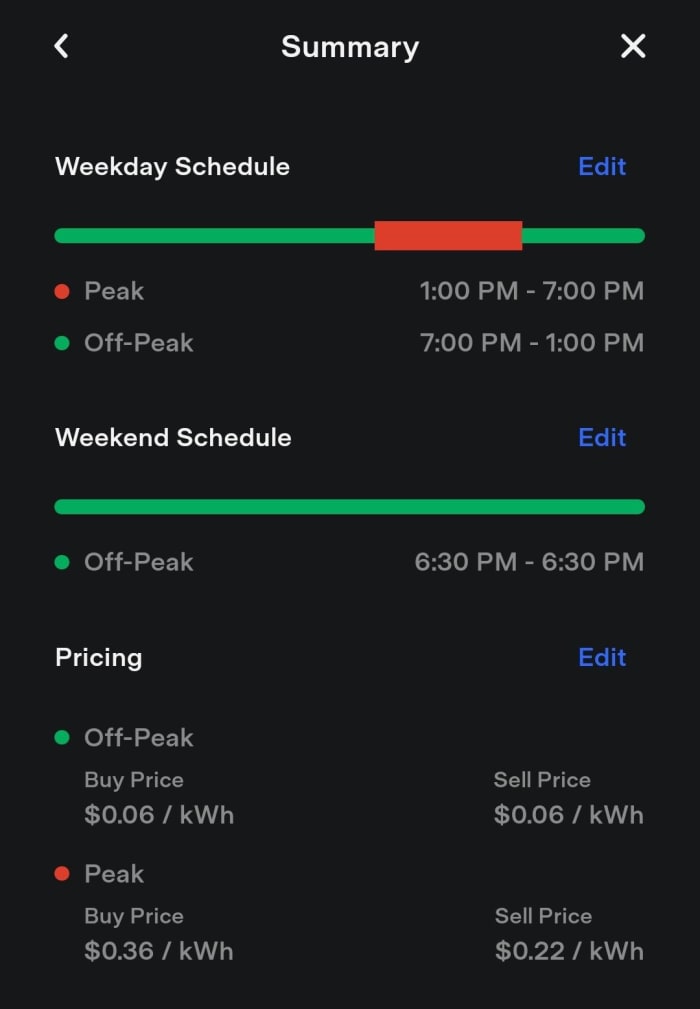

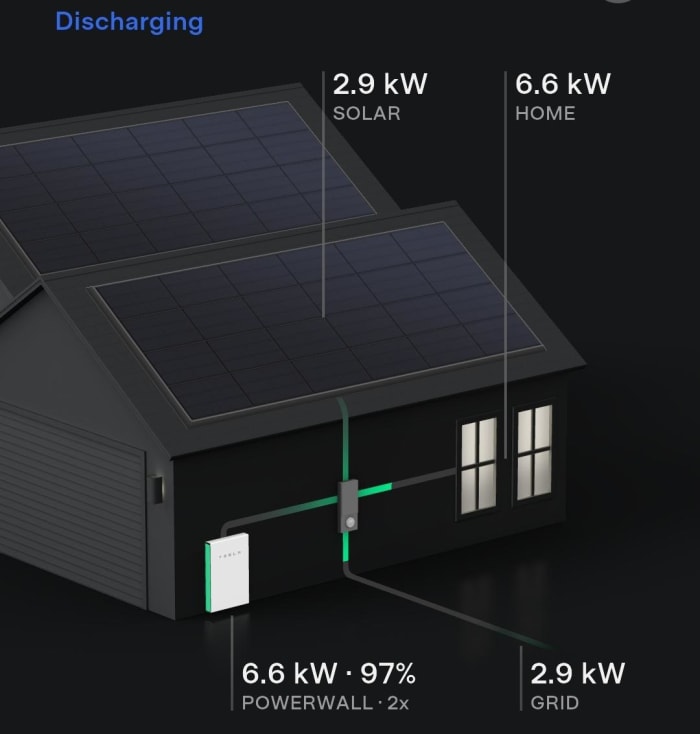

The addition of a Tesla solar with Powerwall battery backups allows for further optimization with net metering billing (net metering takes into account the power used from the grid, minus the power supplied to the grid). Utility companies will credit the customer for excess solar power delivered to the grid above and beyond what they use for the home (the credit rate also varies based on TOU).

In my case, the utility company will pay me $0.28 per kWh for power I deliver to the grid during peak time. So, in the Tesla app, I can configure these settings and it will automatically push/pull from sources to optimize power savings.

Essentially, I consume as much power as needed during off-peak times, then during peak times, batteries supply the house with all power needs (up to 10 continuous kilowatts with two Powerwall batteries), while all solar energy produced goes back into the grid.

As you can see from the screenshots of my Tesla app for June 7, 2022 above, power is consumed from the grid during off-peak times, while solar energy charges my batteries. Then, during the peak event, the batteries power my home energy load while all solar power is redirected into the grid and sold for the highest-possible rate.

Effectively, my house acts as a small power plant during peak times and an energy consumer during off-peak times.

This has the effect of giving the utility provider what they want: more power supply during peak consumption times, and more power consumption during off-peak times. It also works out for my benefit as I am able to consume only low cost power, while getting credited for all power supplied during peak events at the higher rate of $0.28 per kWh.

In the example of this one day, we can break it down as follows (assuming only net usage for comparison):

- Non TOU rate: 98.4 kWh at $0.11 per kwh = $10.82

- TOU Net Metering: 111.3 kWh at $0.06 per kWh – 12.9 kWh at $0.28/kwh = $6.68 – $3.61 = $3.07

- Effective rate: $3.07 / 98.4 kWh = $0.03 per kWh

As we can see, a significant cost advantage to me as a consumer. Instead of $0.11 per kWh, I am effectively paying $0.06 or $0.03 per kWh depending on the season.

Although utility TOU options may not be available in all jurisdictions, it is likely that many utility providers have a need to level out peak demand. Once power companies have the ability to dynamically interface with miners to instantly scale back demand, new rate structures can be implemented to take advantage of this scenario.

Even without a solar and battery backup system installed, a small-scale miner could use dynamic power scaling to scale back mining during peak events, and scale up mining during off-peak events. This could be accomplished through the use of micro controllers and home automation controllers subscribing to live power grid events, which then in turn increase or decrease miner hash rate accordingly.

Heating Your Home With Bitcoin Miners

The cost savings of this technique become even more apparent when coupled with the second key advantage that home miners can use: mining for heat.

All devices that consume electricity put out 100% of that energy in the form of heat, along with their primary purposes (producing light, hashing, etc). A 3,400-watt Bitcoin miner essentially puts out the equivalent wattage in the form of heat. With some innovation and engineering, this heat can be redirected and integrated into heating homes, pools, water heaters, green houses and more.

Double-spending energy already being spent on heating drastically improves ROI as well as improves the perception of mining to the public, though deeper and simpler integration into heating devices is needed and currently in development (check out this list of home Bitcoin miners building systems to repurpose heat for more information).

Dynamic power scaling to meet energy grid demand along with mining for heat are musts for keeping the Bitcoin blockchain protected with highly decentralized, small-scale mining.

Dynamic power scaling based on grid demand is possible on a small scale. And by coupling this with mining for heat, small-scale mining operations can be profitable for the foreseeable future.

I am working to modularize and simplify these control systems for more miners. If you are a home miner employing any of the techniques that I mention here, or are a miner interested in learning more, follow along and join the conversation on Twitter @TechEngineer21.

This is a guest post by TechEngineer21. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Comments (No)