What is Avalanche Network (AVAX)?

Launched in 2020 by Ava Labs, Avalanche is a blockchain platform that is smart contract-capable. Avalanche aims to deliver a scalable blockchain solution while maintaining decentralization and security, focusing on lower costs, fast transaction speeds, and eco-friendliness.

Avalanche quickly became popular in the cryptocurrency space, with Avalanche TVL currently worth $8.41 billion and still rising across Avalanche decentralized applications (DApps). Avalanche is powered by its native token Avalanche (AVAX) and multiple consensus mechanisms.

With Avalanche, users can create an unlimited number of customized and interoperable blockchains. To operate a blockchain on the Avalanche coin, AVAX, one must pay a subscription fee.

What is Avalanche crypto used for?

The native token AVAX is a utility token. AVAX serves as the Avalanche ecosystem’s medium of exchange. In other words, the token is used as currency within the network, typically for fee collection in transactions, incentives and many other use cases.

It is also used for staking AVAX, which serves to secure the network. Stakers are then rewarded with more AVAX. Some users stake AVAX to earn passive income on the network.

History of Avalanche

When the Bitcoin blockchain was launched in 2009, it paved the way for the design and invention of blockchains that came after it, including Ethereum. With today’s wide-scale use of nonfungible tokens (NFTs) and decentralized finance (DeFi) protocols, however, the technical limitations of the original blockchain design became more apparent.

Bitcoin’s proof-of-work (PoW) consensus, for example, inhibits decentralization to an extent due to its resource-intensive validation process. Transactions also tend to be slower. Most Ethereum apps today use layer-2 scaling solutions to address these issues. By using layer 2, transactions are taken away from the main chain. They are then rolled in neat “bundles,” which are sent back to the Ethereum chain, taking pressure off of Ethereum.

Although effective, this solution adds layers of complexity, making the network open to certain security threats. So, how can a blockchain keep everything within a layer-1 protocol that is decentralized and scalable but also secure?

Enter Ava Labs, the founders of Avalanche, who came up with a brilliant three-blockchain solution to address the top problems that plague blockchains. In September 2020, Ava Labs US launched the Avalanche blockchain after raising $6 million during their financing round. Their subsequent token sales — private and public — amounted to $48 million.

Who is behind Avalanche (AVAX)?

The three people behind Avalanche are Kevin Sekniqi, Maofan “Ted” Yin and Emin Gün Sirer. A pseudonymous group called Team Rocket first released fundamental information about the protocol in May 2018 on the InterPlanetary File System.

A group of researchers from Cornell University then developed the technology, led by Cornell professor of computer science and software engineer, Emin Gün Sirer. He was assisted by two of his doctoral students: Maofan “Ted” Yin and Kevin Sekniqi.

The AVA codebase for the Avalanche consensus protocol became open-source in March 2020, making it available to the public. Avalanche’s initial coin offering (ICO) ended in July of 2020, followed by the launch of Avalanche in September of the same year.

What problems does Avalanche (AVAX) solve?

As mentioned earlier, Avalanche was built to address many of the issues most blockchain networks face. By providing an alternative to networks such as Ethereum, platforms like Avalanche work to combat centralization within the crypto space.

Two of the top issues that Avalanche addresses are:

Congestion

Avalanche was deliberately designed with scalability in mind. On par with top-tier payment processors like PayPal and VISA, Avalanche has sub-second transaction times.

Avalanche is also tremendously powerful and efficient, having the capacity to process up to 6,500 transactions per second with sub-second finality. This is a vast improvement on Ethereum’s limitations in terms of the number of transactions that can be processed per second.

Low fees

Considered by many as an Ethereum competitor, Avalanche also trumps Ethereum in terms of gas fees. Fees on Avalanche are more affordable than Ethereum by a wide margin.

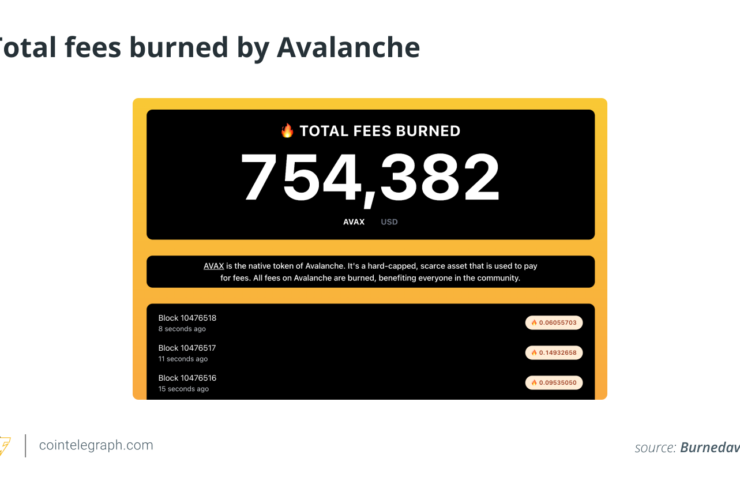

Fees on the network are used for various purposes such as for creating and minting assets, staking, transaction fees and blockchain creation, after which these fees are burned, permanently reducing the number of AVAX within the platform.

Used fees are burned because “$AVAX is a hard-capped, scarce asset used to pay fees and secure the network.” Avalanche shared on Twitter. Burned AVAX can be checked on burnedavax.com.

How does Avalanche (AVAX) work?

In an effort to continuously develop and improve on blockchain technology, Avalanche creators sought to develop a solution to some of the common problems of older blockchains like Bitcoin. Some of these are a lack of interoperability and problems with scalability and usability.

Avalanche tackles the problems mentioned above through a unique approach: using three separate blockchains. Avalanche claims to be “the fastest smart contracts platform in the blockchain industry, as measured by time-to-finality.”

Let’s take a closer look at the three blockchains that make up the Avalanche mainnet:

- X-Chain: This blockchain is used for managing assets. It uses the Avalanche consensus protocol.

- C-Chain: This blockchain is used to create smart contracts. It uses the Snowman consensus protocol.

- P-Chain: This blockchain is used to coordinate validators. It also uses the Snowman consensus protocol.

The Avalanche consensus protocol checks validators’ transaction confirmations randomly by having all nodes work parallel with each other. The idea is that repeatedly doing random checks increases the probability that a transaction is true/valid. The Snowman consensus protocol works pretty much the same but uses blocks in a linear process.

Benefits of Avalanche (AVAX)

The main benefits of Avalanche can be found primarily in the way it was built. Avalanche founders found a way to address the common problems of blockchains through the network’s unique structure.

Interoperability

Only a few blockchains accommodate the trading of various forms of cryptocurrency and data with other platforms. Avalanche facilitates interoperability by allowing different blockchains to share data and effectively “interoperate” with one another.

Scalability

Mining Bitcoin (BTC), for example, requires tremendous energy and computing power. Ethereum can only process 15 transactions per second. While powerful and highly valuable, these blockchains are difficult to scale because of such limitations. Avalanche, on the other hand, was built to be scalable and boasts sub-second transaction times and incredible processing capacity.

Usability

One of the concerns in adopting any technology is usability or the extent to which the software or technology is easy to use and implement in various applications and use cases. Avalanche has proven useful in various cases and is picking up speed in the crypto community at a pace that can rival Ethereum.

Where and how to buy AVAX

Uphold

Uphold is one of the top crypto exchanges in the United States that facilitates trading needs across various cryptocurrencies including AVAX. The platform also offers easy-to-use features that allow users interested in buying AVAX to do so intuitively.

Uphold has both desktop and mobile apps and a customizable trading view for users to feature the assets they trade the most. New traders, in particular, prefer using Uphold because of its simple, modern interface that facilitates easy navigation across both desktop and mobile.

Binance

Known globally as one of the most trusted cryptocurrency exchanges, Binance allows users to purchase AVAX easily. Users who wish to purchase AVAX on Binance can enjoy lower exchange fees, as well as increased liquidity that makes it easier to buy and sell quickly. Binance users in Australia, Canada, the United Kingdom, Singapore and other international locations can purchase AVAX. Currently, U.S. residents are prohibited from purchasing AVAX on the platform.

BitPanda

BitPanda is well-known in Europe as a reputable exchange for buying and selling Bitcoin. Currently, the platform also offers trading of various cryptocurrencies and purchasing assets such as precious metals. AVAX is the easiest to purchase on BitPanda, but it is currently open for European Union residents only.

Gate.io

Gate.io is another reputable trading platform that provides a user-friendly interface that even newbies to trading can easily use. It also offers advanced charts for more technical traders.

The platform is a cryptocurrency exchange that carries a wide range of altcoins including AVAX. Gate.io is notably known for its staunch stance against market manipulation. It is open to U.S. residents, except for those residing in New York and Washington State.

Comments (No)