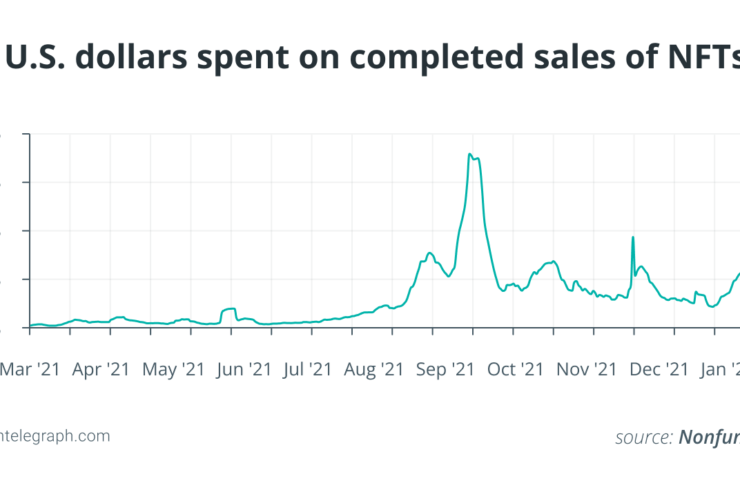

2021 will be remembered as the year of nonfungible tokens (NFTs). In a year where names like Beeple and Bored Ape Yacht Club dominated the headlines, it’s estimated that NFTs have generated more than $23 billion in trading volume.

The rise of NFTs has ushered in a new generation of investors who spend time scouring platforms like Discord and OpenSea looking for the next 100x opportunity. However, it’s important for the NFT investor of today to keep tax implications in mind. Otherwise, they risk repeating the mistakes of the past.

After the 2017 bull run, many crypto traders found themselves in a difficult position. Though they had racked up large tax liabilities while the market was going up, they no longer had the money to pay their tax bills after the crash. Many of these traders simply were unaware of the tax implications of their transactions and did not prepare themselves accordingly.

In this article, we’ll share three things that every NFT investor needs to know about taxes if they wish to take profits without getting in trouble with the Internal Revenue Service, or IRS.

Related: Things to know (and fear) about new IRS crypto tax reporting

You are likely taxed when you purchase your NFT

Disposing of your cryptocurrency is considered a taxable event and buying an NFT with Ether (ETH) or another cryptocurrency would fall into this category. You’ll incur a capital gain or loss depending on how the price of your crypto has changed since you originally received it.

Many NFT traders incur large tax liabilities because the price of their coins has appreciated significantly since they were originally received. To avoid running into issues paying taxes, you should calculate your potential tax bill for every trade that you make and try to put the money aside before tax season.

Related: Not Legal Advice… America: The world’s most creative junkie

You are taxed when you sell your NFT

Selling your NFT is also considered a taxable event whether you’re selling for fiat, crypto or exchanging it for a different NFT. NFTs are taxed similarly to cryptocurrencies — the taxable income from selling your NFT is determined by calculating the difference between your original cost basis when purchasing the NFT and the gross proceeds you receive from selling.

If the value of your NFT has declined since you originally received it, you can claim a capital loss and reduce your tax liability as long as you own your NFT as an investment, rather than for personal use.

You can determine whether an NFT is for investment or personal use by looking at your reason for making the purchase. Do you intend to make a profit or do you intend to just enjoy the NFT for your own use without considering whether the asset will appreciate in value?

Capital losses from an investment can offset your capital gains for the year and up to $3,000 of ordinary income. Capital losses from personal use are not deductible.

Your NFTs may be considered collectibles

Part of what makes classifying NFTs for tax purposes so difficult is that they are a new type of asset class. Unfortunately, that means the IRS has yet to release clear tax guidance on whether certain NFTs will be considered collectibles and taxed at a higher rate.

Related: More IRS crypto reporting, more danger

Certain physical assets are considered collectibles according to tax law. This includes art, metals such as gold and stamp or baseball card collections. When these assets are sold after a year, they are taxed at a top rate of 28%, compared to the typical long-term capital gains rate that ranges from 0 to 20%.

It’s reasonable to conclude that certain NFT art would be considered collectibles for tax purposes. That would likely include 1/1 art pieces such as Fidenza-generated artwork.

Related: Fidenza: Tyler Hobbs wrote software that generates art worth millions

And, what about profile-picture collections like the Bored Ape Yacht Club collection? It’s easy to see why they would be considered collectibles by the IRS, with 10,000 unique images all a part of a “collection.” The issue, however, is still not completely settled.

Any NFT that’s not a piece of artwork would likely not fit under the collectible tax rules without additional IRS guidance. For example, it’s reasonable to assume NFTs representing Uniswap v3 liquidity positions would not be considered collectibles.

Some NFT investors are taking a more aggressive tax option. They argue that without guidance from the IRS, NFTs shouldn’t be considered collectibles due to their intangible nature. These investors are taking this approach because the tax law relevant to collectibles references tangible property — this muddies the water.

This seems to be a tough case to make to the IRS in the case of an audit. But, without guidance, it’s hard to know for certain, and there could be taxpayers who will decide to lean into the uncertainty and take a more aggressive tax approach, knowing IRS guidance on this issue may be years away.

The tax law around collectibles is complex, and when assessing the collectible status of your digital assets, it’s a good idea to speak to a tax professional to figure out the best position to take for your situation.

Related: Crypto in the crosshairs: US regulators eye the cryptocurrency sector

Of course, it’s possible that this issue won’t matter for most NFT investors at this time. Because NFTs are so new, it’s likely that most sales involve NFTs that were held for less than 12 months. These NFTs are taxed as short-term sales at the less-preferred ordinary tax rates, regardless of whether they are classified as collectibles or not.

By keeping in mind the tax implications of NFTs, you can avoid unknowingly incurring a very large tax liability in the year ahead. Remember, you will most likely pay taxes when you buy and sell your NFT, but deciding whether your NFT may be a collectible for tax purposes will require a closer look.

You may still be looking to the IRS for more clarity on how to classify NFTs — that clarity may not come anytime soon. In the short term, it’s possible the IRS focuses instead on NFT investors who choose to not pay any taxes at all.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Miles Brooks is a certified public accountant and is the director of tax strategy at CoinLedger, a cryptocurrency tax software platform built to automate the entire crypto tax reporting process. Miles holds a Master of Science degree in Taxation from California Polytechnic State University – San Luis Obispo. Before joining CoinLedger, Miles previously worked at Apercen Partners, a boutique tax firm that specializes in servicing ultra-high-net-worth founders and investors with income and wealth planning strategies. Miles is a crypto tax expert and has been working with the taxation of cryptocurrencies since 2017.

Comments (No)