This article was originally published in Uncharted Territories.

It’s 2050. The U.S. government just defaulted on its debt. It’s not meeting its social security payments. Hospitals are going down: they can’t operate without Medicare and Medicaid income. Old people line up outside the hospitals, hospitals don’t service them, they can’t afford it. There’s a run on the banks that held too many dollars, they are collapsing. All of the governments around the world caught with too much U.S. debt are defaulting. Those with their savings in dollars have been wiped out. They are looking at the last few decades of their lives like an empty ravine.

What happened? The internet and blockchain technology.

Every time a new information technology is discovered, our power structures change. Speech allowed chiefdoms. Writing allowed kingdoms, empires and churches. The printing press replaced the Catholic Church and feudalism with the nation state. Broadcasting made totalitarianism viable by allowing the efficient transmission of propaganda.

This time, we have not one but two new information technologies: the internet and blockchain technology. How will they undermine the nation state?

The Nation State Becomes Inconsequential

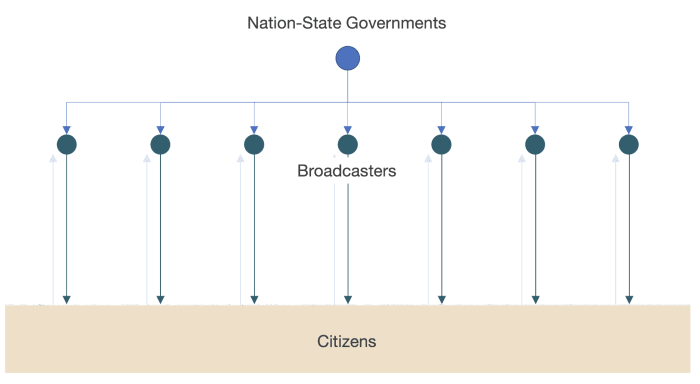

In the 19th and 20th centuries, nation states became the ultimate powers, thanks to their control of gatekeepers. This was nowhere as true as in broadcasting.

The government established the agenda of what was going to be discussed. It controlled what broadcasters would say. Information flowed from newspapers, TV, and radio to citizens. You could hardly influence it in democracies, forget about autocracies.

Then came the internet.

The Sovereign Individual

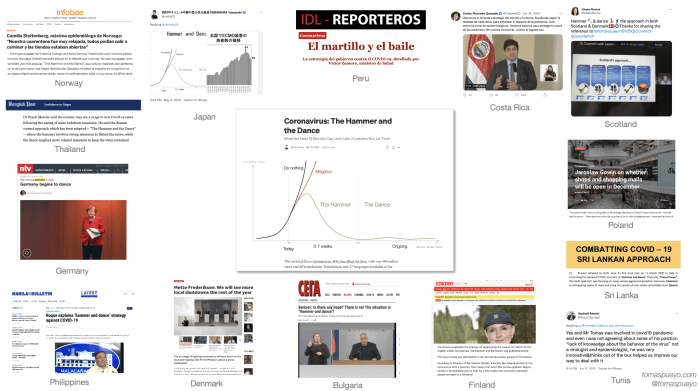

When I wrote “Why You Must Act Now,” I couldn’t conceive that it would be read by over 40 million people. When I wrote “The Hammer And The Dance,” I couldn’t fathom that governments around the world would draw inspiration from it.

A normal guy, surrounded by children in his San Francisco apartment, reading scientific papers in sweatpants, put out a piece that took governments around the world by surprise on the most important topic of their careers.

This would have been impossible 20 years ago: Back then, information flowed from gatekeepers with a tight relationship with governments, from newspapers to TV and radio stations. That establishment decided what people would think that day, and you couldn’t influence it.

You couldn’t search for the scientific papers you needed, because they weren’t available on the internet. And even if you got your hand on the data, you couldn’t let others know because we didn’t have social media. The internet gives you the inputs and outputs to short circuit the nation state and its gatekeeping gang.

That’s how QAnon spread like wildfire, convincing 15% of Americans that its conspiracy movement is legitimate (only 40% reject it), stoked by a pseudonymous person with intimate knowledge of game design.

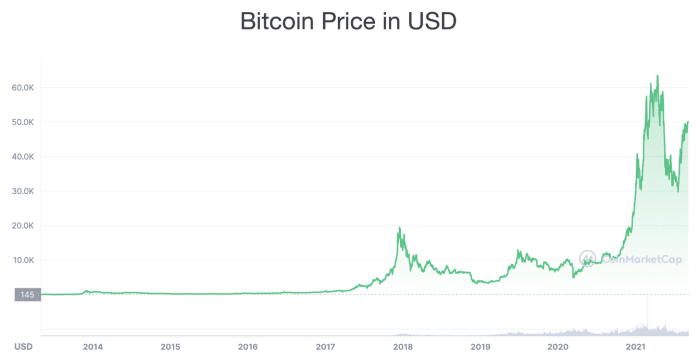

That’s also how another pseudonymous person, Satoshi Nakamoto, created a trillion-dollar asset class by solving a math problem, writing about it, posting his article on the internet, and coding the Bitcoin blockchain.

Now people form their opinions online and spread them online. They interact online and transact online. Most of the time, governments don’t even know that this happens. Traditional gatekeepers are bypassed. No more approval from them.

Given how many authors are killed because of their creations, it’s not a coincidence that both QAnon and Nakamoto were pseudonymous: fake names allow more subversive changes without retaliation. Who’s going to cancel QAnon? Who is going to arrest Nakamoto to bring down Bitcoin?

What is new is not the value of pseudonymity or anonymity: historically, over half of books were pseudonymous or anonymous. What’s new is how easy it is to remain hidden. While crypto-Jews feared for their lives under the Inquisition, Nakamoto could be walking past you and you would never know it.

If a nation state can’t retaliate against creators, how can it prevent them from subverting the nation state?

“The Sovereign Individual” predicted most of this rise in individual power nearly 25 years ago. However, it focused more on the decentralization of power, which would flow from nation states to individuals. But the internet also has a centralization force.

The Rise Of Multinational Organizations

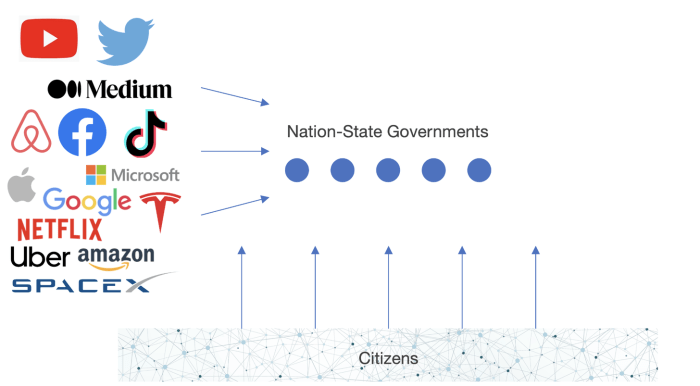

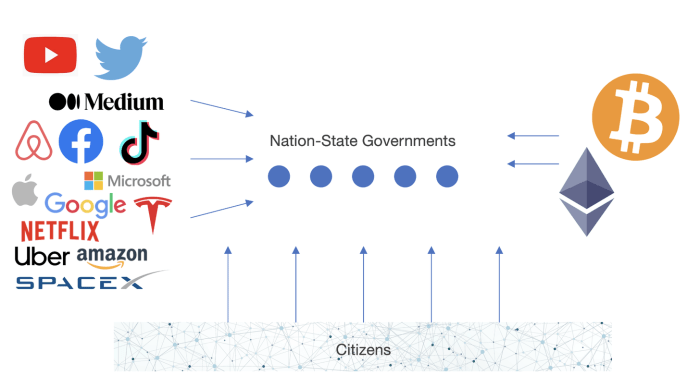

Who enables the search of scientific papers? Google. Who enables the spread of information? YouTube, Twitter, Facebook, LinkedIn, TikTok….

QAnon, the Bitcoin white paper, my COVID-19 articles, or any other person’s posts would have been highly unlikely to be created or distributed without the rise of behemoth tech companies.

The change goes beyond social media.

Who replaces your cabs? Uber. Lyft, too, if you’re in the U.S. And a couple more players internationally.

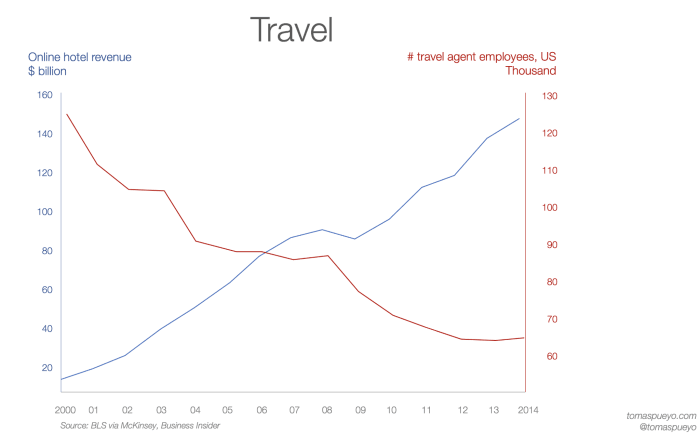

Who replaces your travel agencies? Booking.com, Google Flights, Expedia… Not thousands of companies.

Many of the industries that had millions of companies around the world now concentrate that wealth and influence in just a handful.

How much power do you think they wield? And where do you see that going?

Network effects account for 70% of the value created by tech companies. The more these network effects grow, the bigger these companies become, and the bigger share of the economy they represent.

As these companies grow, they start treating nation-states not as masters, but as peers:

“The director of public affairs of one of these companies pointed out that when he was in charge of relations with public authorities within a large traditional American company, he obeyed the regulators’ instructions without negotiating: ‘then, we complied.’ Today, on the contrary, he states: ‘we don’t surrender without negotiating hard first.’”

When Spain wanted to tax Google News, Google just stopped serving the country with the service. When nation states wanted to preserve their monopolies on cabs, Uber rolled over them until they accepted it. Airbnb disrupts local supply and demand of housing. Tesla challenges dealership laws. Cryptocurrency supporters push back on threatening laws. Apple did not give the FBI backdoor access to phones.

Social media is particularly powerful, by filtering what is acceptable for people to believe, by nudging them in some directions with their algorithms, and sometimes by taking the megaphone away from nation-state leaders.

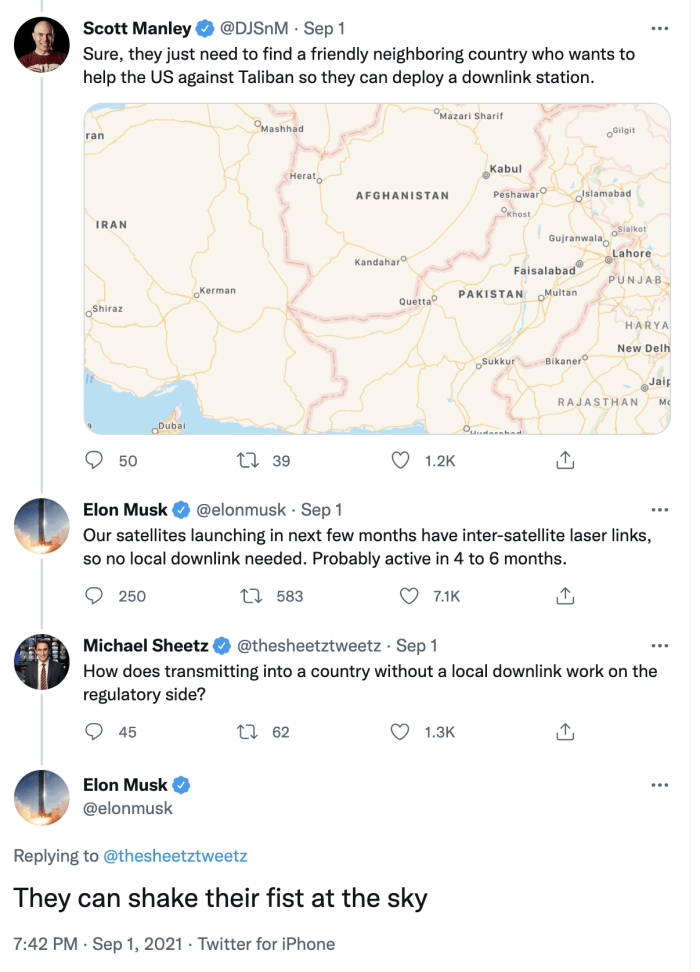

And SpaceX will give everybody everywhere free access to the internet. Governments won’t be able to do much against it.

How will Venezuela censor the free flow of information that falls from the sky?

Look at the sad show of the U.S. Congress hearings of tech executives, or the deplorable show of the Federal Trade Commission case against Facebook. The nation states see the rise of alternative powers like the Church saw the rise of the Protestant Reformation. Both tried to fight, but they’re fighting against the unstoppable progress of technology, which drives the economy, so it will eventually win.

As a result, companies undermine nation states in two ways: On one side, by making information available, they extract power from nation-state gatekeepers and local companies to empower individuals to become more independent. But they also keep some of that power for themselves, becoming new gatekeepers.

Blockchain Technology

This centralizing force of corporations is countered by the decentralization force of blockchains. But blockchain technology means a lot of things to a lot of people. What is it?

There is, of course, bitcoin as a store of value alternative to gold, and stablecoins and fiatcoins as alternatives to fiat currencies, making it that much harder for nation states to print money.

There is Ethereum, Cardano, DeFi, NFTs, and all the rest of the crypto economy, which is building an alternative to the existing economy that bolsters nation states.

But the solution to the Byzantine Generals Problem devised in Nakamoto’s Bitcoin white paper goes further. Why? Because it made decentralized majority rule possible.

Historically, how did you trust that your cab was legit? Because it had a license from the government. How did you know to eat in that restaurant? Because it was certified to be safe by the government. How did you know your house was yours? Because it was registered by the government. How did you know somebody was American? Because they had a passport from the government

You always needed a gatekeeper.

What about money? How did you certify you had money? You either showed the cash or you needed an attestation from your bank. How did you prove you knew something? You needed to show a certificate provided by an academic institution. How did you prove anything was true? You got a seal from a notary public.

You always needed a gatekeeper.

Nation states were the ultimate gatekeepers, because not only did they control their own services, but they also controlled the rest of the gatekeepers via regulation. They drew all of their might from this control.

Since the Bitcoin white paper was published, that power is gone. We haven’t needed gatekeepers to certify most of these things. You don’t need the corruption, absurd regulations, and abuse of power that goes with it. We can build better solutions with more crowd-sourced feedback, faster feedback, crypto-oracle verification. We just haven’t built all of these solutions yet.

The future is already in the brain of the 200 million cryptocurrency holders, who can be better understood as a country, as an alternative community to nation states.

A nation-state citizen doesn’t question the sovereignty of the government, doesn’t question the validity of its currency, doesn’t fathom a world without the TVs and radio stations and notary publics and certification organisms that make the nation state what it is. They wrap their heads around 20th-century country flags. They can’t fathom the end of the nation state, just as 1500s-era Europeans couldn’t fathom the end of the omnipotent Catholic Church.

None of this is true for blockchain citizens. They get it. They hodl (It’s the term for crypto — “hodling” instead of holding) crypto because they don’t trust fiat currencies. They build DAOs because they understand the corporation is on its way to the grave. They insist on smart contracts because how else are we going to trust each other?

Who do you think they have more in common with, their patriot neighbors or their crypto siblings? Do you see alternatives to nation states emerging already?

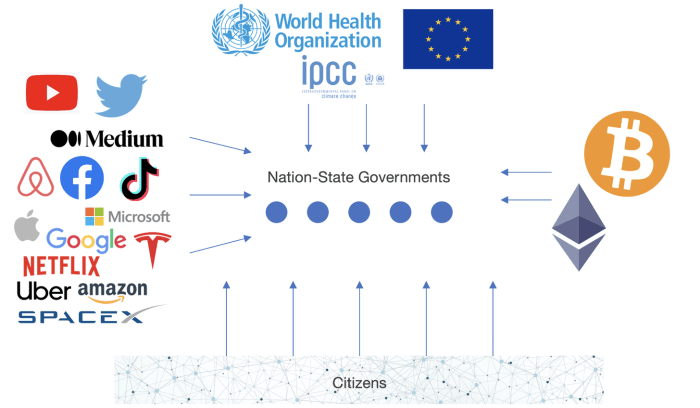

The Supranational Entities

If you’re alone, you don’t need a political system. The point of the government is to agree on how we will coordinate. The more people there are, the more coordination problems emerge, and the more we need to regulate. The size of governments has always grown with the size of the problems to solve.

It’s not a coincidence that the League of Nations appeared just after WWI, and the UN after WWII. New governance follows the size of the problems. Since then, a globalized financial system has birthed the International Monetary Fund and the World Bank to help countries in need of money in exchange for… a bit of their sovereignty. Or a lot. Ask Argentina. The World Trade Organization coordinates countries so that they can better trade between each other, at the expense of some of their sovereignty. They can’t do whatever they want in trade.

The only reason why the World Health Organization (WHO)’s failures have been so salient during the pandemic was because it was so needed. Who cares about a useless organization failing? But we do care about the WHO because we realize that pandemics are not a national problem. They’re global. The Delta variant didn’t care about the Indian soil that saw its birth. As long as countries let people in, it was going to travel with them.

In fact, the main reason why the WHO failed is because of nation states. It was China’s secrecy and its censorship over Taiwan and the American defunding and all this governance that depends on the dysfunctional nation states.

But eventually, some governance systems will emerge to fill the need of global pandemic coordination. Because that problem isn’t going away, and now we know.

Something similar can be said of climate change. Why, despite wildly popular support, are most countries not taking enough action? Because that support has not translated into the political action that nation states monopolize today. No wonder: nation states were never built for global action. They are obsolete to the problems we need to solve.

But why can’t a community emerge where citizens around the world can pledge support to the politicians who do want climate change policies? Why can’t they make that pledge a public, automatic commitment on the blockchain? It hasn’t happened yet because we haven’t gotten around to it. But it will. When that community emerges, will it be more or less powerful than nation states? Or simply another group that nibbles sovereignty away from nation states?

Somewheres Vs. Anywheres

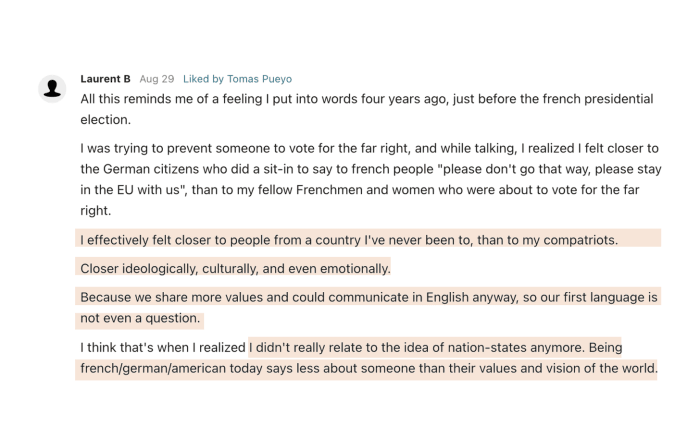

The Somewheres identify with their locality: their city, local sports team, church, regional state, country. The Anywheres don’t care as much. They feel comfortable anywhere with liberal values, from Buenos Aires to Tokyo; places where they can connect to the internet to work, socialize, read… They have more affinity with those who think like them globally than those who live with them locally.

As more of our daily activities move online, as we interact more with people from across the world, identity will continue moving online. The more it does, the more people will leave the ranks of the Somewheres to join the Anywheres.

We know this because it already happened in the past.

Before the printing press, people in Europe talked mostly with their neighbors in their very local vernacular, while the Catholic Church spoke a universal Latin that gave them power. As the printing press started publishing in whichever local vernacular was most widely spoken — i.e., that of the biggest cities — it accelerated Latin’s demise while the local vernaculars of the biggest printing centers slowly grew in popularity until they became national languages that shared ideas and identity across geographies. This is what eventually led to the rise of nation states.

Now that people can talk with anybody in the world, exchange their ideas, find soulmates, and people who think alike, naturally their identity will outgrow nation states.

This will be accelerated because we have one clear winner as local vernacular:

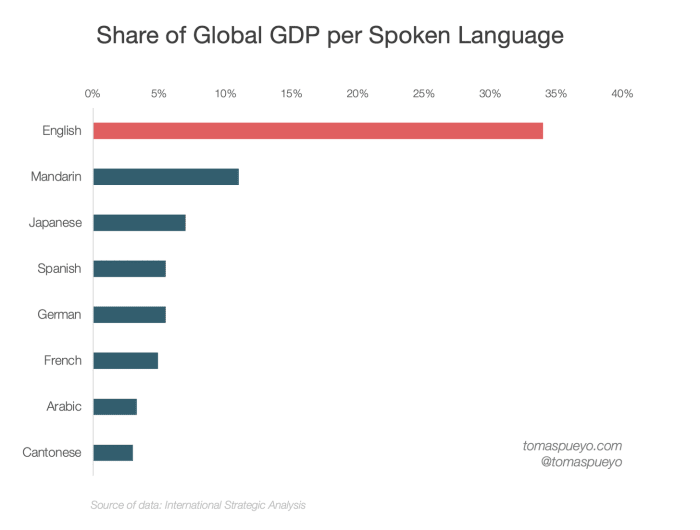

Source: International Strategic Analysis

Which results in the entire world learning English.

The more life happens online, the more content gets produced in the winning vernacular — English — and the more people learn it. As it spreads over the world, so do ideas and identity.

And the only way English doesn’t become the world’s lingua franca is if we get a universal translating device that really works, which would simply achieve the same goals faster.

So, let’s summarize. Nation states will become irrelevant as:

- Individuals become more powerful because they have access to more information, they can spread more information, and they can do so without national gatekeepers controlling their opinions

- The emergence of pseudonyms makes retaliation against individuals hard

- Corporations keep some of the sovereignty they take away from nation states, and start treating them as equals

- Blockchains decentralize power, making government gatekeepers obsolete

- Supranational organizations rise to solve global problems, extracting sovereignty from nation states along the way

- Communities of anywheres emerge globally, accelerated by the internet and blockchain technologies, the desire to fight global problems, the emergence of global governance systems, and an ability to better understand each other through a universal English or its equivalent translation technologies, diluting the patriotic sentiment

All of this erosion of sovereignty happens just as nation states go bankrupt. Even if they haven’t realized it yet.

The Nation State Is Broke

As nation states lose power, their ability to tax and print money will plummet, just as their costs skyrocket. How are they going to keep their promises then?

Corporate Taxation

It’s not a secret that big corporations use international loopholes to avoid paying taxes. What is new is the nation states finally trying to rein them in.

Recently, about 135 countries agreed to fix a minimum floor to global corporate taxes. This is quite a feat: coordinating two-thirds of countries into anything is very hard. Look at climate change. If only countries had the same incentives in that area…

But that agreement obscures the reality that an agreement between 135 countries still leaves 60 countries that don’t participate. Sixty countries for loopholes.

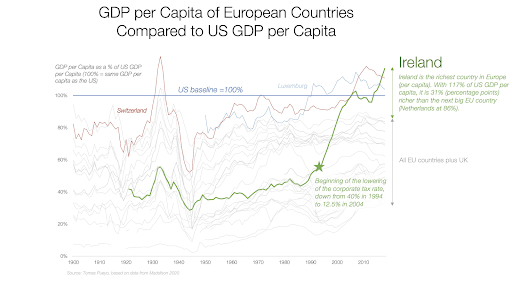

More importantly, some countries’ existence depends on having lower taxes.

Before it reduced corporate taxes in 1995, Ireland was a pretty poor country. Now it’s the richest one per capita in Europe. This is mostly leprechaun economics, a reporting effect due to the oversize impact of big corporations — the average Irish person is not as rich. But it reflects how much Ireland has attracted companies thanks to lower taxes, companies that can then be taxed, even if just a little, thus filling the coffers.

So, why would Ireland agree to such a deal? Maybe because it does not intend to respect the spirit of the law?

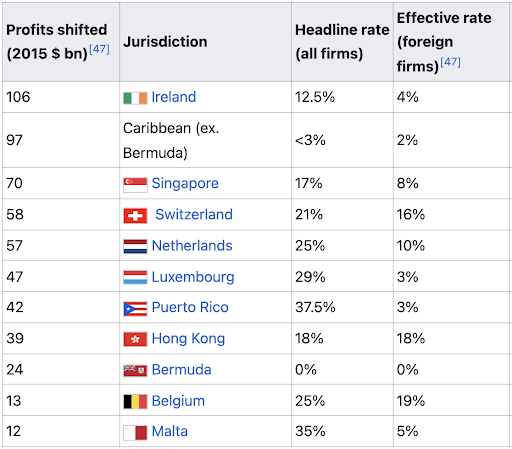

Corporate tax rates: official vs. effective (for foreign firms). E.g., Ireland’s official corporate tax rate might be 12.5%, but foreign companies manage to pay only 4%. Source.

None of this is new. Pharma and finance companies, among others, have been doing this forever, because their value depends mostly on intellectual property, so they’ve been avoiding taxes for a long time.

But this problem is about to enter turbo mode because companies are more global than ever. It’s easy to pressure the local mining company to pay their taxes, or the local manufacturing plant. But how do you tax a company that can put its servers, its lawyers, and its intangibles anywhere it wants? How do you tax the Anywhere companies?

Until now, the answer was: “wherever the headquarters is”. But what if there’s no headquarters anymore?

Remote Work

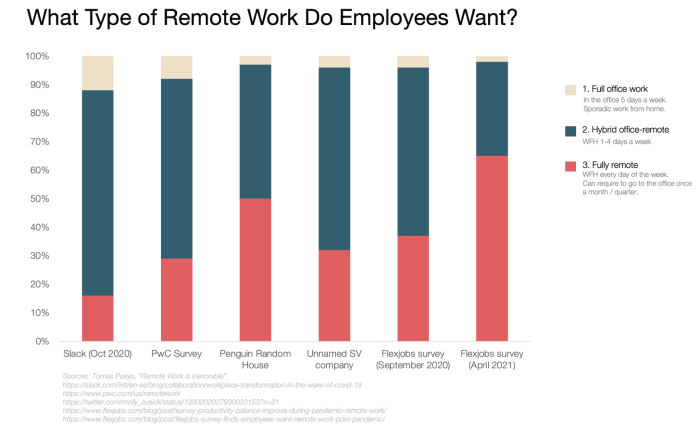

Remote work is inexorable. Before now, the headquarters were defined as wherever the main office was and that was where a company had its leadership and the most white-collar employees.

What if companies don’t have a headquarters anymore, and go fully remote, like Automattic (the maker of WordPress.com), Invision, GitLab, Gumroad, Twitter, Square, Quora, Notion, Zapier, Coinbase, Basecamp, Fujitsu, Hims, Shopify, Dropbox, Skillshare, Spotify, Stripe, Hubspot, Coda, Figma, Trello, Upwork, VMWare, Box, Affirm, Okta, CrowdStrike, Reddit, Docker, Atlassian, Coinbase, Snowflake and REI?

Sure, as we go back to a certain post-COVID normality, many people will go back to the office. But only a few white-collar jobs will be fully office based, while the vast majority will be hybrid.

I estimate that between 10% and 25% of all U.S. jobs will be fully remote after the pandemic, and I believe that will keep going up. Evidently, fully-remote companies can decide to put their headquarters wherever they want. The more they grow, the more they will avoid taxes.

And that’s corporate taxes. What about individual income taxes?

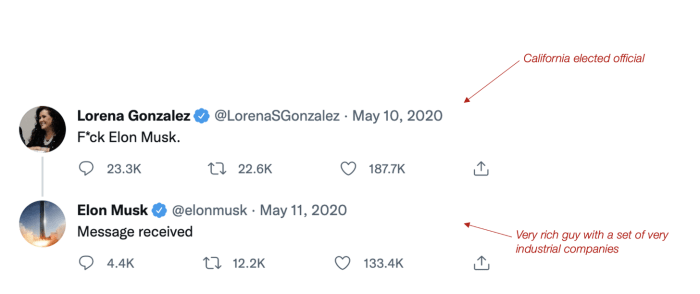

If Musk can pack up and leave for Texas despite leading not one, but two very industrial companies, what do you think all the remote workers will do? Those who can work from a café on the Lisbon beach and pay a flat 20% income tax? Do you think they will stay around in high-tax jurisdictions in the long term?

And as corporations and founders and workers start optimizing for their taxes, how do you think countries will react?

Already, digital nomad visas have been approved in countries like Costa Rica, Georgia, Dubai, Cayman Islands, Bermuda, Antigua y Barbuda, Mexico, Australia, Thailand, Germany, Czech Republic, Portugal, Norway, Estonia and Croatia.

These same countries have started offering lower tax rates to compete for the same remote workers, with a 24% flat income tax for newcomers in Spain, 20% in Portugal, a maximum of 22.5% in Greece, between 5% and 12% in Italy, and no local taxes in Croatia. These are countries that usually have top marginal tax rates close to 50%.

And of course, as an American, the one place in the world where you can reduce your federal income taxes is Puerto Rico, where you could pay as little as 4% in income tax and 0% in capital gains incurred while living there.

To be clear, this is a good thing, for them and for remote workers. These countries are just understanding these dynamics earlier than anybody and adapting to the new world before everybody else because people are less mobile than companies, but they are mobile, too. The same way tax havens lower taxes for all corporations by competing for corporate tax income, so will countries keep lowering their taxes to compete with remote workers.

The way they do this today is by keeping a high taxation rate for locals while luring in people living abroad, so as not to drop their current tax income. But you can imagine that as more people do this, these incentives will become more long term. Spain is already proposing to extend the tax benefits of remote workers from six to 10 years.

So as companies and people become more mobile, they will keep shopping around for the best tax deal, lowering overall taxes. That is, when they even pay taxes.

Crypto Taxes

The more that blockchains power the economy, the harder it will be for nation-state governments to track all of these money movements, and the harder it will be for them to tax these movements.

Today, the way governments do it is by regulating local banks, by getting direct data feeds from them, by intervening the international money flows through the SWIFT system, by freezing assets… But how do you do that in a world where all exchanges are decentralized?

This is why the U.S. government freaked out about cryptocurrencies and tried to force every crypto player to report everything. It’s why when El Salvador announced bitcoin would be legal tender, the World Bank refused to help and the International Monetary Fund warned of dire consequences — both of these organisms are controlled by nation states, particularly the U.S.

The nation state fears the loss of its grip on the financial system, without which it’s much harder to force the tax payments it needs. But that trend is imparable.

And if you think nation states will reduce international tax avoidance, ask yourself: are politicians interested in closing these loopholes?

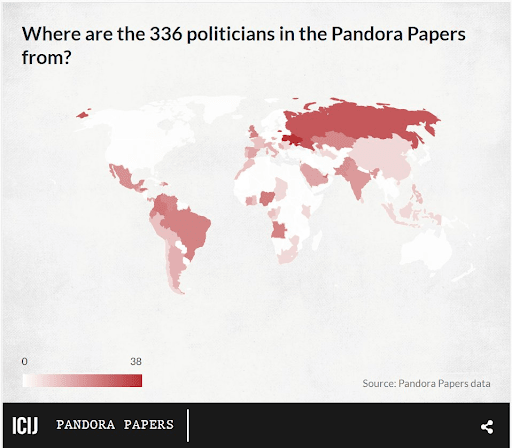

Where are the 336 politicians mentioned in the Pandora Papers from? Source: Pandora Papers, ICIJ.

Politicians are the first to take advantage of these rules. They will never close the loopholes.

Limited Fiat Printing

Of course, at the same time, it’s harder to finance yourself by printing money when people don’t use your money.

Countries like Weimar Germany, Venezuela, Argentina and Zimbabwe know well what happens when you print too much money: dramatic inflation and dollarification — people escape from the local currency and start using dollars instead.

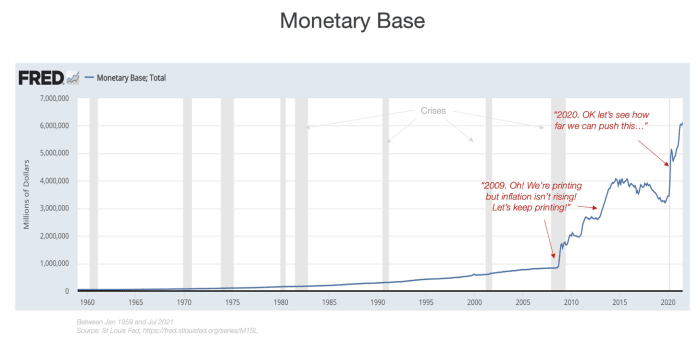

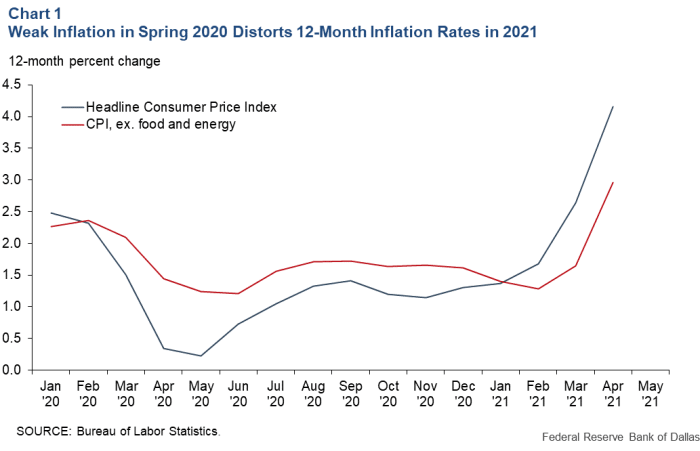

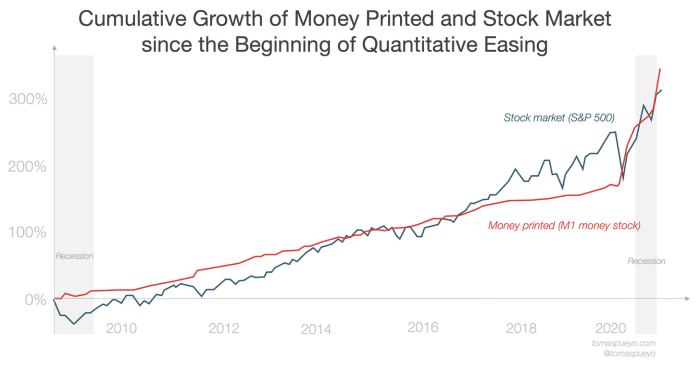

Since 2009, however, governments like in the U.S. and the EU discovered that they could print money without dramatic penalties. So they started pumping the printing press.

It took 96 years for the Federal Reserve to print $1 trillion, but six years to reach $4 trillion (after 2009). Since the beginning of the pandemic, the money supply has doubled. But this time, it wasn’t without consequences.

And you have to realize this is the government printing the money and the government telling you the inflation rate. If the normal escape from local inflation is the dollar, where do you escape from the dollar?

This is one of the key reasons why the stock market has been doing so well in the middle of a pandemic. But stocks aren’t a perfect alternative. Cryptocurrencies are, because they’re not denominated in dollars.

The more of the economy that happens through cryptocurrencies, the less the government will be able to rely on the printing press to fund itself.

All of this, of course, is happening at the time when the governments will break under the weight of pensions they can’t pay from taxing workers that don’t exist.

The Demographic Ticking Bomb

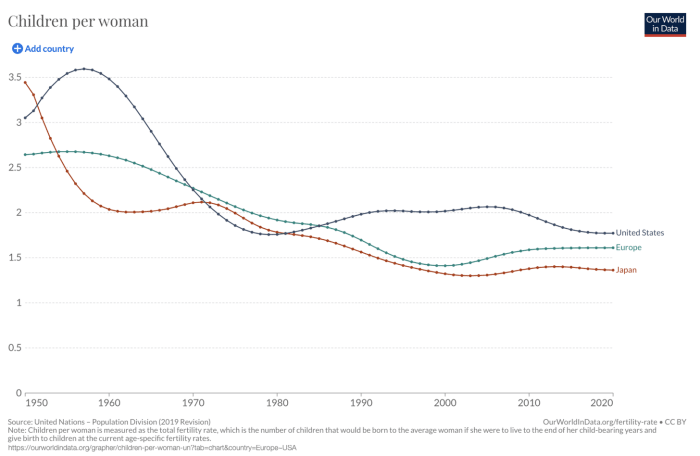

All of this is happening while at the same time we’re having fewer kids.

Children per woman. Source.

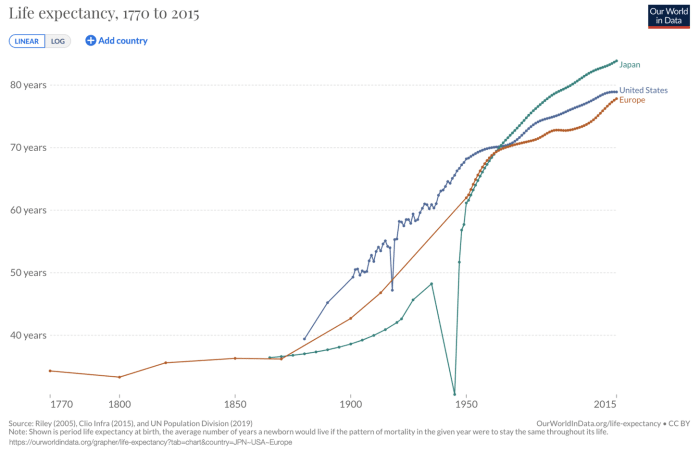

But — thankfully — we’re living much longer.

Life expectancy between 1770 and 2015. Source.

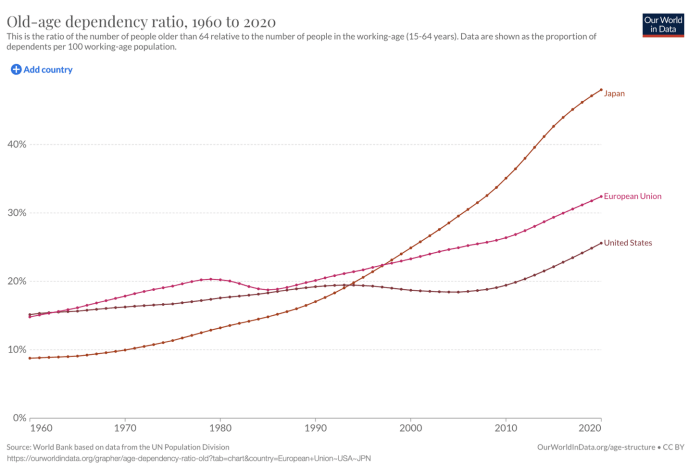

Unfortunately, most nation-state governments are incapable of raising the retirement age accordingly. As a result, workers must support ever more retirees.

Dependency ratio. Source.

This graph means that a retiree in the 1980s in developed countries like Japan, China and the European Union had more than five workers to pay for her old-age benefits like healthcare and pensions. In Japan, every retiree only has two workers to support her. Europe will get there in 10 to 20 years. The U.S. will follow soon after.

Already today, over 20% of European governments’ spending is dedicated to old-age benefits. If that doubles, how much money will be left? Especially since a big chunk of government income must be spent to service the debt — to pay back all of these bonds we happily buy at “risk zero.”

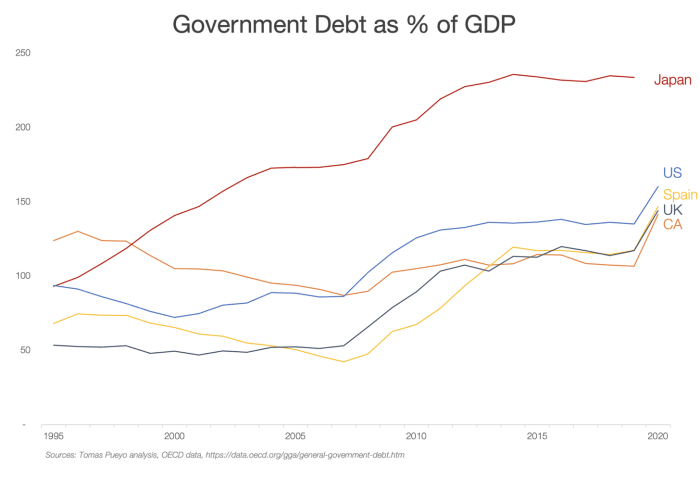

Meanwhile, the debt keeps piling up in the developed world.

Governments in developed countries are more in debt today than after WWII.

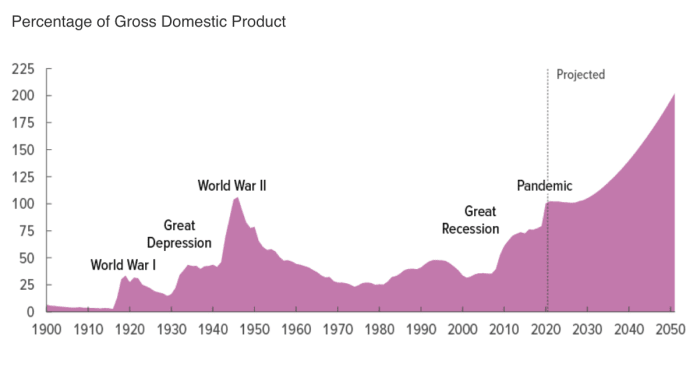

This is the Congressional Budget Office’s (CBO) projection of U.S. federal government debt:

According to the CBO, in 10 years the U.S. federal government will spend half of its discretionary budget on those aged 65 and older.

Escape Velocity

So, just to summarize here:

- Nation states with developed economies won’t be able to fund themselves as they’ll have a hard time taxing corporations and individuals because of the internet, remote work and blockchains.

- At the same time, they will have a harder time printing money because of cryptocurrencies

- They won’t be able to emit debt forever either, because their debt is already through the roof. Servicing it will cost more and more.

- This happens just as their costs increase because their population is aging

Instead of doing what they should — realizing they overpromised and correcting accordingly by raising the retirement age — they try to control their technological foes: social media, multinational corporations, mobile individuals, blockchain technologies…

We know how this ends. It happened five centuries ago, when the Catholic Church tried to suppress the printing press instead of reforming itself. It failed because it couldn’t stop the avalanche of technological progress. Within decades of the invention of the printing press, it had splintered, never to return to its glory days again.

For nation states moving forward, there are only two paths. The first one is totalitarianism. They can do like China, split from the rest of the world, and control everything that happens internally, at the cost of destroying development and erasing individual freedom.

The other alternative is choosing freedom, which means competition between many of the 195 countries that exist today, the extreme difficulty of collusion between them, and the unavoidable result of the demise of the nation state.

The only question left is: What will replace nation states? I will cover this in upcoming articles. Subscribe now to receive them.

This is a guest post by Tomas Pueyo. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Comments (No)