Bitcoin (BTC) price finally reached a $1 trillion market capitalization on Feb.19, which is an important milestone because as BTC gains size, the digital asset will continue to attract new institutional investors who will consider allocating a portion to their portfolios.

Glassnode data suggests that high-net-worth individuals are continuing to pump money into Bitcoin. The number of Bitcoin addresses holding more than $1 million worth of Bitcoin has risen to 94,000.

According to data from Whalemap, another positive sign is that the number of addresses holding between 1,000 to 10,000 BTC has been increasing throughout the current bull run, whereas in the previous bull phase this figure declined.

Ballet crypto wallet CEO and founder Bobby Lee believes the crypto bull market could continue and Bitcoin may “hit $200,000-$250,000 this year.” Lee also expects Bitcoin’s price to reach $500,000 and its market cap to rise above that of gold by 2028.

However, everyone is not bullish on Bitcoin. JPMorgan Chase analysts believe that Bitcoin is trading at much higher valuations than its fair value and is behaving like a cyclical asset. They also termed crypto assets as “the poorest hedge for major drawdowns in equities.”

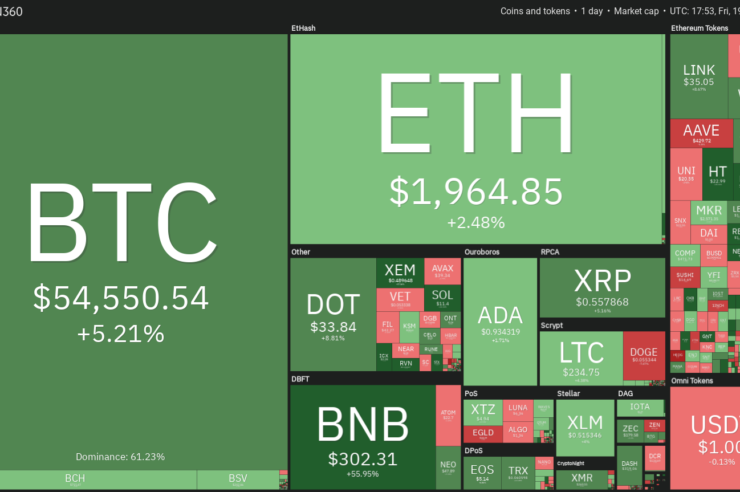

As the crypto bull run continues, let’s study the charts of the top-10 cryptocurrencies to spot the critical levels on the upside.

BTC/USD

Bitcoin broke above the $52,599 resistance today and resumed its uptrend. The bulls are currently attempting to push the price above the ascending channel. If they manage to do that, the momentum could pick up and a rally to $60,974.43 is possible.

The upsloping moving averages and the relative strength index (RSI) in the overbought zone indicate that bulls are in control.

However, if the price turns down from the resistance line of the channel, the BTC/USD pair may drop to the midpoint of the channel where the bulls are likely to provide support. If this level holds, the pair could continue its upward journey towards the target objective.

The first sign of weakness will be a drop below the midpoint of the channel. That could drag the price to the support line of the channel. A break below this support will signal a possible trend reversal.

ETH/USD

Ether (ETH) resumed its uptrend by breaking above the $1,869.473 resistance on Feb. 18. The biggest altcoin is gradually marching towards the psychological level at $2,000 where the bears may again try to stall the rally.

However, if the bulls can propel the price above the resistance line of the ascending channel, the momentum could pick up and the ETH/USD pair may rally to $2,515. The rising moving averages and the RSI in the overbought territory signal that bulls are in command.

This assumption will be negated if the price turns down from the overhead resistance and breaks below the 20-day exponential moving average ($1,714). Such a move will suggest that traders are booking profits at higher levels. The trend could turn negative if the bears sink the price below the support line of the channel.

BNB/USD

Binance Coin (BNB) is witnessing a vertical rally, after having risen sharply in the past few days. The RSI has risen above 94, which suggests the up-move is extremely overbought in the short-term.

When traders fear missing a rally, they continue to buy at every higher level. Usually, such a rally ends with a blow-off top after the last bull has purchased. When the price starts to turn down, the momentum traders are the first to jump off the ship and that deepens the correction.

The long wick on today’s candlestick suggests traders are booking profits at higher levels. If the price dips below the 38.2% Fibonacci retracement level at $260.5707, it will suggest the bulls are not buying the dips anymore. That could pull the price down to the 61.8% retracement level at $206.1262.

A break below this support could lead to panic selling from short-term traders. The pair may then complete a 100% retracement of the entire rally, resulting in a drop to $118. Conversely, if the bulls push the price above $348.6969, a move to $400 is possible.

DOT/USD

The bears defended the resistance line of the ascending channel on Feb. 17 and Feb. 18 and they tried to pull the price down today. However, Polkadot (DOT) reversed the direction sharply from $29.50 and has currently risen above the channel.

If the buyers can sustain the price above the channel, the momentum could pick up and the altcoin may rally to $42.

If the bulls fail to sustain the price above the channel, the DOT/USD pair may re-enter the channel. If the bears can sink the price below $29.50, the pair may drop to the 20-day EMA ($25) and then to the support line of the channel.

If the price bounces off this support, it will suggest the uptrend remains intact, but a dip below the channel will signal a change in trend.

ADA/USD

Cardano (ADA) is gradually moving towards the resistance at $0.9817712. The rising moving averages and the RSI in the overbought zone suggest the possibility of a break above the overhead resistance is high.

If the bulls can thrust the price above the $0.9817712 to the $1 resistance zone, the ADA/USD pair could start the next leg of the uptrend. The target objective on the upside is $1.25 and then $1.50.

Contrary to this assumption, if the price turns down from the overhead resistance, the pair may drop to $0.8082031 and remain range-bound between these two levels.

The first sign of weakness will be a break below the 20-day EMA ($0.74) and the trend will tilt in favor of the bears if the pair plummets below $0.6879684.

XRP/USD

XRP has bounced off the 20-day EMA ($0.49) and the bulls are currently attempting to push the price to $0.65 where the bears may mount a stiff resistance. If the price turns down from the overhead resistance, the altcoin may consolidate between $0.50 and $0.65 for a few days.

If the price breaks below $0.50, it will suggest that bulls are not buying the dips anymore. That could pull the price down to the next support at $0.38550.

However, the upsloping 20-day EMA and the RSI above 61 suggest that the bulls currently have the upper hand. If the buyers can drive the price above $0.65, the XRP/USD pair may start the next leg of the uptrend, which could reach $0.78068.

LTC/USD

Litecoin (LTC) remains in an uptrend as it continues to make new 52-week highs. The bears tried to stall the up-move on Feb. 18 but they have not been able to sustain the price below $230.5305, which suggests the bulls are buying on dips.

Both moving averages are sloping up and the RSI is near the overbought zone, indicating advantage to the bulls. If the buyers can drive the price above $238.8071, the LTC/USD pair may rise to $256 and then $272.

Contrary to this assumption, if the price turns down from the current level and slumps below $220, it will suggest profit-booking by short-term traders. That could pull the price down to the 20-day EMA ($191). The trend will favor the bears if the pair drops and sustains below $185.5821.

LINK/USD

The bears could not sustain Chainlink (LINK) below the midpoint of the ascending channel on Feb. 17, which suggests that bulls are buying the dips and attempting to resume the uptrend today.

If the buyers can propel the price above $35.6945 and the resistance line of the ascending channel, the LINK/USD pair could pick up momentum and rally to $46. The upsloping moving averages and the RSI near the overbought territory favor the bulls.

However, the bears are unlikely to give up easily. They have successfully defended the resistance line of the channel on two previous occasions, hence they will again try to reverse the direction at the resistance line.

If they succeed, the LINK/USD pair could drop to the support line of the channel. A strong bounce off this support will keep the uptrend intact, but a break below the channel will signal a possible change in trend.

BCH/USD

Bitcoin Cash (BCH) has been range-bound between $670 and $745.39 for the past few days. If the price consolidates after a strong rally, it suggests that traders are not booking profits as they expect the uptrend to resume.

If the buyers can propel the price above the $745.39 to $773.32 overhead resistance zone, the BCH/USD pair may start the next leg of the uptrend and soar to $900. The rising 20-day EMA ($589) and the RSI in the overbought zone indicate the possibility of an upside breakout.

Contrary to this assumption, if the price turns down from the current level or the overhead resistance and breaks below $670, the BCH/USD pair may start a deeper correction to the 20-day EMA ($589). A break below this support will indicate that bears have the upper hand.

XLM/USD

Stellar Lumens (XLM) has been trading close to the $0.50 resistance for the past four days, which shows a tussle between the bulls and the bears to establish supremacy. If the bulls overpower the bears and sustain the price above $0.517, a move to $0.600681 is possible.

The bears may again mount a stiff resistance at $0.600681, but if the bulls can push the price above it, the XLM/USD pair could rally to $0.796804. The upsloping moving averages and the RSI near the overbought zone suggest the path of least resistance is to the upside.

On the other hand, if the price turns down from the overhead resistance, the XLM/USD pair could drop to $0.50 and remain range-bound between these two levels for a few days. A break below the 20-day EMA ($0.43) will signal that bears are back in the game.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.

Comments (No)